Good Morning, Asia. This is what’s making information within the markets:

Welcome to Asia Morning Briefing, a each day abstract of high tales throughout U.S. hours and an outline of market strikes and evaluation. For an in depth overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Digital Asset Treasury (DATs) corporations – companies that put bitcoin on the stability sheet – have been the speak of the city throughout BTC Asia in Hong Kong.

However company adoption of Bitcoin generally is a double-edged sword, says Alessio Quaglini, CEO and Co-Founding father of crypto custodian Hex Belief. Whereas treasury holdings put crypto on the stability sheets of public corporations, he warns that leveraged methods may flip adoption right into a supply of instability.

“It’s nice for the adoption. It’s nice as a result of you’ve mainly oblique bitcoin entry to billions of individuals investing in native inventory exchanges and Nasdaq,” Quaglini advised CoinDesk throughout a latest interview on the sidelines of BTC Asia in Hong Kong.

However he drew a pointy line between wholesome diversification and monetary engineering.

“If this itemizing firm exists for the only goal of holding crypto, effectively then, it’s a hedge fund that’s publicly traded. It’s a monetary engineering type of train,” he continued.

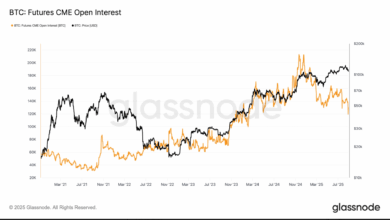

Quaglini, like many others within the business, is worried about extreme ranges of leverage. A latest report from Galaxy illustrates the danger, exhibiting mortgage volumes at their highest since 2022 alongside a $1 billion liquidation wave, whereas Korean regulators have already stepped in to freeze new lending merchandise as they develop involved about leverage straining markets.

“If these corporations deploy leverage, they usually challenge debt to purchase Bitcoin with robust triggers, then it’s an enormous challenge,” Quaglini stated. In public markets, debt covenants are clear, which means merchants can anticipate compelled promoting. “You may be within the state of affairs of the prisoner dilemma… You’ll be able to have this sort of spiral impact that brings extra volatility to the business.”

Even so, Quaglini sees immediately’s treasury gamers as a primary step.

“The following step is that you’ve actual corporations that do have loads of working money movement, they usually’re sitting on large quantities of money, like Apple, Google, and many others.,” he stated. If these companies begin allocating reserves into BTC, the shift can be “extraordinarily constructive.”

In the long run, the true check of the viability of DATs isn’t whether or not small companies flip themselves into bitcoin proxies, however whether or not the world’s largest corporates are keen to place their money piles on-chain.

Market Motion

BTC: Bitcoin is within the inexperienced altering palms above $109K. The world’s largest digital asset is stabilizing after August noticed a uncommon rotation out of BTC spot ETFs into ETH funds, which has weighed on relative BTC demand in latest weeks. Broader macro stays supportive however worth motion remains to be consolidating beneath mid‑August highs

ETH: Ether is buying and selling at $4,298. Market contributors are easing on revenue‑taking after notching document ranges late final month and bumping into resistance close to the excessive‑$4,000s. The August ETF movement development favored ETH, however close to‑time period consolidation dominates after the run‑up

Gold: Gold is holding close to a 4‑month excessive on mounting bets for a September Fed price lower and a softer U.S. greenback, each of which generally assist bullion

Nikkei 225: Asia-Pacific markets largely rose as traders weighed tariff uncertainty and the Shanghai Cooperation Group summit, with Japan’s Nikkei 225 up 0.31% after a U.S. courtroom dominated most of Trump’s international tariffs unlawful.

Elsewhere in Crypto:

- Gavin Newsom Desires to Launch a Meme Coin Simply to Troll Trump (Decrypt)

- South Korea’s FSC chief nominee faces backlash after calling crypto worthless (The Block)

- Trump Household Share of World Liberty Crypto Grows to $6 Billion (Decrypt)