Sensible contract blockchain Avalanche recorded a constant surge in blockchain exercise, as analysts level to rising decentralized buying and selling actions and returning crypto whale hypothesis across the subsequent rising memecoin.

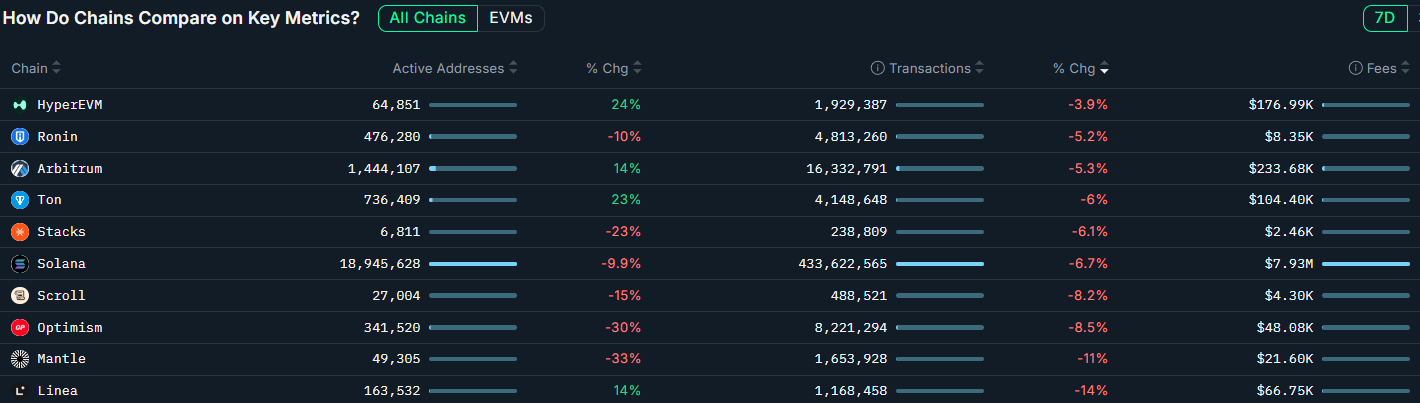

Avalanche’s transaction progress surpassed all different blockchains the previous week, rising 66% to 11.9 million transactions throughout over 181,000 energetic addresses, signaling rising investor mindshare specializing in the blockchain.

The milestone occurred after a “landmark effort” of the US Division of Commerce, which adopted Avalanche, together with 9 different public decentralized blockchains, for publishing its actual gross home product (GDP), Cointelegraph reported on Aug. 29.

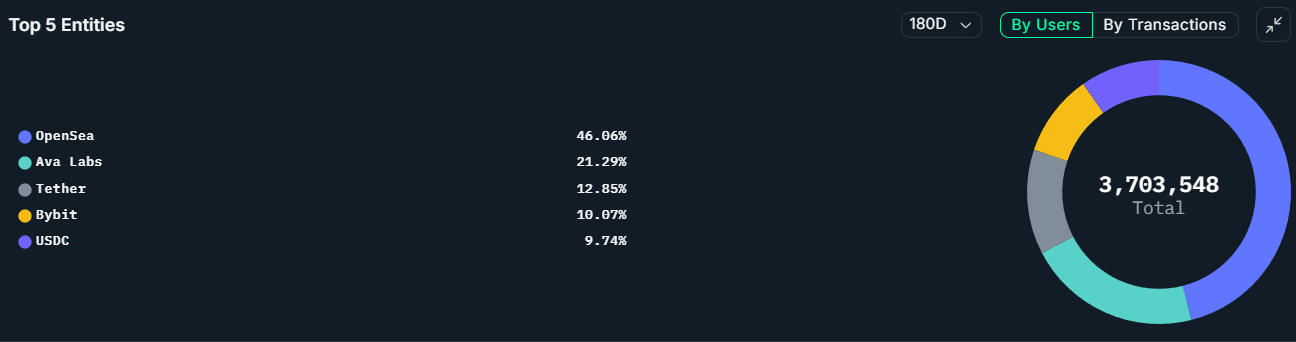

Regardless of Avalanche’s rising institutional and governmental adoption, we “can’t at this level attribute this to the US Authorities adopting Avalanche for its GDP knowledge,” in keeping with Nicolai Sondergaard, analysis analyst on the Nansen crypto intelligence platform.

The community’s rising blockchain exercise is principally pushed by decentralized finance (DeFi) merchants, miner extractable worth (MEV) buying and selling bots, and whales speculating on the following large memecoin launch, the analyst informed Cointelegraph, including:

“The transaction surge is pushed by: 60% DeFi protocol exercise (Dealer Joe, Aave, Benqi), 25% Automated buying and selling bots and MEV, and 10% Whale buying and selling and memecoin hypothesis […].”

The analysis analyst defined that the extra 5% of blockchain exercise was attributed to blockchain gaming and non-fungible tokens (NFTs).

Associated: Avalanche, Toyota Blockchain designing autonomous robotaxi infrastructure

DEX buying and selling, “high-balance” whales drove nearly all of Avalanche blockchain exercise: Nansen

Cryptocurrency buying and selling on decentralized exchanges drove the lion’s share of Avalanche’s blockchain exercise, with Dealer Joe DEX because the “main driver,” which noticed over $333 million value of Avalanche Wrapped Ether (WETH.e) quantity in the course of the previous 7 days.

“Key gamers” driving this exercise included merchants on Nansen’s prime 100 leaderboard, who made a number of six-figure trades, defined Sondergaard.

Aave lending protocol was the secondary driver with $624,000 value of flash mortgage exercise by DEX aggregators, whereas the Benqi Protocol grew to be one other vital driver, after receiving over $650,000 value of deposits from cryptocurrency buying and selling bots.

Automated buying and selling actions and “excessive stability” whale addresses drove the remainder of the blockchain exercise, with the Black (BLACK) token seeing $14 million in buying and selling quantity, with a number of whale addresses amassing as much as $95,000 value of the token.

Associated: Kanye West’s YZY token: 51,000 merchants misplaced $74M, whereas 11 netted $1M

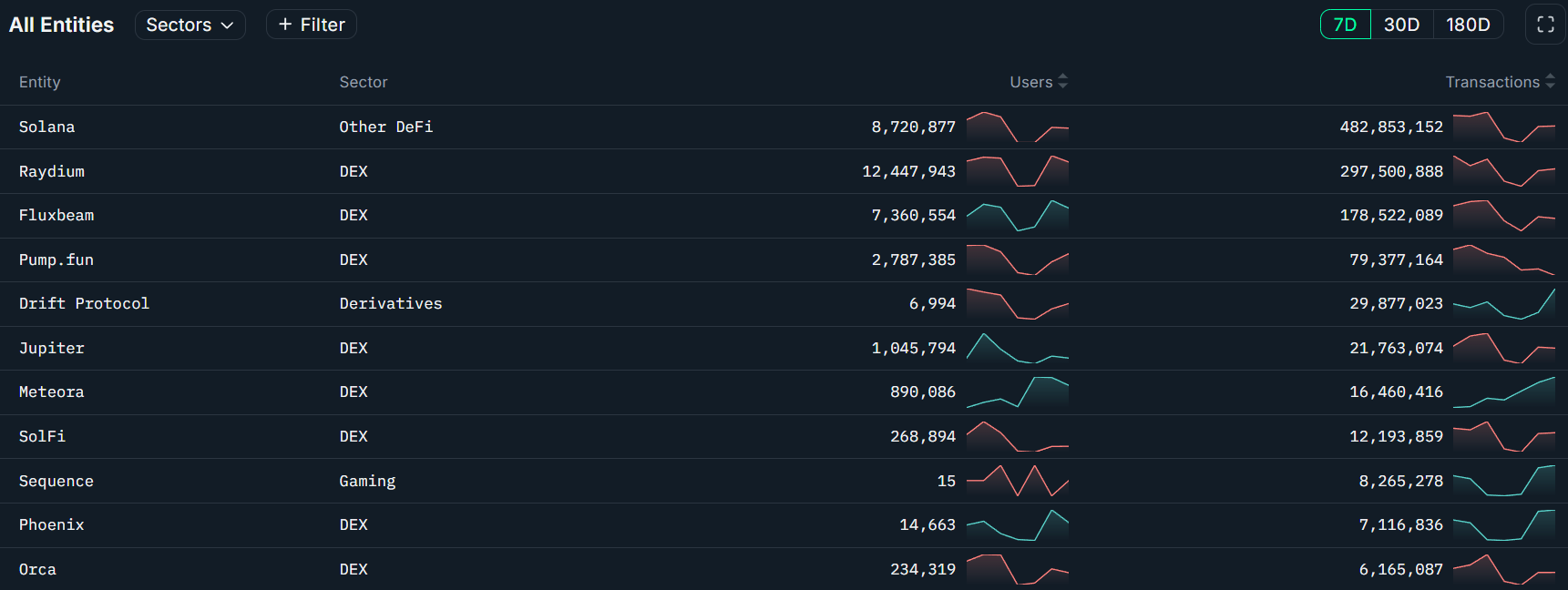

Taking a look at certainly one of Avalanche’s principal opponents, the Solana blockchain noticed a 6.7% lower in weekly transactions, notable 433 million transactions throughout 18.9 million energetic addresses, Nansen knowledge exhibits.

Just like Avalanche, DEX buying and selling drove nearly all of blockchain exercise, together with Raydium DEX with 12.4 million customers and 297 million transactions, adopted by Fluxbeam DEX with 7.3 million customers and 178 million transactions.

Journal: Altcoin season 2025 is sort of right here… however the guidelines have modified