The bitcoin bull run has already stalled with ongoing gross sales from long-term holder wallets and a slowdown in ETF inflows. To make issues worse, one other lesser-known however vital market variable seems to be turning towards BTC bulls, signaling new challenges on the horizon.

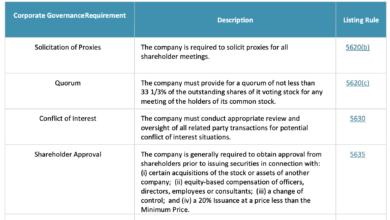

That market variable is the MOVE index, created by Harley Bassman, a former managing director at Merrill Lynch. The index calculates implied volatility utilizing a weighted common of choice costs on one-month Treasury choices throughout a number of maturities (2, 5, 10, and 30 years). This methodology captures the collective expectations of market individuals about future rate of interest actions.

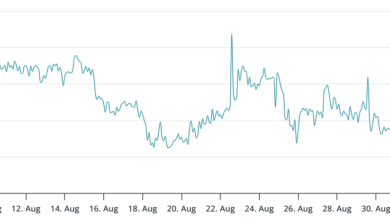

The MOVE index has surged from 77 to 89 in three days, marking the sharpest rise since early April, when President Donald Trump’s tariffs shook world markets, together with bitcoin, which fell to $75,000.

Extra importantly, momentum indicators just like the MACD are signaling a transparent bullish shift, suggesting the index is poised for continued good points. That requires warning on the a part of bitcoin bulls, as spells of upper anticipated bond market volatility, as captured by the MOVE index, are identified to trigger liquidity tightening worldwide.

U.S. Treasury notes are broadly considered high-quality liquid property and kind a cornerstone of the worldwide collateral pool, serving to to scale back credit score danger for lenders and facilitating a easy movement of funds throughout monetary markets.

Thus, heightened volatility in Treasury notes tends to disrupt liquidity, enhance borrowing prices and create ripple results throughout credit score markets and the broader monetary system. In such conditions, lenders demand greater danger premiums, and market individuals pull again from riskier property, finally slowing the movement of funds and including stress to world markets.

Moreover, heightened volatility in Treasury notes usually prompts bondholders to scale back length danger by shifting from longer-dated bonds (reminiscent of 10- or 30-year Treasury notes) to short-term securities, like two-year notes or Treasury payments.

This “flight to high quality” or “flight to security” normally accompanies a broader market sell-off, as buyers scale back publicity to equities, company bonds, and different danger property to protect capital amid volatility within the Treasury market.

Therefore, it is no shock that traditionally BTC’s value rallies have been characterised by declining developments within the MOVE index and vice versa.

To chop to the chase, the newest bounce within the MOVE index may exacerbate the BTC market’s ache, doubtlessly deepening the worth pullback.