The time-travel millionaire delusion

It’s nearly an irresistible daydream: step right into a time machine, purchase a pile of Bitcoin for pennies in 2010 and return to the current to seek out tens of millions sitting in your account.

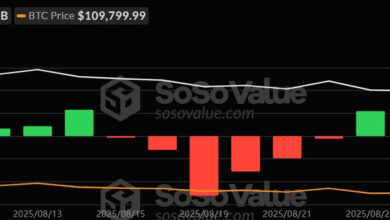

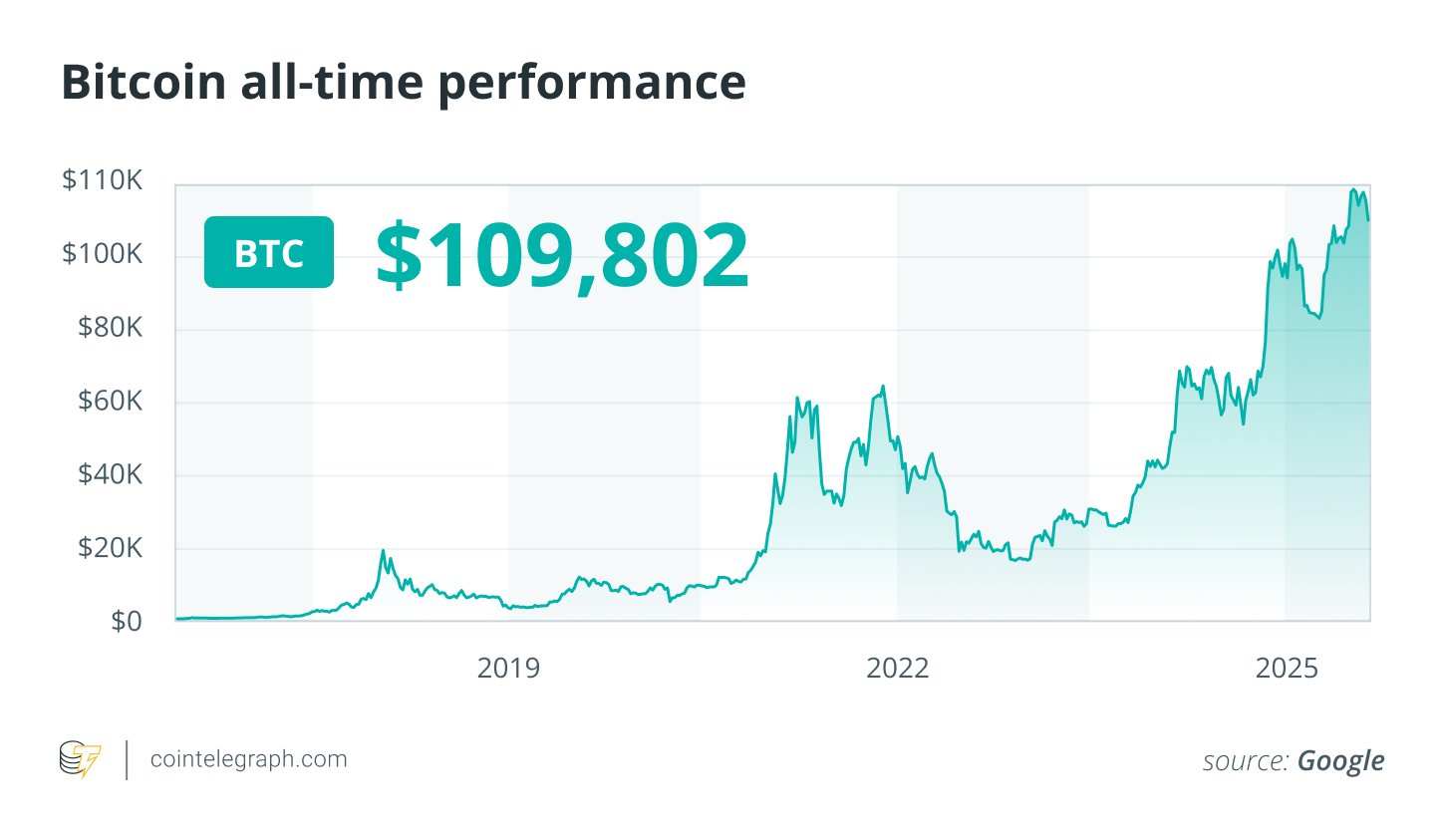

In March 2010, the primary recorded Bitcoin trade value was about $0.003 per Bitcoin (BTC), and costs by no means rose above $0.40 that 12 months. As we speak, BTC trades properly into the six-figure vary.

The reality is, changing into a Bitcoin millionaire requires rather more than shopping for early.

You’ll have wanted to construct a big BTC place after which maintain it by way of a number of 80% to 90% value crashes, trade failures like Mt. Gox, shifting rules, the danger of dropping your non-public keys and years of temptation to take “life-changing income.”

This text seems to be at Bitcoin’s unstable value historical past, the headline-driven shocks, the behavioral traps that journey up even seasoned buyers and the mathematics that makes this fantasy so unlikely.

Surviving Bitcoin’s value rollercoaster

Bitcoin’s journey from obscurity to six-figure valuations was a sequence of sharp surges adopted by brutal crashes, a lot of which might have led a sane particular person to money out.

- 2010-2011: In January 2010, $1 might purchase about 333 BTC at roughly $0.003 every. By June 2011, when Bitcoin peaked at $30, that very same stash was value nearly $10,000. Quickly after, the value collapsed, and the web worth of these 333 BTC fell to about $666.

- 2013: The identical stack soared to roughly $88,000 on the $266 April excessive, then plunged to over $16,500 by summer time. By November’s $1,000 peak, you’d be taking a look at $333,000 (that’s brand-new Lambo cash).

- 2014-2015: The Mt. Gox collapse gutted market confidence, sending the value to round $150 and your stack to nearly $50,000

- 2017-2018: At round $20,000, your preliminary $1 funding hit $6.66 million. However by the 2018 low, it fell to about $1.13 million (nonetheless substantial, however a steep drop).

- 2020-2022: COVID-19’s “Black Thursday” halved Bitcoin’s value in two days. The November 2021 all-time excessive of $69,000 pushed your stack to $22.98 million, solely to slip to $5.29 million a 12 months later.

- 2024-2025: In March 2024, Bitcoin reached a brand new all-time excessive above $73,000, making your unique greenback value greater than $24 million.

After surviving all that — the euphoria, the crashes, the scandals — there’s one final query: Why would you promote now?

In a manner, unrealized beneficial properties in Bitcoin are like quantum superposition — they solely “collapse” into actuality once you promote. Till that second, your tens of millions exist solely as numbers on a display screen, nonetheless hostage to Bitcoin’s subsequent transfer.

Do you know? Andrew Tate has famously remarked that after about $20 million, more cash received’t change your day by day life (until you’re aiming for luxuries like a non-public jet or a yacht).

Headlines that would shake any Bitcoin believer

Not all promoting stress got here from value drops. A few of Bitcoin’s greatest checks got here from information occasions that challenged even probably the most dedicated hodlers. For instance:

- Alternate disasters: In 2014, Mt. Gox (then dealing with over 70% of world Bitcoin buying and selling) revealed it had misplaced greater than 650,000 BTC. Chapter worn out 1000’s of early buyers. Furthermore, in 2016, the Bitfinex hack noticed greater than 119,000 BTC stolen, and it understandably sparked fears of extra trade failures. There are a lot extra of such examples.

- Crime and stigma: The FBI’s 2013 takedown of Silk Highway linked Bitcoin to unlawful commerce within the public thoughts. Multimillion-dollar pockets seizures resurfaced for years, fueling debate over whether or not Bitcoin was inherently tied to crime.

- Coverage shocks: China repeatedly disrupted markets — from its 2013 banking ban to 2017 trade closures to the 2021 announcement making all crypto transactions unlawful. Every occasion sparked fears of wider crypto regulation crackdowns.

- Forks: The 2017 blocksize debate, the Bitcoin Money fork and the abrupt SegWit2x cancellation divided the neighborhood and raised questions on Bitcoin’s scalability.

- Business implosions: The 2022 FTX collapse (on the time the second-largest crypto trade) triggered a liquidity disaster and “crypto is lifeless” headlines throughout mainstream media.

Every of those moments compelled buyers to rethink: Is holding definitely worth the danger?

Even for those who had the foresight to purchase Bitcoin early and the self-discipline to carry by way of each market crash, scandal and coverage shift, there’s an actual risk you wouldn’t nonetheless have your cash immediately.

You might need misplaced entry to it, too

Bitcoin possession is binary (you both management the non-public keys otherwise you don’t), and as soon as they’re misplaced, your fortune is gone.

Misplaced cash are a significant component. Chainalysis estimates that 2.3 million-3.7 million BTC is completely out of circulation, locked in wallets with keys that have been misplaced, destroyed or in any other case inaccessible. Many of those belonged to early adopters who handled Bitcoin as a curiosity, storing it on laptops or exterior drives that have been later wiped, recycled or discarded.

Some of the well-known examples is James Howells, an engineer from Newport, Wales who by chance threw away a tough drive containing about 8,000 BTC (now value lots of of tens of millions) and has spent years searching for permission to dig by way of a landfill to recuperate it.

Even diligent holders weren’t immune. Cash saved on exchanges that later failed (similar to Mt. Gox or QuadrigaCX) might disappear in a single day, leaving “holding” out of the proprietor’s management. In Bitcoin’s historical past, the larger hazard usually wasn’t promoting too quickly however dropping entry fully.

Do you know? In 2014, the Mt. Gox collapse froze over 650,000 BTC, leaving 1000’s of holders unable to entry their cash. For a lot of, “hodling” wasn’t a selection; their Bitcoin was merely gone.

The fact for many who did maintain on

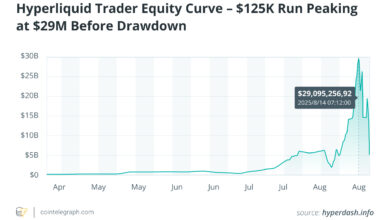

Historical past exhibits there are nearly no documented instances of the $1-to-Bitcoin-millionaire story by 2025. As an alternative, the next examples replicate the situations that occurred much more usually.

- Kristoffer Koch purchased round 5,000 BTC in 2009 for $26.60 and bought 1,000 BTC to purchase an house, years earlier than Bitcoin’s greatest rallies.

- Stefan Thomas misplaced entry to over 7,000 BTC ($400 million immediately) as a result of a forgotten password.

- The Winklevoss twins grew to become Bitcoin billionaires after shopping for round 70,000 BTC with an $11 million lump sum in 2013, lengthy after Bitcoin’s sub-$1 days.

- Li Xiaolai collected over 100,000 BTC by making giant purchases in 2011, not with spare change.

To chop a protracted story quick, Bitcoin fortunes weren’t made by an off-the-cuff buy-and-forget technique with mere pocket cash.

They got here from giant early stakes, strict safety practices, distinctive self-discipline and the uncommon means to endure each parabolic rises and extreme crashes with out panic promoting.

That’s why the “time-travel millionaire” thought stays extra delusion than actuality and why the quantity of people that have lived by way of Bitcoin’s full value historical past whereas nonetheless holding their unique stack is vanishingly small.