Central financial institution easing and subdued sentiment indicators point out crypto bull cycle nonetheless in early stage

Julien Bittel, head of macro analysis at World Macro Investor, argued that the bull run stays in its early levels based mostly on complete financial indicators.

In a Sept. 8 evaluation shared through X, Bittel counters widespread “peak cycle” sentiment in crypto markets, difficult late-cycle narratives by inspecting conventional financial markers.

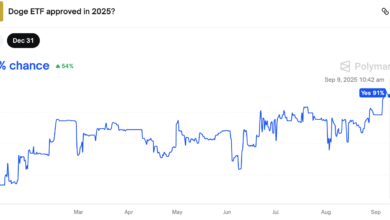

Peak sentiment

Basic late-cycle economies sometimes characteristic excessive manufacturing sentiment with ISM readings round 60, elevated companies sentiment, excessive homebuilder confidence, robust client and employee confidence, bullish investor sentiment, and accelerating wage development.

Bittel stated present knowledge paints a unique image. When scoring inputs from ISM, NAHB, NFIB, BLS, AAII, and The Convention Board right into a composite sentiment measure, US financial sentiment stays “very subdued” and much from euphoric late-cycle extremes.

He said:

“This doesn’t seem like an above-trend late-cycle economic system. It appears to be like way more like an early-cycle economic system attempting to construct momentum.”

Central financial institution coverage offers extra help for this thesis. Almost 90% of central banks globally are chopping charges, creating what Bittel describes as “extraordinary” circumstances and “an enormous tailwind for the enterprise cycle” on a forward-looking foundation.

Oil costs reinforce the early-cycle argument, buying and selling almost 20% beneath pattern and persevering with to fall. This represents easing monetary circumstances slightly than the tightening sometimes related to late-cycle dynamics.

Traditionally, oil costs operating 50% above pattern have signaled recession because the early Nineteen Seventies.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

Bull cycle in early levels

Non permanent Assist Companies knowledge reveals “early-cycle vibes” with rising development from profoundly destructive ranges, indicating financial restoration slightly than rollover.

In keeping with Bittel, late-cycle intervals sometimes characteristic constructive year-on-year development that’s slowing, reflecting an overheated economic system shedding steam.

He attributes rising unemployment to the lagging nature of jobs knowledge, calling it “a six-month look within the rear-view mirror.”

Companies first enhance time beyond regulation hours and short-term employees earlier than committing to costly full-time hires with advantages and pensions.

Bittel additionally frames present circumstances as “early-cycle” transitioning to “mid-cycle,” describing the development as “Macro Spring” (development up, inflation down), transferring towards “Macro Summer time” (development up, inflation up).

He concluded that this macro perspective challenges the prevailing crypto market sentiment, which means that the bull cycle has peaked. As an alternative, he assessed that the present financial circumstances help continued enlargement slightly than contraction.