Everybody’s shopping for gold.

The boomer rock blasted previous $3,600 this week to mark a contemporary all-time excessive and draw traders far and huge into its glittery orbit. So why is the gold worth surging? It’s the results of an ideal storm: a cooling labor market within the U.S., expectations of fee cuts, relentless geopolitical jitters, and central banks diversifying away from the greenback.

Simply go searching: El Salvador’s shopping for gold, BRIC international locations are shopping for gold, central banks are shopping for gold, Aunt Mildred is shopping for gold; everybody’s shopping for gold. Do you have to?

El Salvador’s golden hedge

El Salvador lit up Crypto Twitter this week with a choice to purchase $50 million price of gold, a transfer that had the Bitcoin crowd asking, “Since when does the world’s first Bitcoin nation want shiny metals as a backup?”

El Salvador’s mega gold purchase marks the nation’s first gold buy in 35 years, growing its holdings by practically a 3rd, in an try and diversify its worldwide reserves and improve monetary stability, particularly given its heavy Bitcoin publicity.

By holding each Bitcoin and gold, El Salvador seeks to reassure worldwide companions and sign prudent threat administration to world establishments just like the IMF.

Regardless of the believable logic, El Salvador’s gold buy went down like $50 million price of gold bars among the many Bitcoin neighborhood. Self-proclaimed Bitcoin Chief HODLer Carl B Menger commented:

“I shall strip the El Salvador flag from my title. As soon as a beacon of hope for a greater future, it has turn into a shadow of disappointment.”

After President Bukele made Bitcoin authorized tender, shopping for gold seems to be like hedging on a legacy protected haven, calling the nation’s Bitcoin conviction into query, and backtracking on the “digital gold” narrative.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

Everybody’s shopping for gold; do you have to?

Past El Salvador, the BRICs (Brazil, Russia, India, and China) are ramping up their purchases to historic ranges, and Poland’s central financial institution governor plans to extend its goal for gold as a part of the nation’s reserves from 20% to 30%.

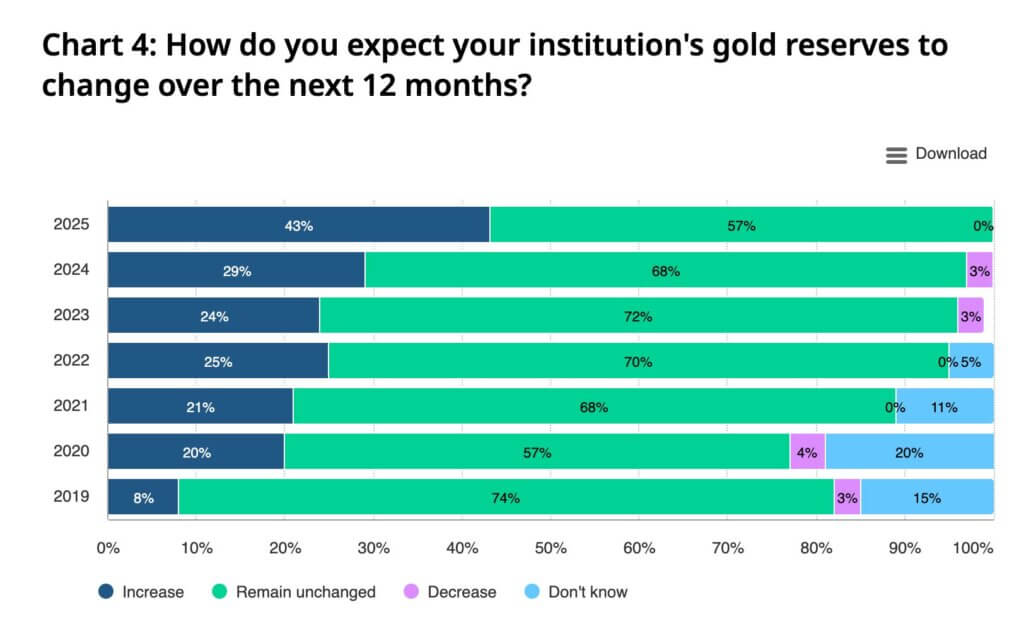

Central bankers world wide, in reality, have demonstrated a big sentiment shift these days away from the greenback and towards gold. As Balaji Srinivasan commented:

“Central bankers count on to purchase extra gold.”

Whereas gold is actually having a second, does it make for a greater funding than Bitcoin? Peter Schiff, economist and perma-gold bull, actually thinks so, popping out as soon as once more to bounce prematurely on Bitcoin’s grave this week.

“Priced in gold, since hitting a excessive of about 37.2 ounces on Aug. 12, Bitcoin is down 18%, simply 2% above official bear market territory…. How do you sq. this dismal efficiency with all of the hype?”

But, the actual fact stays, Bitcoin has qualities that go away gold within the mud. It’s straightforward to switch, laborious to grab, provably scarce, and world on the velocity of sunshine. And, its historic upside return makes gold’s victory look foolish. As crypto dealer borovik reminded us:

“Gold simply hit a brand new ATH of $3600, up virtually 4x from its worth in 2009. Bitcoin then again is up 11,000,000x since 2009. Select correctly”

Gold’s run is spectacular, however Bitcoin’s efficiency since inception is the stuff of legends, far outstripping the returns of any shiny metallic.

So, sure, everybody’s shopping for gold, banks, governments, even El Salvador, and definitely, Peter Schiff. However gold’s not the one refuge in a stormy world.

Bitcoin presents portability, privateness, and a worth chart that’s extra exponential than golden. With each property hitting new highs, the selection is sharper and extra controversial than ever: select correctly.