LINK, the native token of oracle service Chainlink has been beneath stress lately as a variety of constructive headlines failed to interrupt the decline.

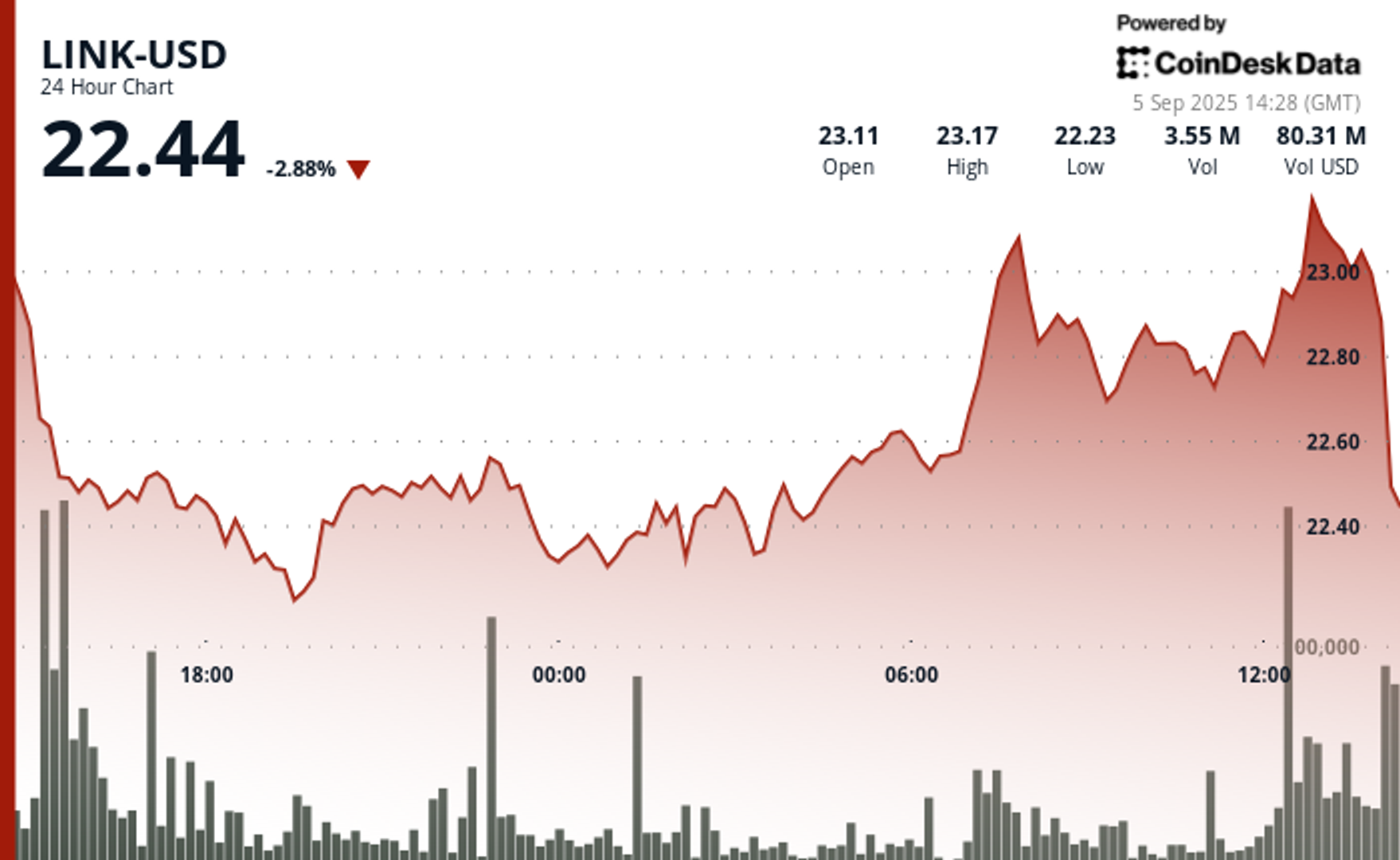

The token slid one other 2.8% over the previous 24 hours to $22.4 whereas the broader market, as measured by the CoinDesk 20 Index was little modified, CoinDesk knowledge reveals. It is buying and selling 15% decrease since topping $27 on Aug. 22, regardless of being tapped by the U.S. authorities to publish financial knowledge on the blockchain and Bitwise submitting for a LINK exchange-traded fund (ETF).

The cool-off interval follows a rally that noticed the token reserving a 37% achieve in August, one of many strongest advances amongst main cryptos. It additionally coincides with bitcoin , ether (ETH) and the broader crypto market pulling again since mid-August.

The losses occurred although the Chainlink Reserve, an automatic mechanism that buys tokens on a weekly foundation, primarily taking them out of circulation and lowering provide, bought one other 43,937 LINK on Thursday. Since its debut in early August, the mechanism has purchased a complete of 237,014 tokens, price $5.5 million at present costs.

Technical evaluation

- LINK encountered persistent bearish stress, forming decrease highs and decrease lows because the broader crypto market is in a consolidation interval, CoinDesk Analysis’s technical evaluation mannequin reveals.

- Key technical help ranges established round $22.28-$22.32.

- Robust volume-backed resistance shaped across the $23.10-$23.16 degree.

Disclaimer: Elements of this text have been generated with the help from AI instruments and reviewed by our editorial group to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.