Technique (MSTR) continued its relentless bitcoin purchases, buying one other 4,048 cash final week and bringing firm holdings to 636,505 cash.

Final week’s buys have been made for just below $450 million, or a median price of $110,981 every. They have been funded principally via gross sales of widespread inventory, with gross sales of the corporate’s numerous most popular shares making up the remainder.

The widespread inventory gross sales have been considerably controversial of late as Saylor and staff not way back promised to by no means subject shares when the inventory’s mNAV — the ratio of the inventory valuation in comparison with worth of bitcoin holdings — fell beneath 2.5x.

The tough experience for the inventory of late although, has introduced the mNAV to the 1.5x space. With apparently simply modest demand for most popular inventory and none for convertible debt, the corporate — if it needed to proceed to make sizable bitcoin purchases — had little alternative however to scrap the mNAV 2.5x promise.

The issue with gross sales of widespread inventory at such a modest premium to mNAV, say the naysayers, is that the issuance dangers being dilutive to present shareholders.

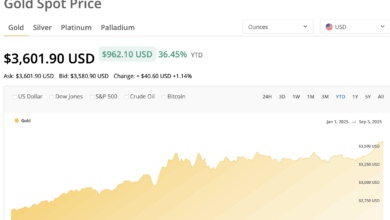

The corporate’s bitcoin holdings are value just below $70 billion at bitcoin’s present value of $109,400.

MSTR shares are modest decrease in premarket buying and selling.