World Liberty Monetary’s WLFI token went reside on Sept. 1 after months of anticipation, and the debut rapidly turned heads throughout the crypto market.

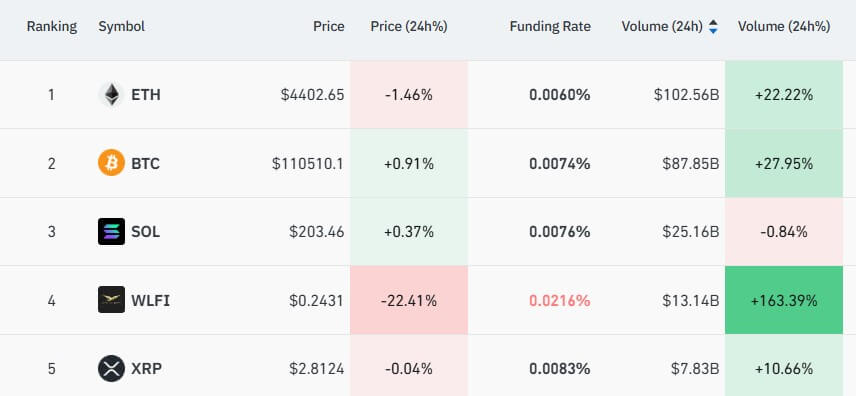

In keeping with CoinGlass information, WLFI’s derivatives exercise surged previous $13 billion inside its first 24 hours, putting it behind solely Bitcoin, Ethereum, and Solana.

Notably, that quantity is sort of double that of XRP, the third-largest crypto asset by market capitalization.

This highlights the extent of speculative demand across the new Donald Trump-related digital asset.

Moreover, its spot buying and selling quantity through the interval reached $4.7 billion, putting it among the many high 10 most-traded digital property.

In the meantime, the depth of the buying and selling actions got here at a price as WLFI’s worth slipped greater than 14%, falling from about $0.33 to $0.24 as of press time.

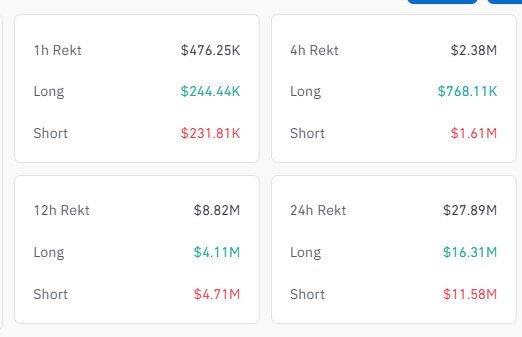

CoinGlass information confirmed that this pullback triggered an estimated $30 million in dealer losses, underscoring how fast inflows can amplify volatility throughout early buying and selling classes.

WLFI’s buyback proposal

The launch coincided with a proposal from World Liberty Monetary that would outline WLFI’s long-term trajectory.

The crew submitted a plan on Sept. 1 to make use of protocol-owned liquidity (POL) charges to purchase again WLFI from the open market and completely burn these tokens. Charges generated by impartial liquidity suppliers would stay exterior this system.

Underneath the proposal, POL charges from liquidity swimming pools on Ethereum, BSC, and Solana can be collected and redirected to burn addresses, lowering circulating provide over time.

The challenge representatives mentioned the initiative rewards dedicated holders by rising their relative stake as speculative tokens are faraway from circulation.

WLFI neighborhood members will quickly vote on whether or not to approve the buyback-and-burn technique or reject it in favor of maintaining charges within the Treasury.

If authorized, the measure would set up a framework for recurring provide reductions and will later increase to incorporate different protocol income streams.