Because the August U.S. nonfarm payrolls report (NFP) nears, bitcoin merchants on the CME are snapping up cheap bearish bets by buying far out-of-the-money places, hedging in opposition to the potential for an unexpectedly robust jobs print that would set off a sell-off in threat property.

The NFP, due Friday, is anticipated to indicate that the financial system added 110,000 jobs, up from 73,000 in July, based on consensus estimates from FactSet. The jobless price is anticipated to have held regular at 4.2%. In the meantime, hourly earnings are projected to rise 0.3%, the identical as in July.

The labor market outlook has already darkened, with JOLTS knowledge revealing that job openings declined greater than anticipated to 7.2 million in July, whereas a low give up price factors to moderating wage pressures. Early Thursday, ADP’s non-public sector employment report revealed that employers added simply 54,000 jobs in August, a steep decline from the 104,000 positions recorded in July.

These figures strengthen the case for Fed price cuts, a bullish improvement for asset costs. But, merchants on the Chicago Mercantile Alternate (CME) are contemplating the potential for an upbeat NFP report, which may dent Fed price lower bets and ship BTC decrease.

“We’ve seen sturdy urge for food for leveraged draw back publicity via 5-delta, OTM places, with constant demand throughout the curve. This positioning indicators traders are bracing for the potential for an upside shock in August’s NFP report that would re-anchor the Fed’s concentrate on inflation and cut back the percentages of price cuts this yr,” Gabe Selby, head of analysis at CF Benchmarks, informed CoinDesk.

Put choices give the client the fitting, however not the duty, to promote the underlying asset at a predetermined value by a specified future date. Merchants purchase places to hedge in opposition to or to revenue from a drop within the asset’s value.

The 5-delta put choices are deep out-of-the-money places with strike costs effectively beneath the present market value, making them comparatively cheap in comparison with choices nearer to the spot value. Merchants typically purchase these low cost “lottery ticket” places as speculative bets on sharp downward strikes or as low-cost hedges in opposition to excessive bearish situations.

Draw back concern

Selby noticed that, not like earlier pre-NFP intervals when put shopping for was primarily centered on long-term expiries, this time the exercise is unfold throughout each short-term and long-term expiries.

“The breadth of put shopping for displays a market recalibrating round uneven dangers, as a lot of this exercise is centred round far OTM places, indicating merchants nonetheless see a materially robust jobs print as an outdoor likelihood. That traces up with our view that even an in-line or barely stronger-than-expected payrolls quantity wouldn’t be adequate to tilt the Fed’s steadiness of dangers again towards its value stability mandate,” Selby informed CoinDesk.

Choices listed on Deribit, the world’s largest crypto choices trade by quantity and open curiosity, additionally exhibit draw back fears, with quick and near-dated places buying and selling at a notable premium to calls, based on threat reversals tracked by Amberdata.

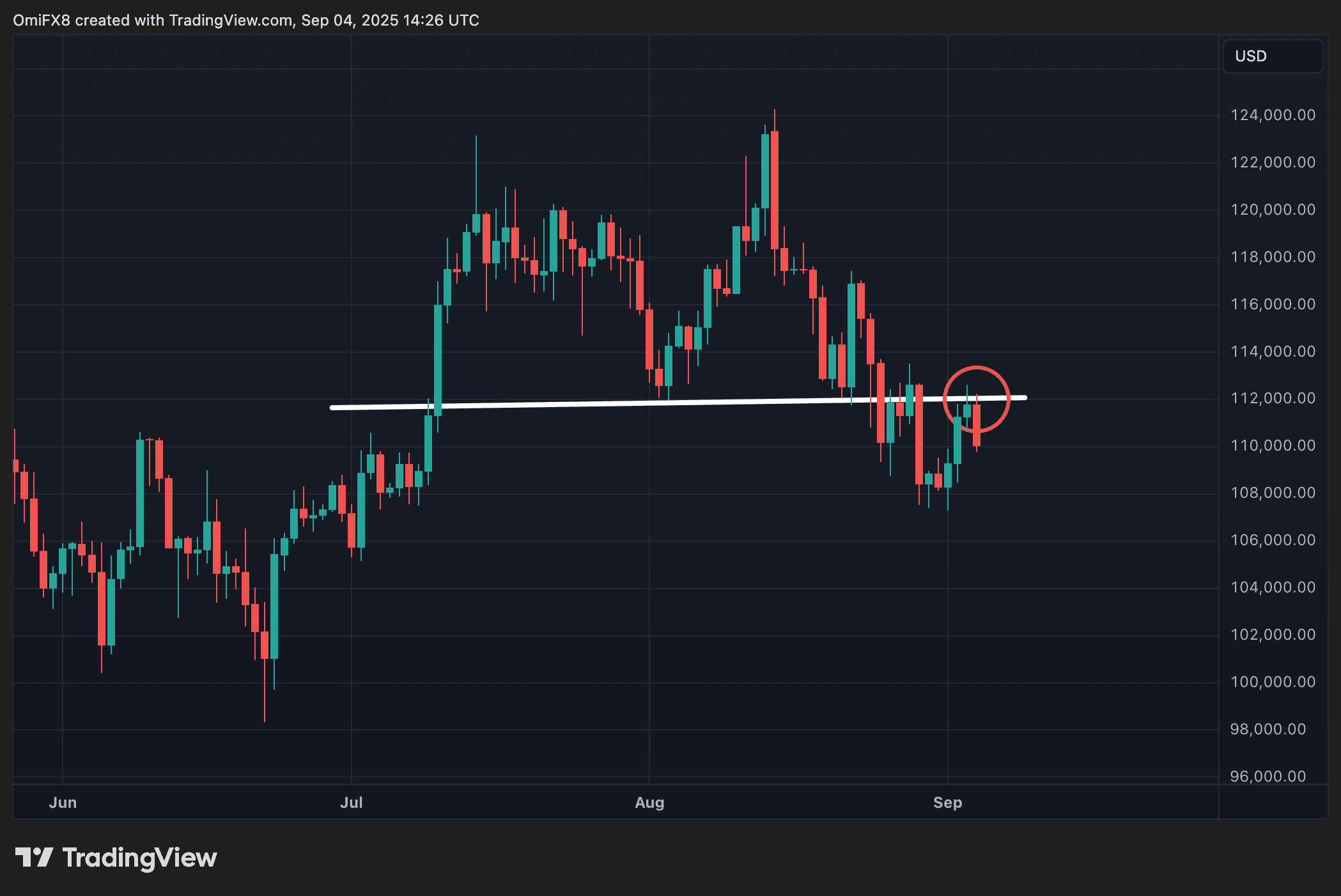

As of writing, BTC modified fingers at $109,950, down 2% on a 24-hour foundation, based on CoinDesk knowledge. The restoration from weekend lows ran out of steam above $112,000 on Wednesday, reinforcing the Aug. 3 low as key resistance.