Key takeaways:

-

Ethereum whales purchased 260,000 ETH within the final 24 hours, signaling accumulation.

-

Whales, BitMine and ETFs add billions of {dollars} in ETH, reinforcing bullish demand.

-

Worth technicals favor the bulls with targets between $5,000 and $6,000.

Regardless of the value drawdown, whales preserve shopping for tons of of hundreds of ETH, igniting hopes of Ether’s potential return to all-time highs.

Ethereum whales purchase the dip

Responding to the market correction over the past week, Ether (ETH) whales took benefit of the drop to $4,200.

Information from Santiment exhibits that whale addresses holding between 10,000 and 100,000 ETH rose by 4% between Aug. 24 and Tuesday. Furthermore, these huge traders have amassed about 260,000 ETH price $1.14 billion previously 24 hours.

This underscores the arrogance these giant traders have sooner or later prospects of ETH, regardless of its newest worth correction.

Associated: Ether might see the ‘largest bear entice’ this month: Analysts

As Cointelegraph reported, Bitcoin (BTC) whales rotating billions of {dollars} into Ether is a seamless pattern.

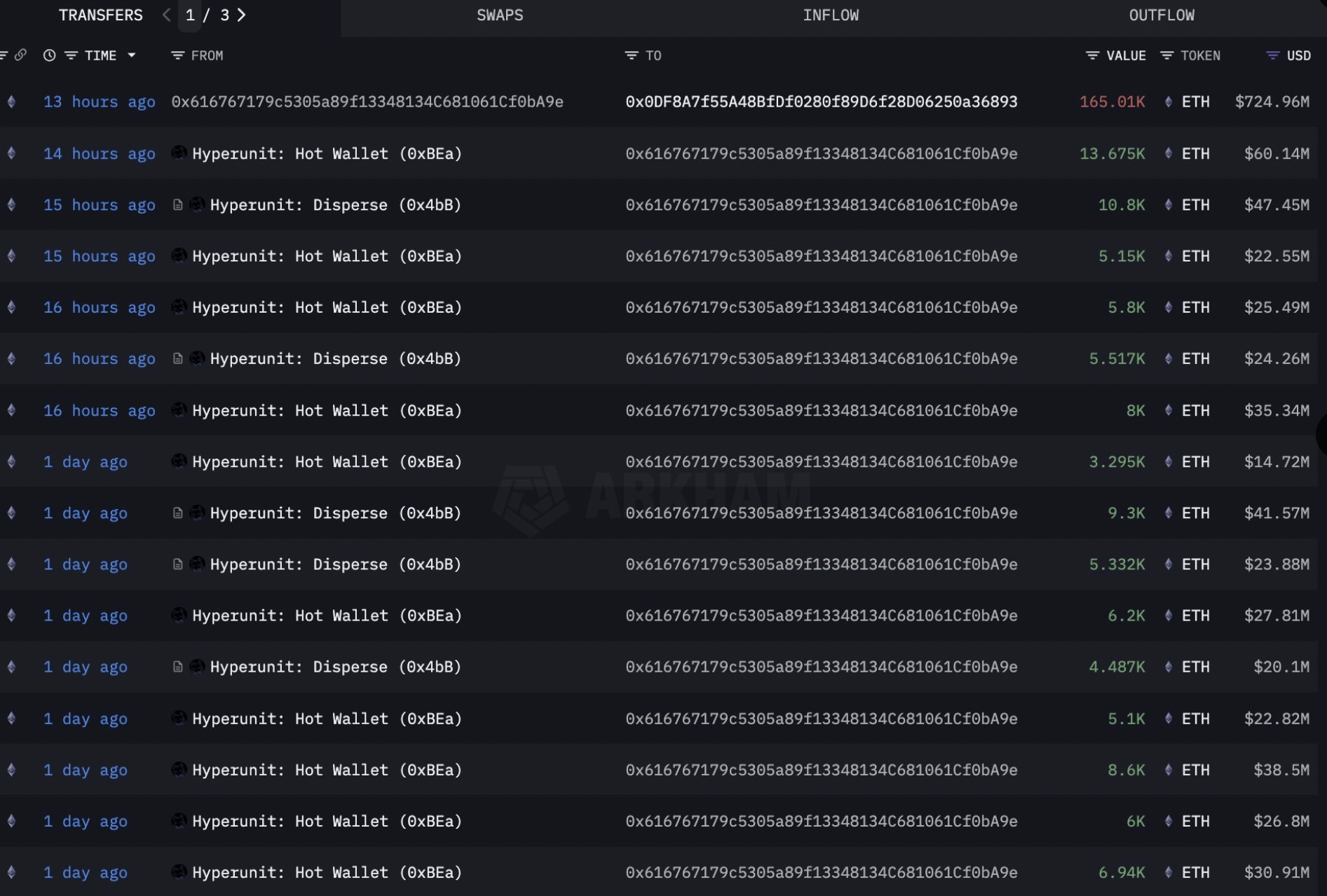

On Monday, a whale holding $5 billion price of BTC purchased and staked $1.08 billion of ETH by way of Hyperunit, information useful resource Arkham Intelligence revealed in a put up on X, including:

“Together with final week’s purchases, this whale has now purchased and staked $3.5 billion of ETH in complete.”

These strikes coincide with BitMine’s continued push into Ethereum. Over the previous week, the corporate added $354.6 million in Ether, pushing its complete holdings to 1.71 million ETH (valued at about $8 billion), making it the most important company holder of ETH and the second-largest crypto treasury behind Technique.

🧵

1/5

BitMine disclosed newest crypto holdings. As of August twenty fourth at 5:30pm ET:– 1,713,899 $ETH,

– 192 Bitcoin ($BTC) and

– unencumbered money of $562 million

– totally diluted shares excellent 221,515,180= BMNR NAV per share $39.84

Whole NAV $8.8 billion.

BitMine is #2… pic.twitter.com/PjN7nry3bf— Bitmine BMNR (@BitMNR) August 25, 2025

World Ethereum funding merchandise attracted greater than $1.4 billion in inflows final week, whereas spot Ethereum ETFs noticed $1.4 billion in inflows between Aug. 25 and Friday.

This strengthens the narrative that Wall Road views the latest ETH worth drawdown as a very good entry alternative.

Can ETH worth recuperate to $5,000?

Information from Cointelegraph Markets Professional and TradingView exhibits ETH buying and selling inside a symmetrical triangle within the four-hour time-frame, as proven within the chart under.

The value should shut above the triangle’s higher trendline at $4,440 to verify a bullish breakout. Be aware that that is the place the 50-period easy transferring common (SMA) and the 100 SMA converge.

Above this degree, the value faces resistance between $4,800 and a $4,950 all-time excessive, which, if damaged, can climb shortly to the measured goal of $5,249.

Such a transfer would convey the whole features to twenty% from the present degree.

Common analyst CryptoGoos says Ether’s macro construction stays sturdy, with the altcoin’s breakout from a falling wedge nonetheless in play on the weekly chart.

The measured goal of the falling wedge was $6,100, as proven within the chart under.

“Don’t promote your $ETH too early!” the analyst informed followers in an X put up on Tuesday.

Different metrics additionally counsel that Ethereum’s bull cycle shouldn’t be over, with a number of technical setups projecting that ETH’s worth might climb towards $10,000-$20,000 within the coming months.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.