Tokenized belongings are rising as a blockchain-based belief layer for institutional traders concentrating on sustainable market alternatives, signaling a possible inflow of capital onto blockchain rails.

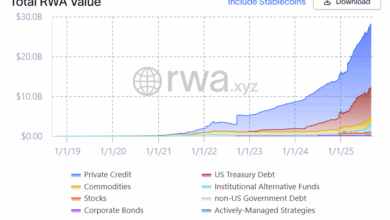

Actual-world asset (RWA) tokenization refers to monetary and tangible belongings minted on a everlasting blockchain ledger, providing advantages comparable to fractional possession, wider investor entry and 24/7 liquidity.

In accordance with Corey Billington, co-founder and CEO of tokenization infrastructure agency Blubird, tokenized RWAs supply a tamper-proof belief system that’s absent in conventional finance and local weather finance.

“The previous system may be very sluggish, very damaged, and sadly, that’s the place a lot of the market appears in the meanwhile,” stated Billington, talking throughout Cointelegraph’s Chain Response every day reside X areas present on Monday, including:

“A [tokenized NFT] is their receipt, and that can not be doctored. It might’t be cast. Nothing could be finished about that.”

This “creates a complete different belief layer that simply doesn’t exist in the meanwhile,” stated the CEO, including that this may increasingly appeal to extra institutional capital onchain.

Associated: RWA protocol exploits attain $14.6M in H1 2025, surpassing 2024

$32B emission discount tokenization milestone

The feedback come shortly after Blubird and wealth tokenization platform Arx Veritas tokenized $32 billion price of Emission Discount Property (ERAs), stopping almost 400 million tons of CO₂ emissions, Cointelegraph reported final Thursday.

The $32 billion marks the biggest tokenization occasion aligned with the Environmental, Social, and Governance (ESG) framework.

#CHAINREACTION https://t.co/tNB8P4DTaI

— Zoltan Vardai (@ZVardai) September 1, 2025

Associated: Mantle 2.0 to speed up DeFi-CeFi convergence: Delphi Digital

Tokenization to convey trillions in institutional local weather investments onchain

The issuance of tokenized ERAs could convey trillions in institutional capital to the blockchain.

“It actually creates lots of new entry factors for local weather finance,” which is at present restricted by the inefficiencies of current methods, Billington stated.

One main bottleneck is the sluggish verification course of for carbon belongings, which might take as much as 18 months by means of nonprofit standard-setter Verra, developer of the extensively used Verified Carbon Normal (VCS).

Nonetheless, tokenized RWAs are already enabling billions of {dollars} to circulation into ESG-aligned initiatives.

Blubird has greater than $18 billion in tokenization offers lined up by means of 2026, representing one other 230 million tons of potential CO₂ emissions averted, in keeping with Billington.

“We’re taking a look at roughly 230 million tons of CO₂ prevented emissions equal to that extra $18 billion pipeline,” stated Billington.

If pipelines like Blubird’s materialize, tokenization may change into the spine of institutional ESG funding methods by 2030.

Journal: TradFi is constructing Ethereum L2s to tokenize trillions in RWAs — Inside story