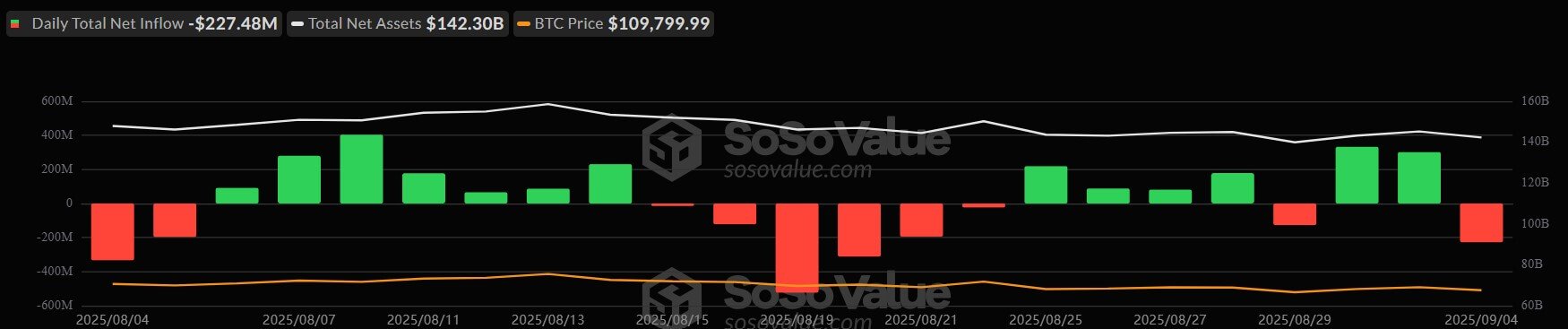

Spot Bitcoin and Ethereum ETFs posted vital outflows of almost $400 million on Sept. 4, extending the asset class’s week of uneven efficiency.

In line with SoSoValue knowledge, Bitcoin ETFs reversed a two-day streak of inflows and closed with $227 million in web outflows.

Investor pullback was most evident throughout flagship merchandise, as Constancy’s FBTC noticed $117.45 million in redemptions, Ark Make investments’s ARKB dropped $125.49 million, and Bitwise’s BITB confronted $66.37 million in outflows.

In distinction, BlackRock’s IBIT was the lone brilliant spot, attracting $134.71 million in inflows, although this was outweighed by losses elsewhere.

Institutional curiosity in Ethereum ETFs

The losses had been additionally pronounced on the 9 Ethereum ETFs facet.

The ETH-focused ETFs noticed $166.38 million in outflows, marking the fourth consecutive day of withdrawals. BlackRock’s ETHA absorbed $149.81 million exits on the day, however Constancy’s FETH processed a bigger $216.68 million redemption.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

Further declines got here from Bitwise’s ETHW ($45.66 million), VanEck’s ETHV ($17.22 million), and Grayscale’s flagship ETHE ($26.44 million).

In the meantime, Grayscale’s mini ETH fund shed $6.44 million, whereas Invesco’s QETH and Franklin’s EZET posted extra minor losses of $2.13 million and $1.62 million, respectively.

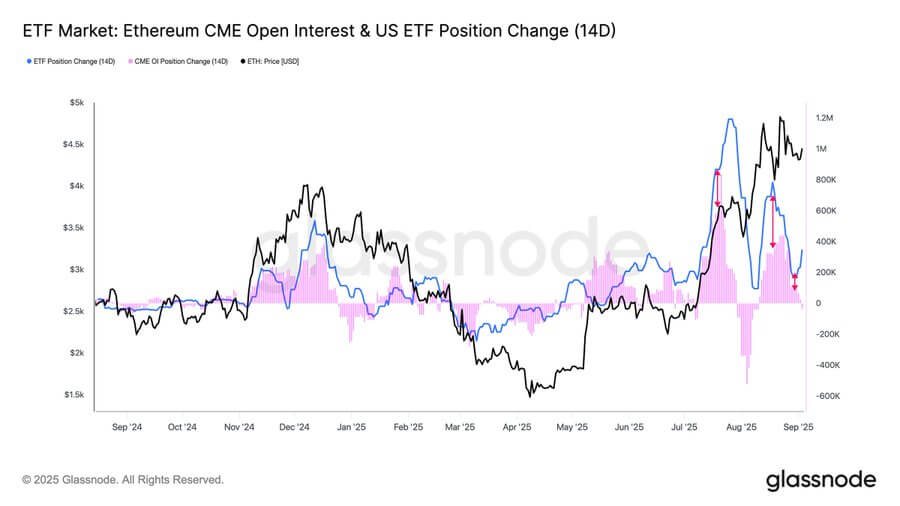

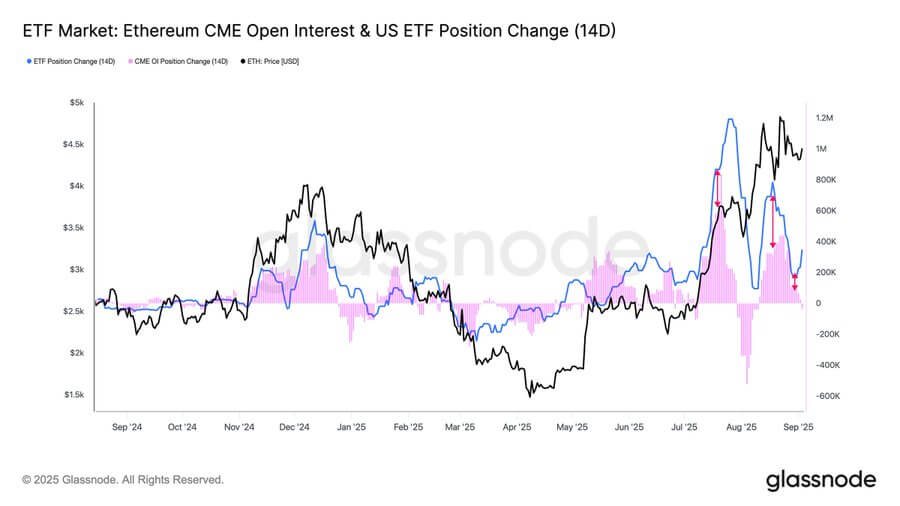

Glassnode knowledge reveals that institutional participation stays lively in Ethereum markets regardless of the downturn. In line with the agency, rising open curiosity on the CME has mirrored greater than half of all ETH ETF inflows.

This development means that conventional finance establishments usually are not solely chasing worth publicity. As a substitute, they seem like combining outright directional trades with arbitrage methods as ETH trades beneath its latest native highs.