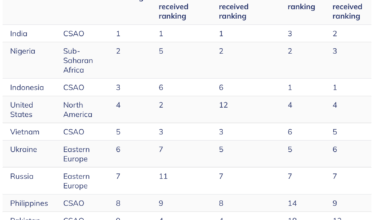

Key factors:

-

Bitcoin disappoints with volatility round US jobs information, leading to a dive below $111,000.

-

BTC worth motion offers up all its good points whereas gold goes on to hit yet one more all-time excessive.

-

Merchants keep expectations of a $100,000 help retest.

Bitcoin (BTC) flipped risky at Friday’s Wall Avenue open as US jobs information fell far wanting expectations.

Gold beats file with US labor market “quickly deteriorating”

Knowledge from Cointelegraph Markets Professional and TradingView confirmed BTC/USD reaching new September highs of $113,400 earlier than dropping nearly $3,000 in an hour.

The August print of US nonfarm payrolls (NFP) confirmed that the financial system added 22,000 jobs — far fewer than the anticipated 75,000.

The US greenback’s energy plummeted consequently, whereas gold hit new all-time highs.

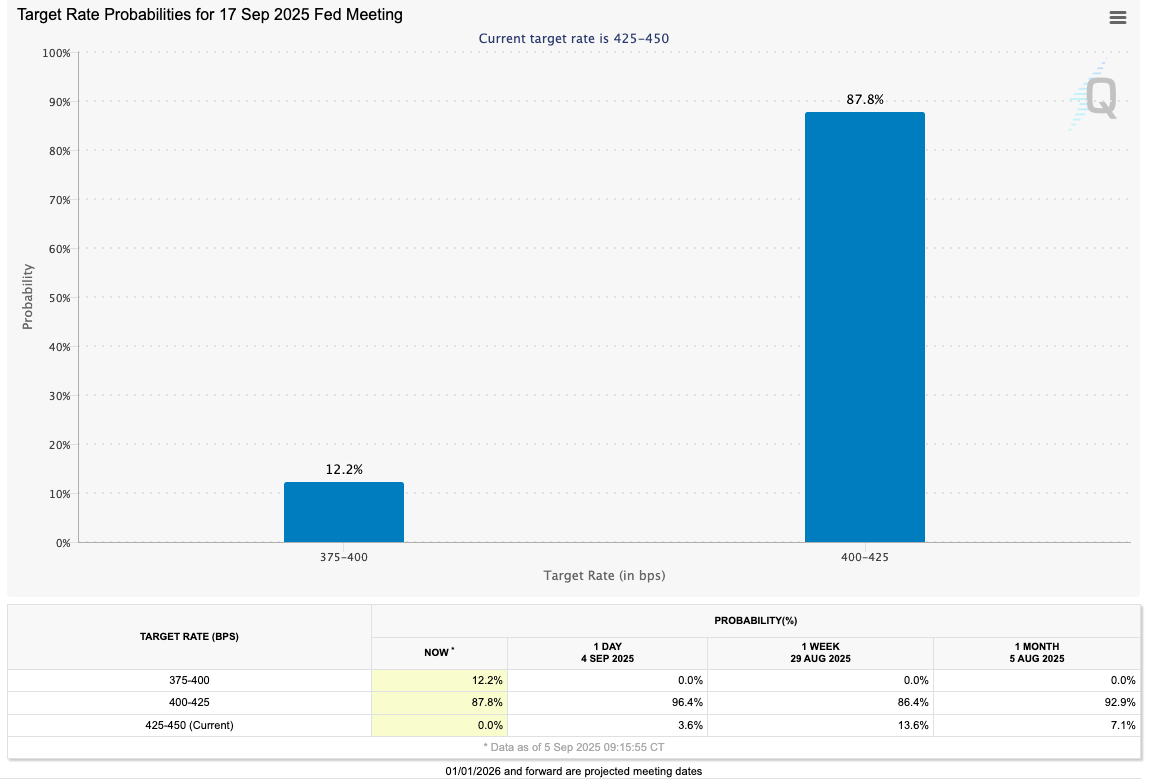

Reacting, market individuals agreed that the course was now set for a key risk-asset tailwind occasion: the Federal Reserve chopping rates of interest at its Sept. 17 assembly.

Knowledge from CME Group’s FedWatch Device underscored the probability of such an consequence.

“This marks the 2nd lowest jobs report quantity since July 2021,” buying and selling useful resource The Kobeissi Letter wrote in a part of a thread on X.

“The labor market is quickly deteriorating.”

Kobeissi famous that the job numbers for earlier months had additionally been revised down.

“The labor market is way worse than you suppose: Not solely was June’s jobs quantity unfavorable, however the US financial system misplaced -357,000 full time jobs in August,” founder Adam Kobeissi added.

Bitcoin worth targets double down on $100,000 dip

Regardless of the optimistic implications of the NFP print for Bitcoin, BTC worth motion provided a noticeably lackluster response.

Associated: Bitcoin units 2024-style bear lure forward of ‘main quick squeeze’: Dealer

This was not misplaced on some market individuals, who included widespread commentator WhalePanda.

Who banned Bitcoin? pic.twitter.com/iOKhtC7Z3O

— WhalePanda (@WhalePanda) September 5, 2025

Merchants as an alternative seemed to key resistance ranges nonetheless in want of being flipped again to help. Common dealer Daan Crypto Trades flagged the 200-period easy (SMA) and exponential (EMA) shifting averages on four-hour time frames.

“The 4H 200MA & EMA are typically seen as an excellent momentum indicator for the quick to mid timeframe development. These have each acted as resistance for the previous few weeks and at the moment are being examined once more,” a part of an X put up defined.

“This can be a very essential stage to reclaim for extra upside,” fellow dealer ZYN agreed concerning the pre-NFP worth zone, including that “bulls can be absolutely again” ought to $113,000 help return.

Bearish views remained, with crypto investor and entrepreneur Ted Pillows reiterating expectations of a drop towards $100,000.

“Additionally, if this stage doesn’t maintain, BTC may go round $92K-$94K CME hole stage,” he warned on the day.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer entails danger, and readers ought to conduct their very own analysis when making a call.