The $303-million ETH lengthy place

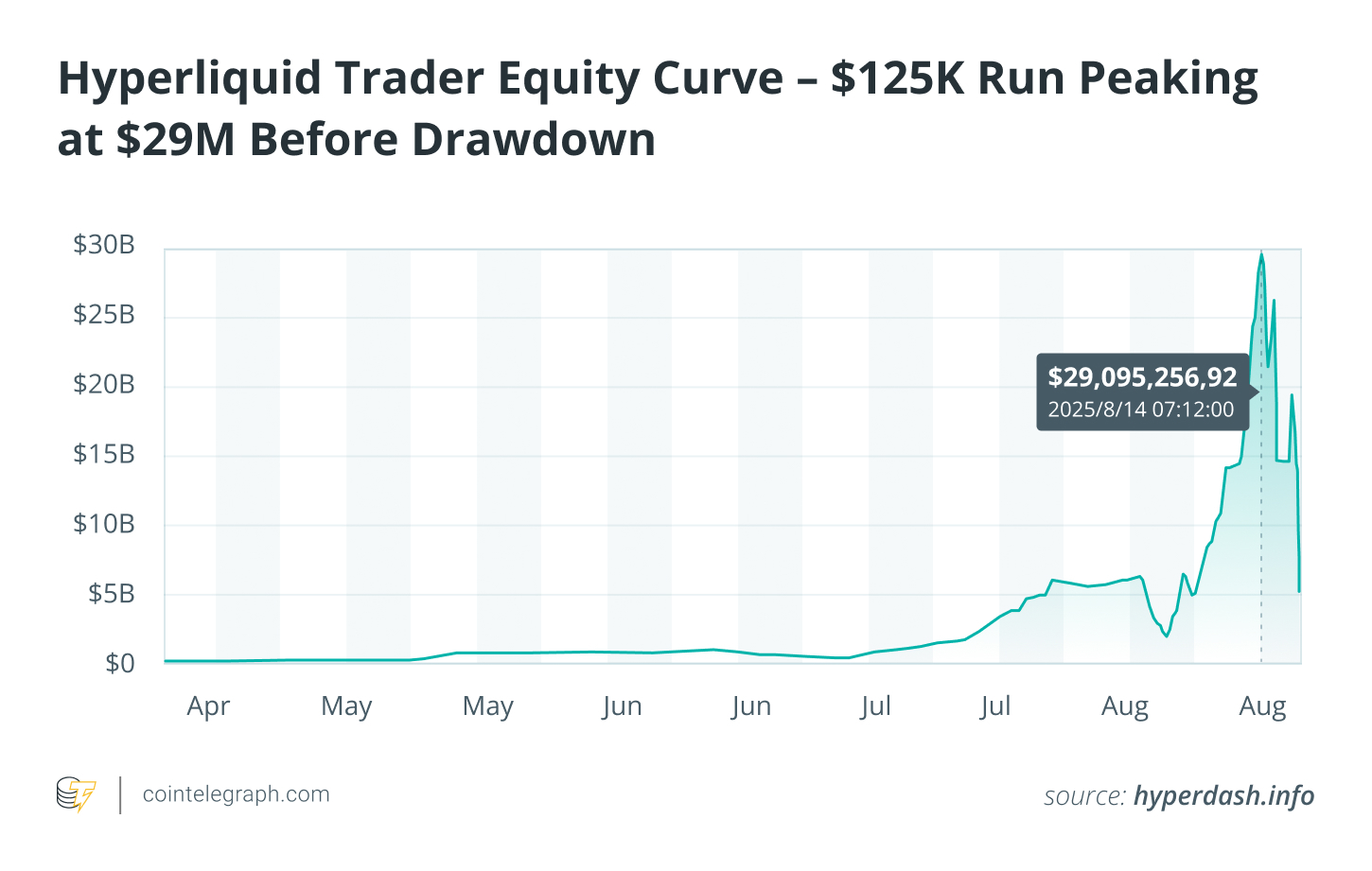

A crypto dealer managed to show a $125,000 deposit into one of many largest Ether positions ever seen on Hyperliquid.

Over 4 months, they compounded each achieve right into a single Ether (ETH) lengthy, ultimately controlling greater than $303 million in publicity. At its peak, his fairness hit $43 million. When the market started to reverse, they closed the commerce fully, strolling away with $6.86 million in realized revenue (a 55x return on the preliminary stake).

This consequence reveals each the extraordinary potential of aggressive compounding and leverage and the way simply it may have unraveled in the other way.

Do you know? Ethereum’s dominance in decentralized finance (DeFi): As of July 2024, Ethereum accounted for about 59.2% of whole worth locked (TVL) throughout all blockchains, with DeFi’s TVL topping $90 billion.

The journey from $125,000 to $43 million

Again in Could, the dealer deposited $125,000 into Hyperliquid and opened a leveraged lengthy on ETH. Quite than securing early income, they rolled each greenback again into the place, steadily rising the dimensions as value motion labored of their favor.

Inside 4 months, the place had grown right into a $303-million lengthy. On the top of the rally, the account confirmed greater than $43 million in fairness, representing a 344x paper return on the unique deposit.

Nevertheless, markets flip shortly. In August, amid heightened volatility and heavy promoting by massive ETH holders, the dealer unwound 66,749 ETH longs. The exit locked in $6.86 million, a fraction of the height paper positive factors however nonetheless a 55x return.

Why it labored: Compounding with leverage

Two forces powered the run: compounding and leverage.

They created exponential progress by recycling each achieve into the identical commerce. Every win funded a bigger place, and leverage magnified the impact, accelerating each danger and reward.

Crucially, timing additionally mattered. Whereas the dealer was compounding, whales had been starting to trim publicity, and US spot ETH exchange-traded funds (ETFs) noticed $59 million in outflows, ending a months-long influx streak. These alerts of cooling demand probably influenced their resolution to step apart earlier than the correction deepened.

The consequence was the alignment of aggressive technique with shifting market context, a window the place compounding, leverage and well timed exit choices converged to supply a unprecedented consequence.

Do you know? In DeFi lending, the typical leverage throughout main platforms often sits between 1.4x and 1.9x (roughly on par with conventional hedge funds). In contrast, the Hyperliquid dealer virtually actually operated at 20-30x leverage, an order of magnitude increased.

Why it may have gone fallacious

The upside was spectacular, however the technique carried monumental danger. Leveraged trades rely upon strict margin thresholds. When markets flip, they’ll unravel in seconds. A single value swing is sufficient to erase months of positive factors.

We don’t must look far for examples. In July 2025, crypto markets noticed $264 million in liquidations in in the future, with Ether longs alone dropping greater than $145 million as bearish strain cascaded throughout positions. For anybody compounding aggressively, that type of transfer would have been deadly.

The dealer’s resolution to exit was the one cause their story resulted in revenue. Many others operating comparable high-octane methods on Hyperliquid weren’t as fortunate. One report prompt a dealer (Qwatio) who booked $6.8 million in income gave all of it again with a $10 million loss.

Compounding and leverage open the door to huge returns, however they amplify each weak spot in your method.

Do you know? Hyperliquid notably rejected enterprise capital funding, allotted 70% of its tokens to the neighborhood and channels all platform income again to customers, driving fast HYPE token worth progress into the highest 25 cryptocurrencies by market cap.

What will be discovered?

Listed here are the ideas price carrying ahead:

- Compound with warning: Reinvesting income can speed up progress, but it surely cuts each methods. Simply as positive factors construct on themselves, so do errors.

- Have an exit plan: The dealer preserved $6.86 million by cashing out when alerts turned. And not using a outlined exit technique, paper positive factors typically keep simply that — on paper.

- Respect leverage: Leverage magnifies outcomes in each instructions. Even modest swings in ETH can set off liquidation on outsized positions.

- Learn the market backdrop: Broader alerts matter. Whale promoting and $59 million in ETF outflows in mid-August hinted at cooling sentiment. These indicators strengthened the case for stepping apart.

- Assume in situations, not simply upside: All the time stress-test. What occurs if the value drops 20% and even 40%? Your margin has to outlive as a result of income solely matter should you keep solvent via the downturns.

- Deal with leverage as a software, not a crutch: Used sparingly with stop-limits or partial de-risking, it may well improve trades. Used recklessly, it’s the quickest path to destroy.

Broader implications for crypto merchants

This dealer’s story highlights each the chance and the hazard of DeFi buying and selling on platforms like Hyperliquid.

Powered by its personal high-performance layer 1 (HyperEVM) and an onchain order guide, Hyperliquid can course of trades at speeds that rival centralized exchanges — one thing most conventional decentralized exchanges (DEXs) nonetheless wrestle to realize. That effectivity makes it doable to run positions as massive as lots of of hundreds of thousands of {dollars}.

However scale brings fragility. The JELLY incident, the place governance needed to step in to guard the insurance coverage pool, uncovered how shortly cross-margin danger fashions can buckle beneath stress.

The intervention prevented losses, but it surely additionally raised uncomfortable questions on centralization, transparency and whether or not these platforms are actually “trustless.”

There are wider classes right here. Institutional capital (from ETFs to company treasuries) is beginning to steer value flows in Ether, forcing retail merchants and whales to react extra shortly to exterior pressures.

In the meantime, methods as soon as confined to centralized venues are migrating onchain, with merchants deploying multimillion-dollar leverage straight via DeFi protocols.

For platforms, this evolution creates a urgent want for stronger safeguards: extra resilient liquidation engines, stricter margin controls and governance frameworks that encourage confidence quite than doubt.

This commerce is a window into how infrastructure, governance and institutional cash are reshaping DeFi markets. For merchants, the message is obvious: The instruments are getting extra highly effective, however the margin for error is getting smaller.