Gemini, a crypto trade based by Cameron and Tyler Winklevoss, has introduced the launch of an preliminary public providing (IPO) of 16.67 million shares of Class A standard inventory.

Gemini House Station formally filed a Type S-1 for IPO on Tuesday, planning to promote the shares priced between $17 and $19 per share, to boost as much as $317 million.

Topic to completion, the submitting comes weeks after the corporate filed with the US Securities and Alternate Fee to checklist its Class A standard inventory on the Nasdaq International Choose Market underneath the ticker GEMI on Aug. 16.

With the IPO, Gemini trade is in search of a valuation of as much as $2.22 billion, in accordance with a report by Reuters.

Goldman Sachs, Citigroup amongst lead bookrunners

Gemini’s IPO includes participation from outstanding monetary establishments, together with Goldman Sachs, Citigroup, Morgan Stanley and Cantor, who’re appearing as lead bookrunners.

Extra bookrunners embrace Evercore ISI, Mizuho, Truist Securities, Cohen & Firm Capital Markets, Keefe, Bruyette & Woods, A Stifel Firm, Needham & Firm and Rosenblatt.

Moreover, Academy Securities, AmeriVet Securities, and Roberts & Ryan are appearing as co-managers.

Rising progress firm

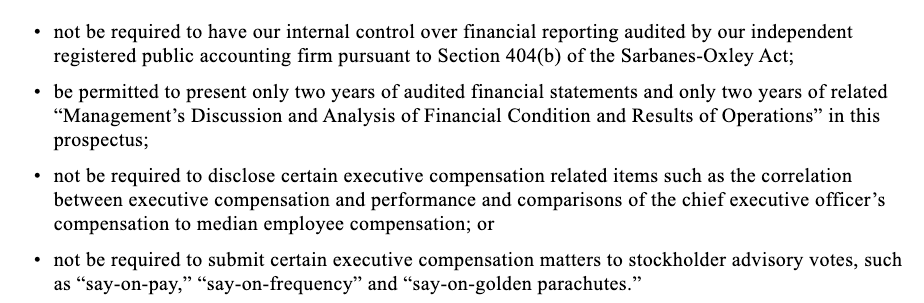

Within the submitting, Gemini confused that it recordsdata for an IPO as an “rising progress firm,” which, in accordance with the US federal securities legal guidelines, makes it topic to lowered public firm reporting necessities.

“We qualify as an ‘rising progress firm’ as outlined in Part 2(a)(19) of the Securities Act of 1933,” Gemini wrote, including:

“In consequence, we’re permitted to, and intend to, depend on exemptions from sure disclosure necessities which are relevant to different corporations that aren’t rising progress corporations.”

Associated: Grayscale submits confidential IPO submitting with SEC

As an rising progress firm with lowered reporting exemptions, Gemini disclosed that it had offered solely two years of audited monetary statements and omitted a compensation dialogue, amongst different reliefs.

Gemini’s IPO submitting got here months after the corporate filed a confidential draft registration assertion about its IPO in June, which allowed it to file for IPO earlier than publicly disclosing delicate data.

The confidential submitting got here the subsequent day after Circle, the issuer of the second-largest stablecoin by market capitalization, USDC (USDC), debuted buying and selling on the New York Inventory Alternate on June 5.

Journal: Bitcoin to see ‘yet another huge thrust’ to $150K, ETH strain builds: Commerce Secrets and techniques