SEC Commissioner Hester Peirce warned that layer-2 blockchains working centralized matching engines could face change registration necessities whereas advocating for regulatory safety of really decentralized protocols.

Throughout an interview on The Gwart Present, Peirce famous her imaginative and prescient for crypto regulation, drawing sharp distinctions between immutable code working on decentralized networks and centralized entities utilizing blockchain expertise to facilitate buying and selling.

Decentralized protocols can’t be owned

The pinnacle of the SEC’s Crypto Process Pressure views protocols as units of guidelines that can’t be owned, stating “no one owns” a very decentralized protocol as a result of “it’s on the market and anybody can use it.”

Layer-2 options introduce regulatory complexity, as they typically centralize transaction ordering to deal with Most Extractable Worth (MEV) points.

These chains run matching engines that management transaction sequencing, departing from the distributed node structure that defines conventional blockchain censorship resistance.

Pierce mentioned:

“When you’ve got an identical engine that’s managed by one entity that controls all of the items of that, then that appears much more like an change.”

She added that operators of such programs must think about that in the event that they’re transacting, they’re matching securities transactions. Nevertheless, the SEC needs to keep away from forcing really decentralized protocols to register as exchanges or broker-dealers.

Peirce famous the significance of defending immutable sensible contracts deployed on sufficiently decentralized layer-1 networks, describing them as “code simply doing its factor on the market” that “can’t register with us.”

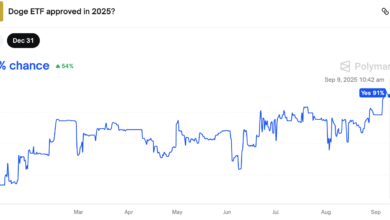

Learning MEV

MEV options create this regulatory rigidity. Whereas centralized sequencers typically present higher retail execution by stopping front-running and sandwich assaults, they focus management over transaction ordering in ways in which could set off securities legislation obligations when dealing with tokenized securities.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

Peirce acknowledged monitoring MEV however prefers letting the neighborhood develop options earlier than intervening with regulation. She mentioned:

“I don’t need us essentially to leap in and resolve the issues, the MEV, the problems round MEV that the neighborhood itself can resolve.”

The excellence turns into crucial as conventional securities migrate to blockchain infrastructure. Peirce needs clear boundaries defending builders who “write code” from registration necessities whereas making certain centralized intermediaries adjust to current frameworks.

This method displays Peirce’s broader regulatory philosophy of principles-based oversight that preserves innovation whereas sustaining investor safety.

She advocates for guidelines that distinguish between code working autonomously and entities utilizing code to carry out regulated actions.

The commissioner’s framework suggests that really decentralized protocols obtain a regulatory secure harbor whereas layer-2 chains with centralized management mechanisms face conventional middleman oversight.

This backdrop creates a spectrum the place regulatory necessities correlate with centralization ranges somewhat than expertise kind.

As tokenization of conventional securities accelerates, layer-2 operators should consider whether or not their centralized elements set off change registration obligations, notably when processing securities transactions by means of managed matching engines.