StablecoinX and TLGY Acquisition have secured a further $530 million in financing to purchase digital property, bringing complete commitments to $890 million forward of a deliberate merger and Nasdaq itemizing.

The mixed firm, to be renamed StablecoinX Inc., is ready to carry greater than 3 billion ENA, the native token of the Ethena protocol. In accordance with the corporate, it is going to be the primary devoted treasury enterprise for the Ethena ecosystem, which points the USDe and USDtb stablecoins.

The capital was raised by means of a personal funding in public fairness (PIPE) transaction, which permits public firms to lift capital by promoting discounted shares to institutional buyers.

New buyers within the firm embrace YZi Labs, Brevan Howard, Susquehanna Crypto, and IMC Buying and selling, in addition to returning backers Dragonfly, ParaFi Capital, Maven11, Kingsway, Mirana and Haun Ventures.

The PIPE deal was priced at $10 per share, with a part of the proceeds allotted to discounted locked ENA bought from a basis subsidiary.

“The extra funding strengthens ecosystem resilience, deepens ENA liquidity, and helps the sustainable progress of USDe, USDtb, and future Ethena merchandise,” Marc Piano, director on the Ethena Basis, mentioned in an announcement.

The announcement follows a July 21 disclosure that outlined TLGY and StablecoinX’s proposed merger, an preliminary $360 million PIPE financing, and a $260 million ENA buyback program.

Associated: Race for world stablecoin rails heats up with Stripe, Fireblocks launches

Ethena stablecoin is setting data

Launched in early 2024 by Ethena Labs, the Ethena protocol points artificial greenback stablecoins resembling USDe and USDtb, that are backed by a delta-neutral hedging mannequin fairly than conventional reserves.

The mission is overseen by the Switzerland-based Ethena Basis, which is liable for governance and ecosystem improvement.

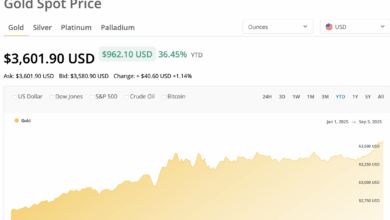

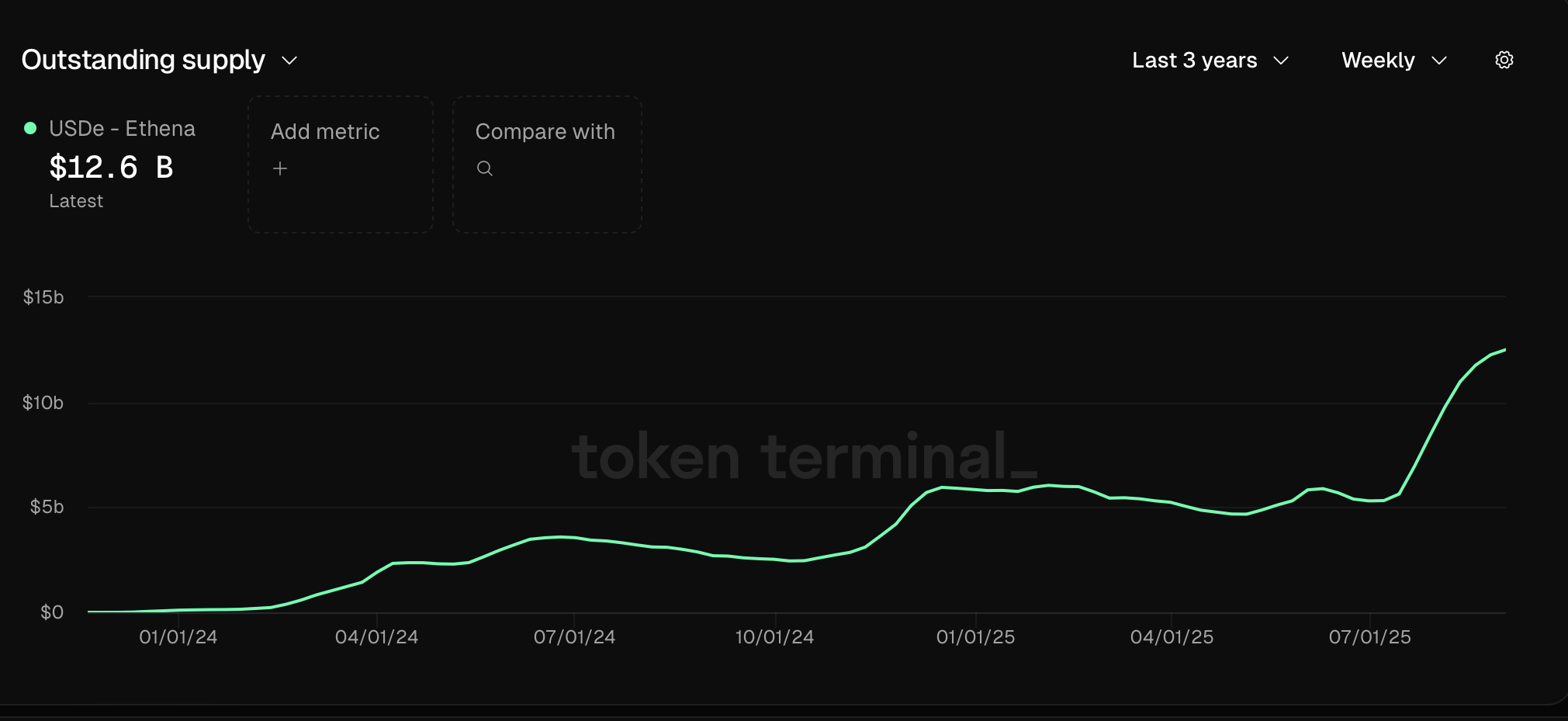

In accordance with Binance Analysis’s September report, USDe turned the quickest stablecoin to surpass $10 billion in provide, reaching $12.6 billion as of September. The report famous that the milestone got here in beneath ten months, in contrast with about 88 months for Tether’s USDT and 38 months for Circle’s USDC.

Token Terminal information exhibits USDe provide has grown 31% up to now month, making Ethena the third-largest stablecoin issuer behind Tether and Circle.

Ethena has additionally generated over $500 million in cumulative income as of August, lately exceeding $13 million in weekly protocol earnings.

Binance Analysis attributed the rise to greater demand for USDe and returns from the mission’s hedging mannequin, which captures yield from crypto markets to take care of the stablecoin’s peg.

It additionally famous that Ethena’s fiat-backed stablecoin, USDtb, is being developed with a pathway to compliance beneath the lately enacted US GENIUS Act, which US President Donald Trump signed into regulation on July 18.

Journal: Bitcoin vs stablecoins showdown looms as GENIUS Act nears