Key takeaways:

-

Bitcoin’s Price Foundation Distribution exhibits sturdy purchaser help versus Ether’s weaker flows.

-

Coinbase and Binance netflows trace at a liquidity regime shift favoring reaccumulation.

-

BTC should break $113,650 to substantiate a bullish pattern, else threat a drop towards $100,000.

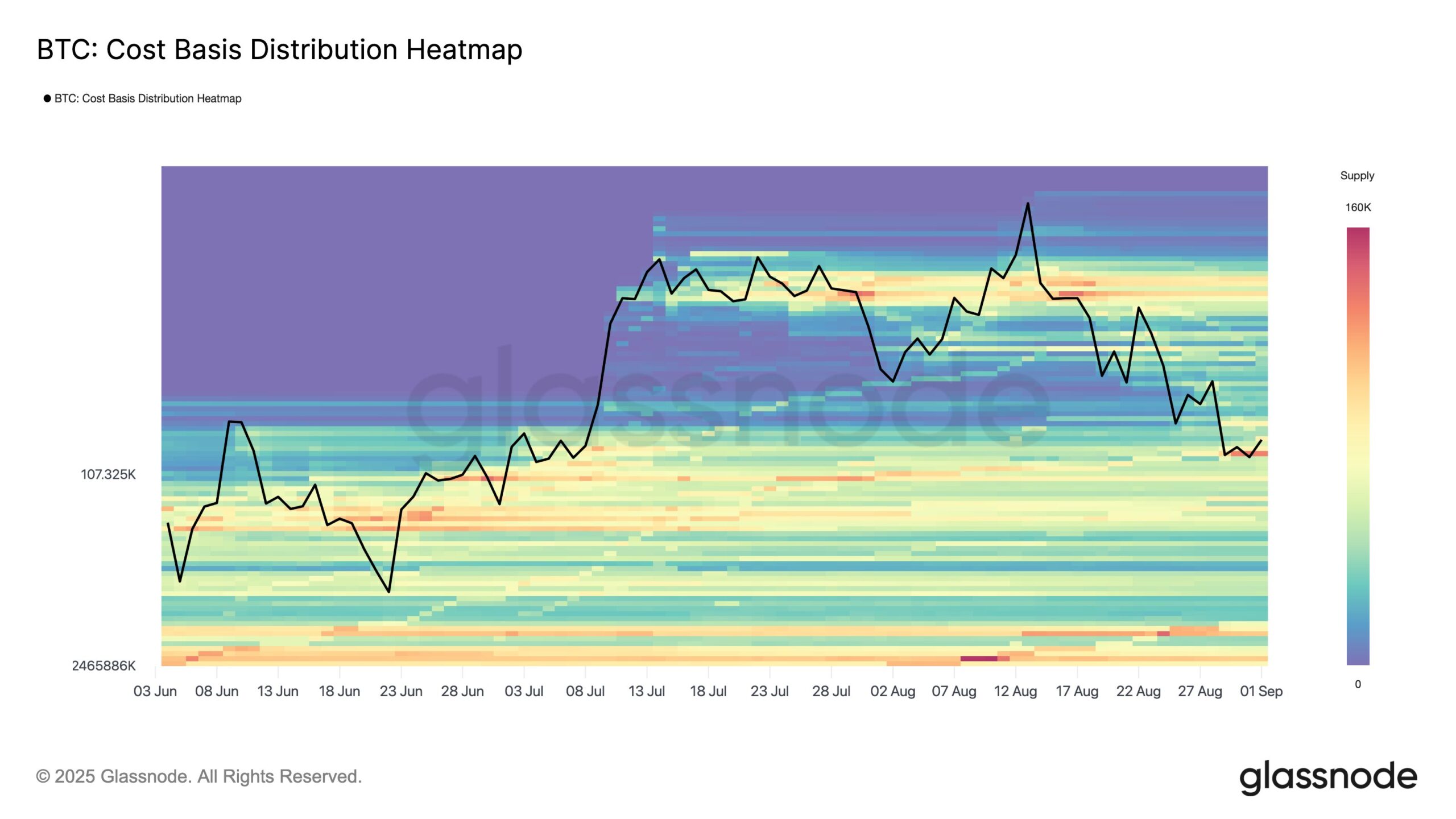

Bitcoin’s (BTC) spot market is flashing indicators of a possible restoration rally. Knowledge from Glassnode signifies BTC’s Price Foundation Distribution (CBD) exhibits a pointy divergence with Ether (ETH). The CBD is an onchain metric that identifies worth ranges the place important provide has been accrued or distributed. Whereas ETH flows stay sparse, Bitcoin spot exercise is denser, with transactions clustering tightly throughout latest ranges.

This density may point out a robust purchaser’s conviction, and up to now, it has offered extra sturdy help than futures-driven momentum.

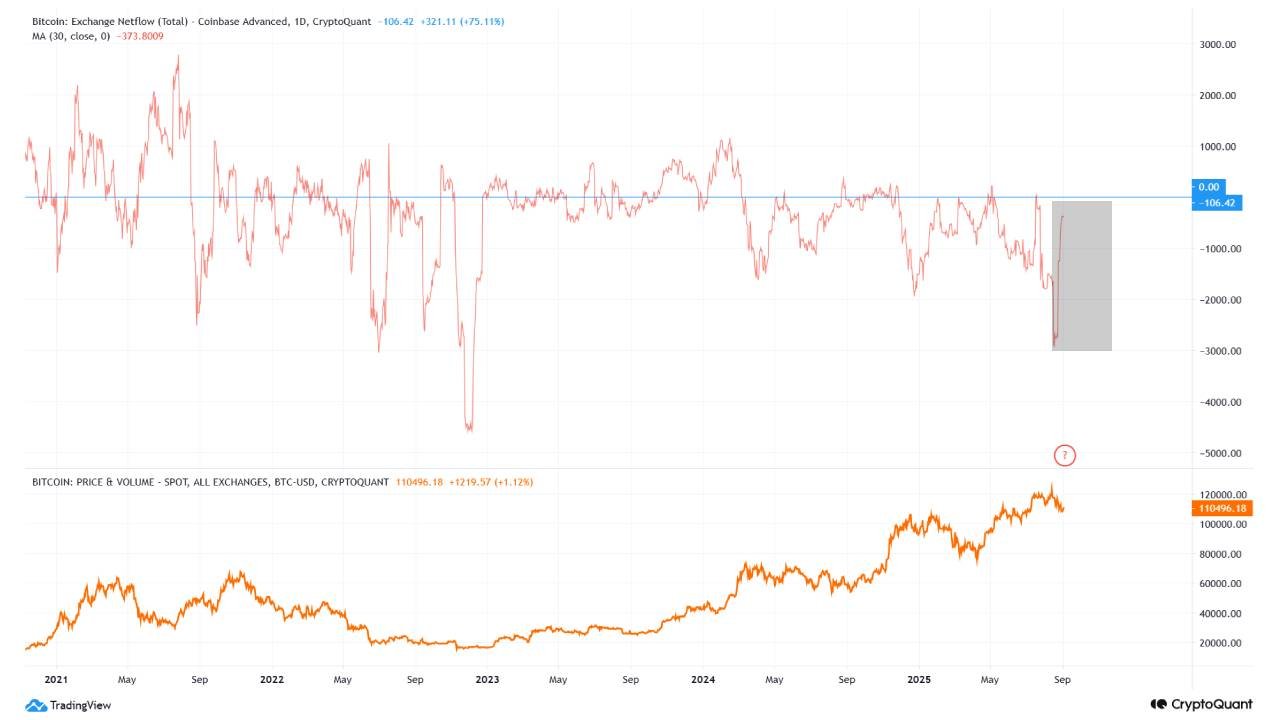

Alternate flows add weight to the thesis. A CryptoQuant quicktake put up factors out that Coinbase recorded a constant netflow spike between Aug. 25–31, instantly after its 30-day easy shifting common (SMA) hit the bottom degree since early 2023. Sharp reversals from multi-year troughs typically sign a regime shift in liquidity, whether or not by way of settlement restructuring or preparations for greater alternate exercise.

In the meantime, Binance noticed its 30-day SMA netflow attain the best since July 2024 on July 25 and Aug. 25, a degree that traditionally coincided with reaccumulation phases earlier than new native highs.

The simultaneous Coinbase trough and Binance peak level to significant reserve redistribution, doubtlessly setting the stage for upside.

Lengthy-term holder (LTH) spending or potential profit-taking has additionally accelerated in latest weeks, with the 14-day SMA trending greater. But exercise stays inside cycle norms and properly under the October–November 2024 peaks, suggesting measured distribution moderately than aggressive promoting.

Associated: How excessive can Bitcoin worth go as gold hits document excessive above $3.5K?

Bitcoin eyes key breakout as $113,600 degree comes into focus

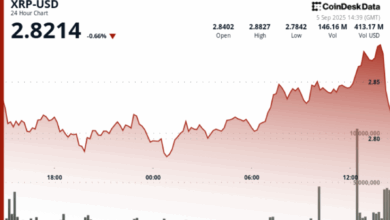

Bitcoin (BTC) confirmed indicators of resilience this week after dipping to $107,300 on Monday, a degree that aligns carefully with its short-term realized worth, hinting at potential help. From that low worth, BTC rebounded sharply, breaking above Monday’s $109,900 excessive through the New York buying and selling session on Tuesday.

The transfer comes after a two-week corrective section, with decrease time frames such because the 15-minute and 1-hour charts now flashing a bullish break of construction. On the 4-hour chart, the relative power index (RSI) has additionally reclaimed ranges above 50, reinforcing the rising bullish conviction.

For the restoration to proceed, Bitcoin should clear speedy resistance between $112,500 and $113,650. A decisive shut above $113,650 would affirm a bullish break of construction on the every day chart and invalidate the descending trendline that has capped worth motion for the previous two weeks. Such a breakout may open the trail towards liquidity targets at $116,300, $117,500, and doubtlessly $119,500.

Nevertheless, merchants ought to stay cautious given September’s bearish seasonality. A failed breakout or sustained weak point under $113,650 would go away BTC weak, with draw back targets extending towards the order block between $105,000 and $100,000.

Associated: Bitcoin bulls cost at $112K as gold hits recent all-time highs

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes threat, and readers ought to conduct their very own analysis when making a call.