US-based spot Ether exchange-traded funds (ETF) have posted 4 consecutive days of web outflows in the course of the shortened buying and selling week attributable to US Labor Day.

The week of outflows comes after a robust August for spot Ether (ETH) ETFs, which recorded $3.87 billion in web inflows, whereas Bitcoin (BTC) ETFs posted $751 million in outflows for the month, in response to Farside.

Friday alone noticed Ether ETFs shed $446.8 million, bringing complete web outflows over the 4 days to $787.6 million. In the meantime, Bitcoin ETFs recorded $250.3 million in web inflows throughout the identical interval.

Merchants eye rebound in ETH inflows

A number of crypto market members count on inflows to select up quickly. Crypto dealer Ted mentioned, “I’m anticipating inflows to return if Ethereum continues this pump.”

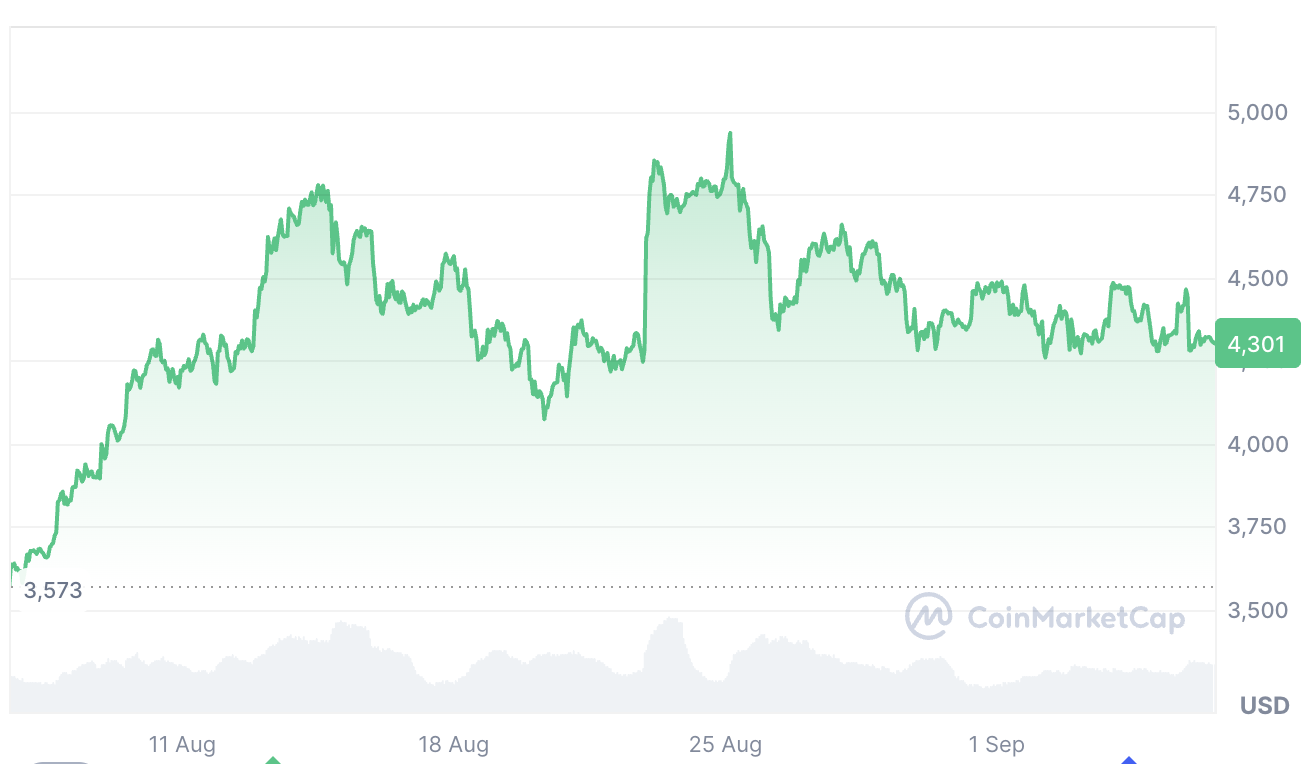

Ether has dipped barely over the previous seven days, down 2.92%, buying and selling at $4,301 on the time of publication, in response to CoinMarketCap.

General, crypto market sentiment has been blended not too long ago, with the Crypto Concern & Greed Index exhibiting ‘Impartial’ readings over the previous two days.

Ether predictions stay excessive

Regardless of the latest outflows, Ether advocates stay bullish.

On Wednesday, BitMine chairman Tom Lee reaffirmed his prediction that ETH will attain $60,000 in the long run on the Medici Presents: Degree Up podcast. Lee mentioned Wall Avenue’s curiosity in ETH may develop into a “1971 second,” which may propel the asset increased.

Associated: Ether trade reserves fall to 3-year low as ETFs, company treasuries absorb provide

BitMine, the most important Ether treasury firm, holds roughly $8.04 billion in ETH, in response to StrategicETHReserve information. General, Ether treasury corporations now maintain 2.97% of the overall provide, valued at $15.49 billion on the time of publication.

Crypto sentiment platform Santiment not too long ago reported that Ether whales have additionally been ramping up their ETH shopping for because the token dipped to yearly lows in April.

“In precisely 5 months, they’ve added 14.0% extra cash,” Santiment mentioned in an X put up on Wednesday, referring to whale holders with 1,000 to 100,000 ETH, valued between $4.31 million and $430.63 million.

Journal: ChatGPT’s hyperlinks to homicide, suicide and ‘unintentional jailbreaks’: AI Eye