Outstanding voices within the crypto sector are questioning the US Securities and Trade Fee (SEC) after its Workplace of the Inspector Normal (OIG) disclosed that just about a 12 months of textual content messages from former Chair Gary Gensler had been completely deleted.

On Sept. 3, the OIG disclosed that Gensler’s SEC-issued smartphone stopped syncing with the company’s machine administration system on July 6, 2023.

Regardless of working usually, the machine appeared inactive for the subsequent 62 days, and IT workers did not detect the problem.

When the Workplace of Data Know-how launched a coverage in August 2023 to routinely wipe units that had not related for 45 days, Gensler’s cellphone was flagged as misplaced or stolen.

Nonetheless, when the SEC workers tried to revive the machine, they mistakenly carried out a manufacturing facility reset. That error erased textual content messages protecting Oct. 18, 2022, via Sept. 6, 2023.

The SEC later admitted that its restoration efforts couldn’t totally restore the information, noting that some federal information have been completely misplaced. Since then, the company has disabled textual content messaging throughout most workers units, knowledgeable the Nationwide Archives in June 2025, and launched new backup measures.

The officers additionally acknowledged that the loss might have an effect on responses to Freedom of Data Act requests.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

Crypto leaders react

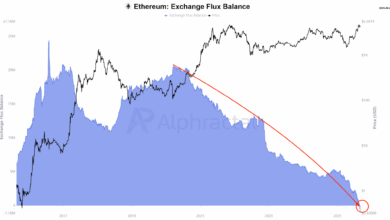

The crypto trade has reacted sharply to this report, noting that the lacking messages span a crucial interval in market historical past.

Custodia Financial institution CEO Caitlin Lengthy famous that the lacking interval coincided with among the trade’s most turbulent occasions.

These included the collapse of FTX, the alleged Operation Chokepoint 2.0 marketing campaign, Silvergate Financial institution’s liquidation, the Silicon Valley Financial institution run, and federal deposit insurance coverage communications that rattled monetary establishments.

Coinbase Chief Authorized Officer Paul Grewal criticized the SEC for failing to uphold its personal requirements of transparency. Grewal argued that the deletion was not an harmless mistake however the destruction of information related to ongoing litigation.

He stated:

“This isn’t some ‘oops’ second. This was a destruction of proof related to pending litigation. All of us deserve higher, particularly from ‘leaders’ who see match to smear others and forged aspersions so freely.”

Contemplating the severity of the state of affairs, a Bitcoin investor, Wayne Vaughan, advised that:

“A number of non-public firms needs to be tasked with monitoring and backing up regulators’ communications. Every firm ought to put up a constancy bond, forfeited in the event that they fail to satisfy the required service requirements. This will’t hold taking place.”