Nasdaq would require shareholder votes earlier than inventory issuances used to purchase crypto. Technique shares fell on the information however have clawed again 3% in pre-market buying and selling.

The added checkpoint lands immediately on a fast-growing playbook through which public corporations promote fairness or convertibles, then buy tokens for his or her stability sheets.

The evaluation enhances current itemizing requirements. Nasdaq’s Rule 5635 already requires shareholder approval in a number of conditions, together with non-public placements that attain the so-called 20 p.c threshold and sure change-of-control or acquisition constructions, as codified within the trade’s rule textual content filed with the SEC and associated steerage.

Nasdaq’s enforcement arm additionally emphasizes its mandate to police compliance with trade guidelines and federal securities legal guidelines.

The timing issues. A surge of “crypto-treasury” pivots reshaped small-cap capital markets this 12 months. Architect Companions tracks 184 public corporations which have disclosed plans to boost greater than $132 billion for token purchases, with many listings on Nasdaq.

The wave spans belongings akin to Bitcoin, Ethereum, Solana, and XRP and consists of autos purpose-built to carry or accumulate crypto.

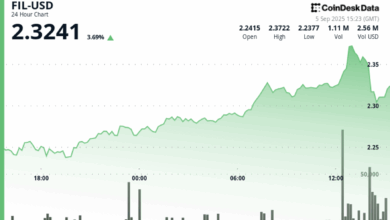

Markets responded shortly to the reported coverage shift. Crypto-treasury shares fell throughout Thursday’s session as traders weighed the prospect of added procedural steps and timing danger.

But urge for food for pure-play publicity stays seen. American Bitcoin, a Trump-family-backed miner and treasury firm created by a merger, debuted on Nasdaq and closed its first day up 16.5 p.c at $8.04.

Regulatory context is shifting in parallel. The SEC launched a rulemaking agenda that factors to a broader framework for digital belongings, together with clearer therapy for presents and gross sales and paths to commerce on nationwide securities exchanges and various buying and selling techniques.

Separate Home and Senate proposals would delineate jurisdiction between the SEC and CFTC and set timelines for implementing new guidelines. That federal backdrop interacts with exchange-level gatekeeping, which may sluggish or speed up capital raises in observe.

The Crypto Investor Blueprint: A 5-Day Course On Bagholding, Insider Entrance-Runs, and Lacking Alpha

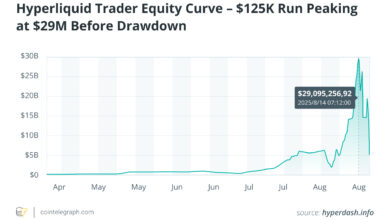

Crypto treasury corporations have exploded

The panorama spans greater than Bitcoin. Ethereum-centric treasuries have fashioned by massive spot purchases and staking applications. SharpLink disclosed greater than 176,000 ETH accrued at a mean of $2,626 and later crossed 200,000 ETH as a part of a said reserve technique.

Solana has drawn company balance-sheet pivots and financing, together with Upexi and DeFi Improvement Corp., whereas Bitcoin-only constructions search listings by SPACs akin to Bitcoin Customary Treasury Firm. XRP-focused plans have additionally surfaced, led by VivoPower’s fundraising and deployment applications and follow-on strikes to earn yield through Flare.

Nasdaq’s shareholder-approval display screen doesn’t ban crypto treasuries. It raises the bar by routing many financings by a vote, which may have an effect on deal cadence and pricing outcomes.

Corporations considering PIPEs, convertibles, or related-party constructions must mannequin the trade guidelines prematurely, together with thresholds and exceptions akin to monetary viability or modifications of management.

The coverage change arrives as issuers nonetheless pursue token publicity for balance-sheet administration, funds experimentation, or equity-per-coin positioning.

The primary part of the 12 months’s treasury rush delivered new listings, bigger token reserves, and value volatility throughout small-cap names.

Nasdaq’s added evaluation turns that rush right into a course of that can run by shareholder conferences, proxy calendars, and compliance checks.

The trade has began to use the scrutiny, and issuers planning crypto treasuries now face a vote.