Key takeaways

-

Blockchain development in 2025 hinges on actual utilization and tech upgrades, not hypothesis or hype.

-

Energetic customers, measured by pockets addresses, are the important thing metric.

-

DeFi, NFT ecosystems and stablecoin adoption are driving tens of millions of latest customers.

-

Partnerships with main platforms and institutional inflows by means of Bitcoin ETFs are accelerating adoption.

-

Networks nonetheless face inflated metrics, scalability trade-offs, regulatory stress and L1-L2 competitors.

The blockchain business is rising quickly, with new networks rising to compete with established leaders. However are these platforms really gaining widespread use?

In 2025, blockchain development has been pushed by actual consumer engagement and progressive expertise, not simply hypothesis. From foundational layer-1 blockchains to environment friendly layer-2 options, networks are vying to draw tens of millions of customers by means of low-cost transactions, seamless integrations with mainstream platforms and thriving decentralized finance (DeFi) and non-fungible token (NFT) ecosystems.

This text ranks the highest 10 fastest-growing blockchains based mostly on their lively consumer development.

Standards for rating

Our rating of the highest 10 fastest-growing blockchains of 2025 relies totally on lively consumer numbers. Every entry additionally highlights whether or not the community is a layer 1 (L1) or layer 2 (L2), the metrics supporting its rise, the principle drivers behind its development and the challenges it faces.

For the uninitiated, L1 blockchains present foundational infrastructure with native consensus mechanisms, whereas L2 options are designed to boost the scalability of L1 blockchains and cut back their prices. For example, Ethereum is an L1 blockchain, whereas Polygon is an L2.

The time period “lively customers” refers to a novel pockets tackle that completes a transaction.

Absolutely diluted valuation (FDV) is the theoretical whole market worth of a cryptocurrency, assuming all its tokens are in circulation on the present worth. This metric gives a broader view of a challenge’s potential worth. It additionally helps decide whether or not a token is overvalued or undervalued relative to its whole potential provide.

Prime 10 fastest-growing blockchains

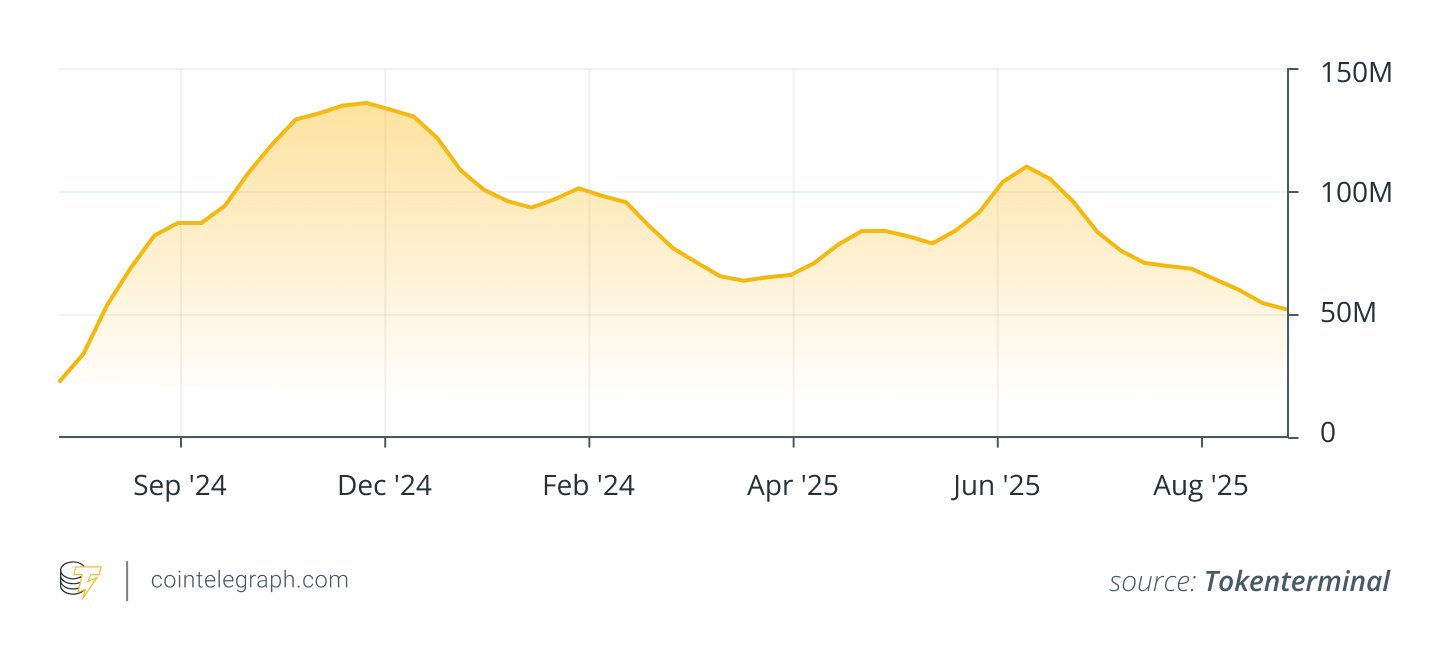

1. Solana

Solana is a high-speed L1 blockchain with a proof-of-history (PoH) consensus mechanism, designed for scalable decentralized purposes (DApps) and marketplaces.

-

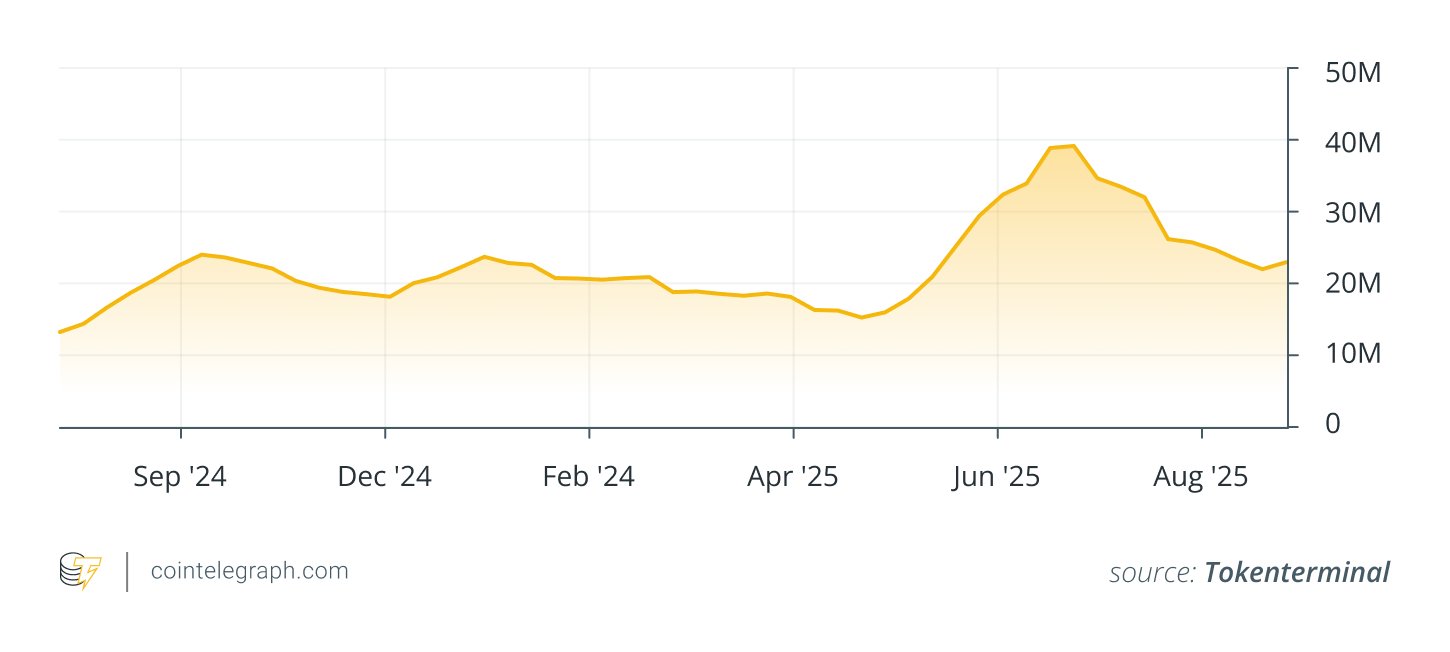

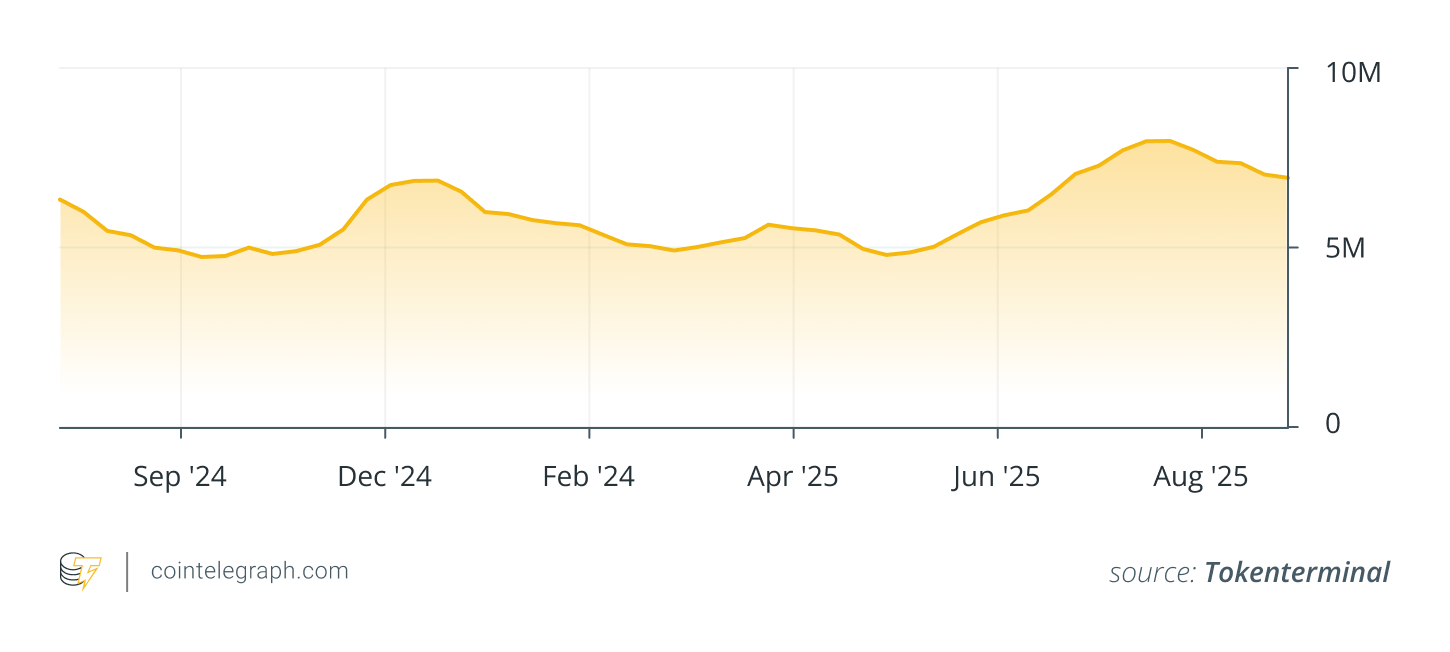

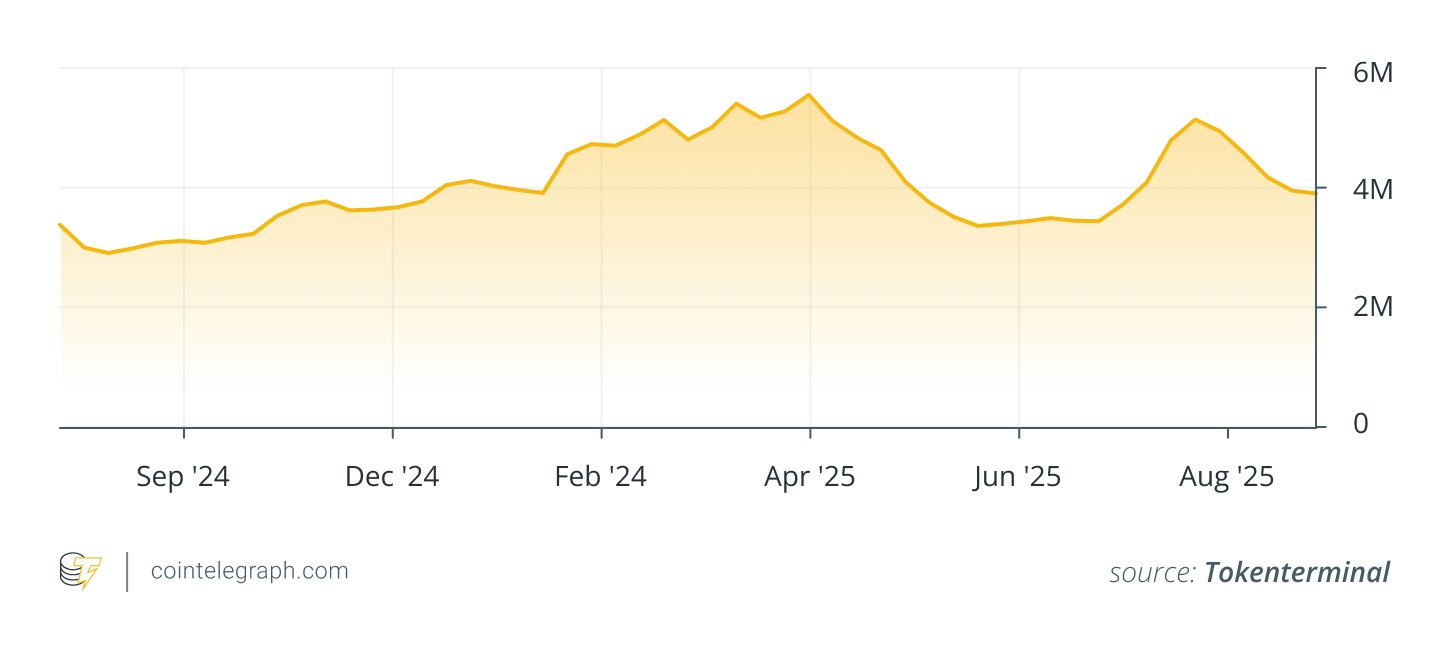

Month-to-month lively customers: 57 million

-

FDV: $107.2 million

-

Token buying and selling quantity (30 days): $284.2 billion

-

Key drivers: Solana’s development has been fueled by DeFi and NFTs, a surge in high-frequency buying and selling of memecoins, the Firedancer validator shopper boosting reliability and rising institutional adoption.

-

Challenges: Previous community outages have an effect on reliability. Different challenges embody criticism concerning the diploma of centralization and competitors from L2 options.

Do you know? Solana’s proof-of-history lets it course of hundreds of transactions per second, powering DeFi, NFTs and even memecoin buying and selling at lightning pace.

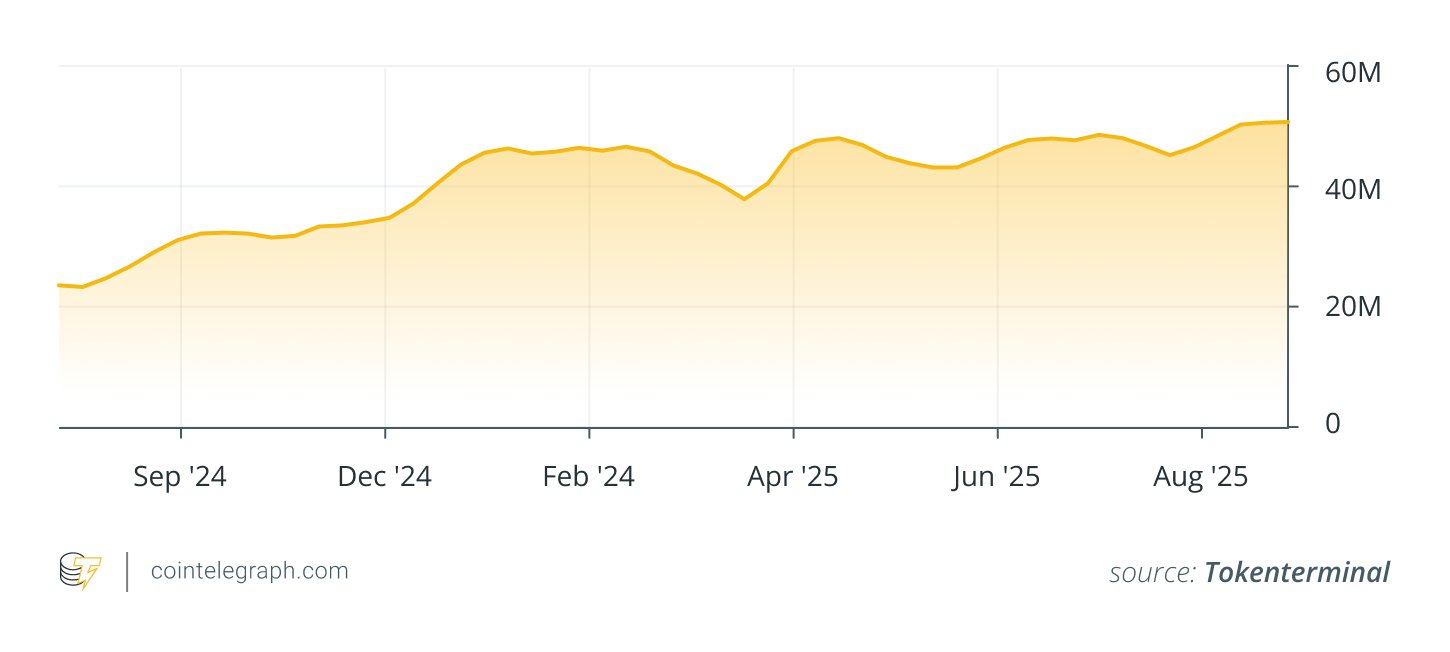

2. Close to Protocol

Close to Protocol is a layer-1 blockchain utilizing a thresholded proof-of-stake (TPoS) consensus. It focuses on scalability, developer-friendly instruments and integration of AI-native options for decentralized purposes.

-

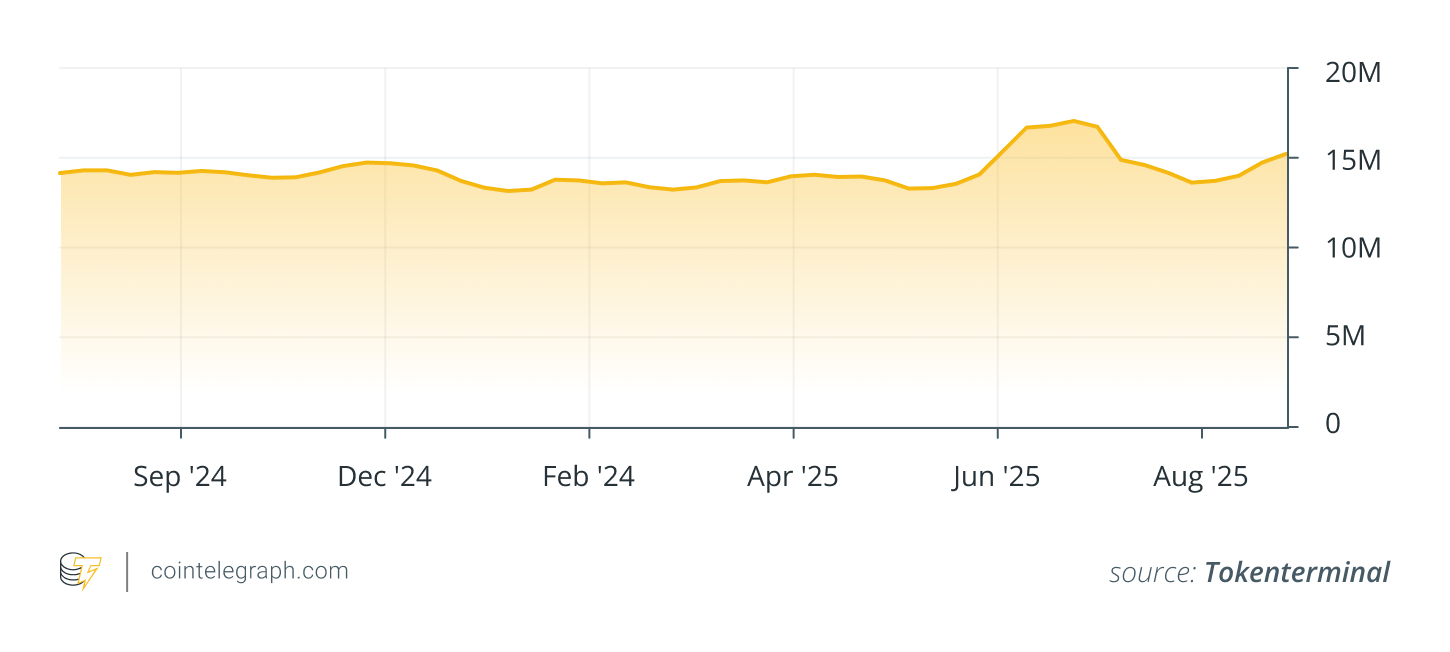

Energetic addresses (month-to-month): 51.2 million

-

FDV: $3.1 million

-

Token buying and selling quantity (30 days): $7.8 million

-

Key drivers: AI integration for user-owned brokers and intents, low transaction charges with carbon neutrality, partnerships like with EigenLayer for quick finality and ecosystem expansions in DeFi and gaming.

-

Challenges: Competitors from sooner L1s and L2s, worth volatility regardless of consumer development and potential vulnerabilities in sharding complexity.

Do you know? Close to Protocol boasts carbon neutrality with low charges. It has proven sturdy momentum regardless of competitors from sooner chains.

3. BNB Chain

BNB Chain is a Binance-backed L1 blockchain supporting DeFi, NFTs and DApps with Ethereum Digital Machine (EVM) compatibility.

-

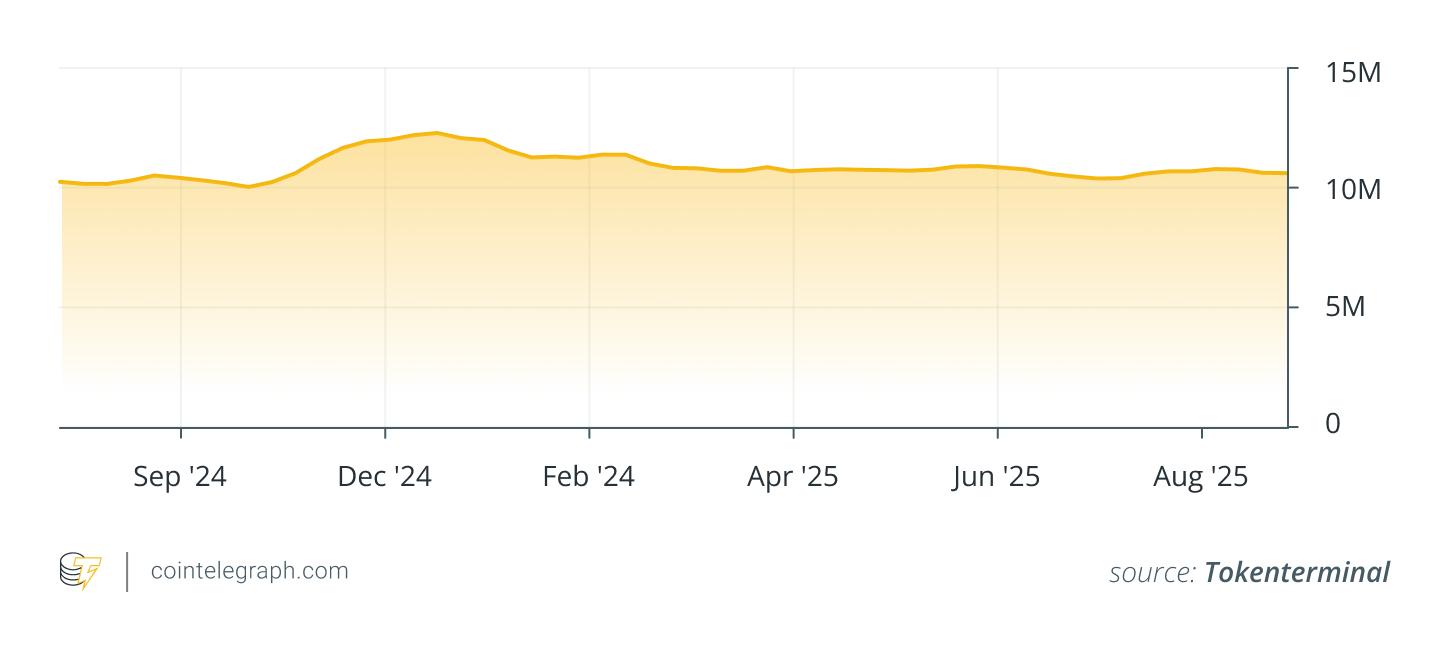

Energetic addresses (month-to-month): 46.4 million

-

FDV: $121.2 billion

-

Token buying and selling quantity (30 days): $56.1 billion

-

Key drivers: Lowered block time to 0.75 seconds, AI integrations for information possession.

-

Challenges: Centralization considerations because of backing of Binance, regulatory scrutiny.

4. Base

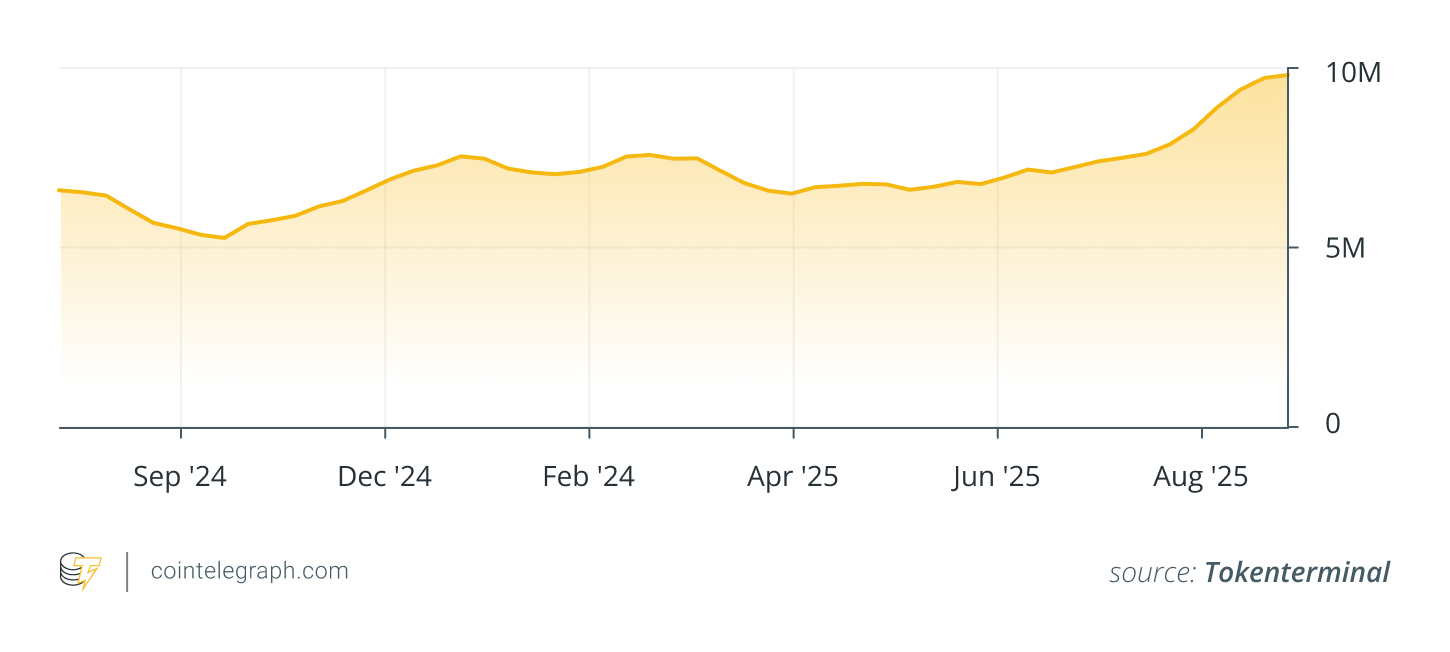

Coinbase developed Base, an Ethereum L2 blockchain utilizing optimistic rollups, specializing in low-cost DeFi, shopper apps and seamless integration.

-

Energetic addresses (month-to-month): 21.5 million

-

FDV: $2.92 billion

-

Key drivers: Extremely-low charges ($0.01 common), Coinbase’s 100 million+ consumer base for onboarding, stablecoin flows and partnerships for shopper DApps.

-

Challenges: Community congestion from excessive exercise, dependence on Ethereum for safety and regulatory compliance as a more moderen ecosystem.

5. Tron

Tron is a high-throughput L1 blockchain targeted on decentralized content material sharing and integration with Telegram and emphasizes low-cost stablecoin transactions.

-

Energetic addresses (month-to-month): 14.4 million

-

FDV: $33.5 billion

-

Token buying and selling quantity (30 days): $51.7 billion

-

Key drivers: Negligible transaction charges, AI and cross-chain integrations and partnerships like with Rumble Cloud.

-

Challenges: Regulatory scrutiny, centralization dangers.

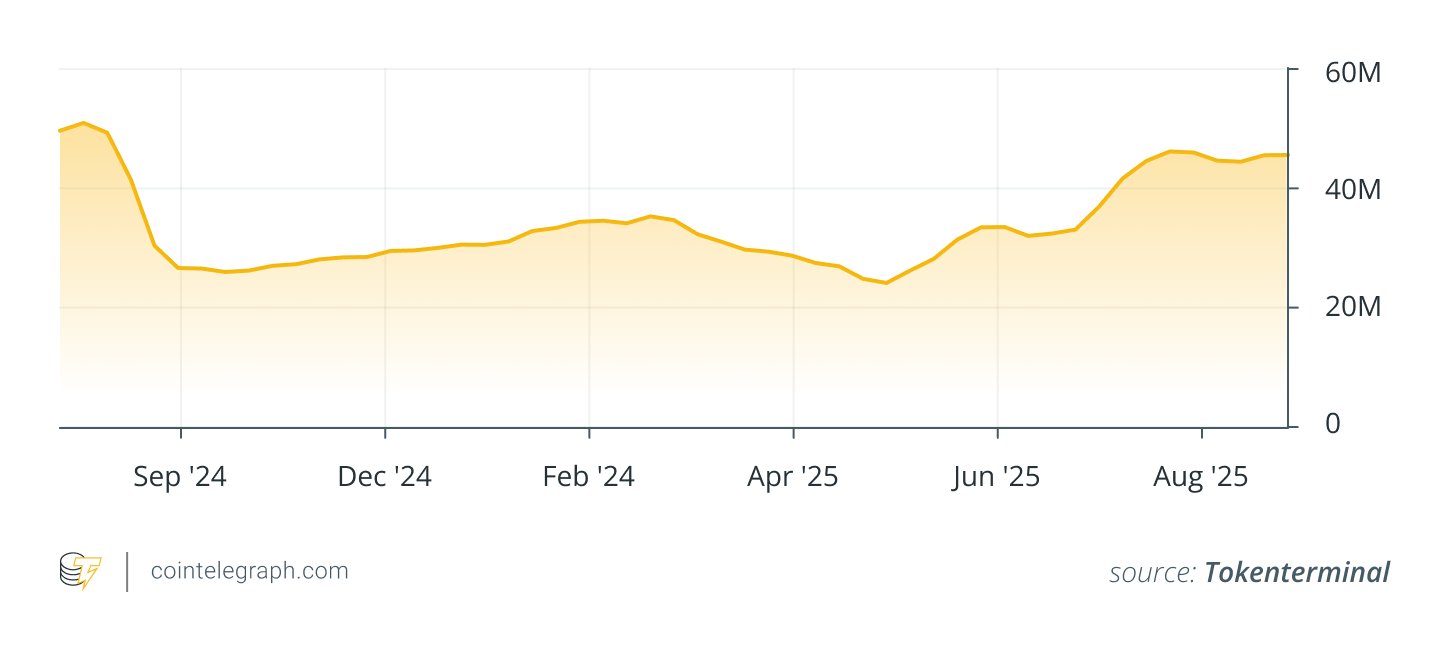

6. Bitcoin

Bitcoin is the unique decentralized cryptocurrency utilizing proof-of-work (PoW) consensus. It serves as digital gold for store-of-value and funds.

-

Energetic addresses (month-to-month): 10.8 million

-

FDV: $2.3 trillion

-

Token buying and selling quantity (30 days): $1.3 trillion

-

Key drivers: Institutional inflows through exchange-traded funds (ETFs). (As of This fall 2024, skilled traders with over $100 million below administration maintain Bitcoin ETFs price $27.4 billion.) Lowered provide because of halving occasions and adoption as a strategic reserve.

-

Challenges: Excessive power consumption; volatility from macroeconomic elements.

7. Aptos

Aptos is an L1 blockchain by ex-Meta engineers utilizing the Transfer language, emphasizing scalability, DeFi and developer development for DApps.

-

Energetic addresses (month-to-month): 10 million

-

FDV: $5.3 billion

-

Token buying and selling quantity (30 days): $13 billion

-

Key drivers: Peak 19,200 TPS; Transfer language for safe contracts; partnerships like Tether’s USDt (USDT) launch

Challenges: Wants broader adoption and competitors from established L1s.

8. Ethereum

Ethereum is a number one L1 blockchain for good contracts, DeFi and NFTs, with an unlimited developer ecosystem utilizing a proof-of-stake (PoS) consensus.

-

Energetic addresses (month-to-month): 9.6 million

-

FDV: $522.7 billion

-

Token buying and selling quantity (30 days): $1.1 trillion

-

Key drivers: Pectra improve for higher UX and scalability, ETF inflows and institutional staking.

Challenges: Scalability points, greater charges than rivals and regulatory pressures.

9. Polygon

Polygon gives a multichain scaling resolution for Ethereum utilizing PoS, supporting DeFi, NFTs and enterprise apps with EVM compatibility.

-

Energetic addresses (month-to-month): 7.2 million

-

FDV: $2.6 billion

-

Token buying and selling quantity (30 days): $4.2 billion

-

Key drivers: Upgrades like Heimdall v2 for interoperability and partnerships with Fortune 500 corporations.

-

Challenges: Regulatory scrutiny below Markets in Crypto-Belongings (MiCA) and competitors from different L2s.

Do you know? The Polygon improve Heimdall v2 has boosted interoperability throughout chains, solidifying Polygon’s function as a multichain scaling hub within the web3 world.

10. Arbitrum One

Arbitrum One is a number one Ethereum L2 utilizing optimistic rollups for sooner, cheaper transactions whereas inheriting Ethereum’s safety.

-

Energetic addresses (month-to-month): 4 million

-

FDV: $5.1 billion

-

Token buying and selling quantity (30 days): $14.3 billion

-

Key drivers: Integrations like Robinhood for tokenized property and upgrades like Stylus for decrease charges.

-

Challenges: Dependence on the Ethereum mainnet, regulatory uncertainty and competitors from Optimism.

Traits driving blockchain development

The story of blockchain in 2025 is certainly one of acceleration. New applied sciences and mainstream acceptance are pushing development on each the foundational L1 degree and the scaling L2 layer. The generally noticeable developments embody:

-

Stablecoin adoption boosting transaction volumes: Stablecoins like USDT and USDC (USDC) are considerably rising transaction exercise. This enhances liquidity and consumer engagement throughout ecosystems.

-

Layer-2 options enhancing scalability and lowering prices: Scaling options like Arbitrum One and Base enhance Ethereum’s capability for dealing with transactions and decrease charges to as little as $0.01 per transaction. This makes DApps extra reasonably priced and accessible.

-

DeFi and NFT ecosystems entice new customers: DeFi protocols and NFT marketplaces are bringing in tens of millions of latest customers. Companies like GMX on Arbitrum and Polygon’s NFT quantity ($227 million in Q1 2025) supply progressive instruments for finance and digital collectibles.

-

Integration with mainstream platforms: Blockchains are rising by integrating with main platforms. For example, Base is constructed into Coinbase, giving it entry to over 100 million potential customers.

-

Institutional curiosity and partnerships: Rising institutional involvement is making blockchain extra legit. Bitcoin ETFs acquired $36.4 billion in 2024. Company partnerships with blockchain networks have additionally helped improve the credibility of blockchains. For example, Starbucks has partnered with Microsoft and the blockchain community Azure to create a traceability system.

Person development, challenges and the trail ahead

The speedy development of the highest 10 blockchains by lively customers in 2025 highlights the increasing function of decentralized expertise. Networks like Solana and Arbitrum are main this adoption with low-cost transactions, DeFi purposes and mainstream integrations.

Nevertheless, key challenges stay:

-

Inflated metrics: Bot exercise and inactive addresses can exaggerate true consumer development.

-

Scalability vs. decentralization: Some high-speed networks compromise on decentralization.

-

Regulatory uncertainty: Scrutiny of stablecoins and illicit actions creates adoption dangers.

-

Market competitors: Intense rivalry exists between L1 chains and Ethereum’s L2 options.

In response, blockchains are innovating with higher bot detection, improved scaling options, regulatory compliance and distinctive choices like AI and asset tokenization. These efforts are essential for sustaining long-term development and shaping the way forward for the ecosystem.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a choice.