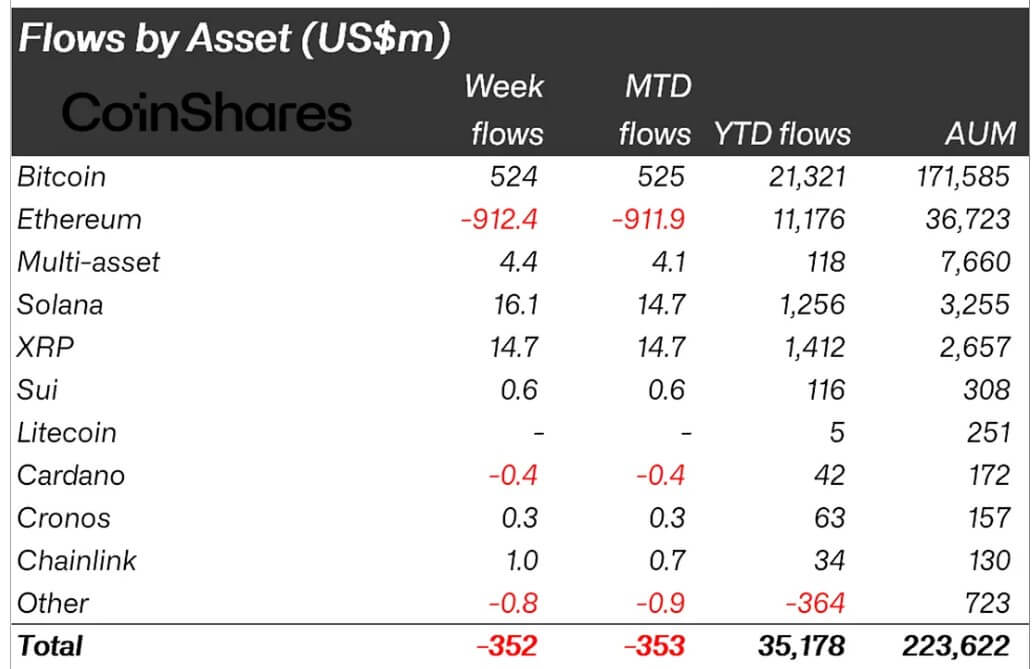

Funding exercise in crypto funds slowed sharply for the week ending Sept. 6, with whole outflows reaching $352 million regardless of US financial indicators pointing towards circumstances that often encourage risk-taking, based on CoinShares‘ newest report.

James Butterfill, head of analysis at CoinShares, mentioned weaker employment numbers and rising expectations for a Federal Reserve charge reduce in September ought to have acted as tailwinds.

As a substitute, they coincided with a 27% drop in weekly buying and selling volumes, signaling that traders had been much less keen to commit new capital to digital belongings. Regardless of the downturn, longer-term market sentiment stays optimistic.

Based on CoinShares, year-to-date inflows stand at $35.2 billion on an annualized foundation, placing the market 4.2% forward of final 12 months’s full-year whole of $48.5 billion.

Ethereum outflows dominate

Whereas Bitcoin merchandise managed to tug in $524 million final week, the general market image was dominated by Ethereum’s struggles.

Based on CoinShares, traders eliminated $912 million from ETH-linked merchandise, extending a sample of every day withdrawals throughout a number of issuers for seven consecutive days.

This setback displays the slowing sentiment surrounding the digital asset, whilst its inflows for the 12 months stay sturdy at $11.2 billion.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

In distinction, different main altcoins, equivalent to XRP and Solana, continued to draw regular curiosity, displaying that institutional traders’ urge for food stays massive for these merchandise.

Through the reporting interval, Solana logged $16.1 million in weekly inflows, marking its twenty first straight optimistic week and bringing the 12 months’s whole to $1.16 billion. Conversely, XRP-focused funds added $14.7 million in recent capital, pushing their 2025 inflows to $1.22 billion.

Analysts hyperlink this constant exercise to hypothesis surrounding the eventual approval of spot ETFs tied to each belongings. Notably, Bloomberg analysts have assigned an over 90% probability of this taking place.

US traders lead market redemption

Throughout the areas, capital actions diverse as US traders led redemptions available in the market.

Based on CoinShares, the US led international outflows with $440 million, whereas Sweden and Switzerland posted $13.5 million and $2.7 million in redemptions.

On the identical time, Germany topped the influx chart with $85.1 million, adopted by Hong Kong with $8.1 million. Buyers in Canada, Brazil, and Australia additionally added modest contributions of $4.1 million, $3.5 million, and $2.1 million, respectively.