Key takeaways:

XRP (XRP) value prolonged the losses from the sharp sell-off final week. The altcoin’s value is down 1.78% during the last 24 hours to commerce at $2.78 on Monday.

Threat-off sentiment within the broader crypto market and a decline in onchain exercise recommend XRP might stay caught in a downtrend over the subsequent week or two. Nevertheless, a reversal might play out if key help ranges maintain.

XRP traders enter risk-off mode

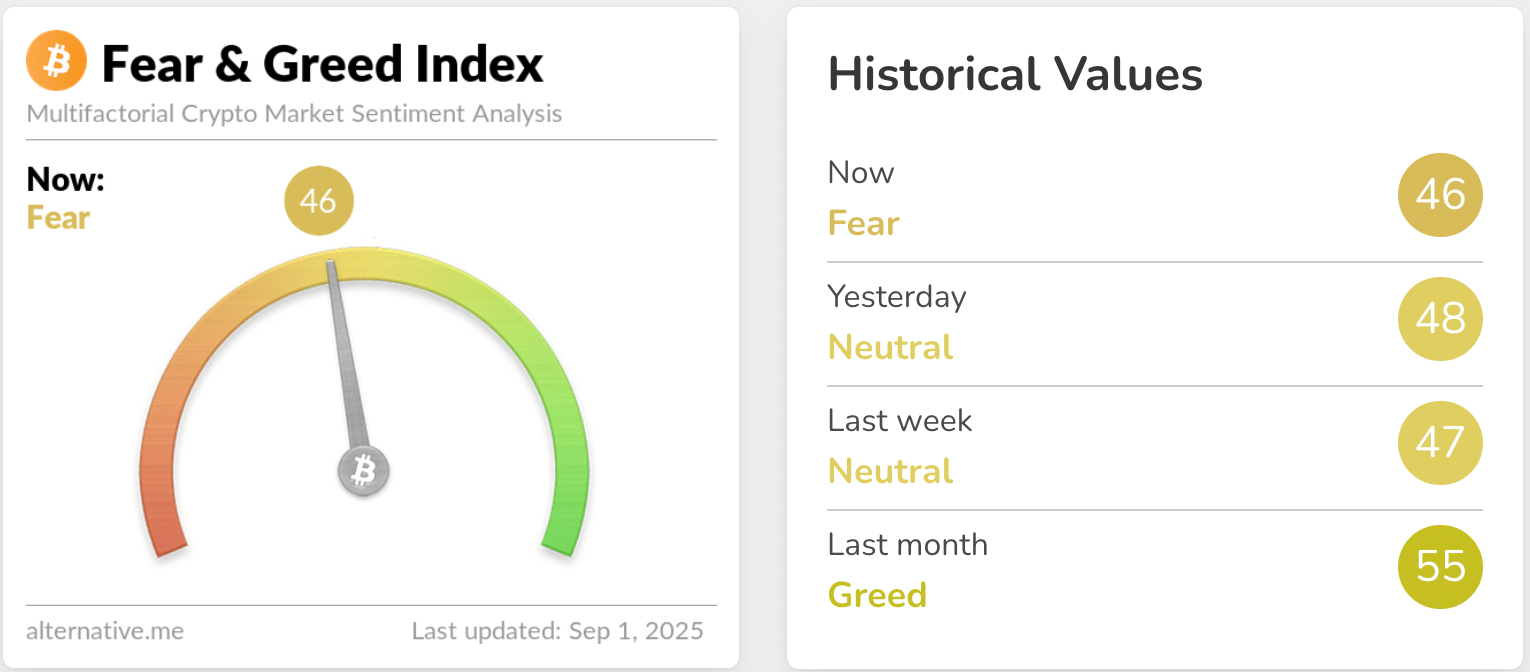

The Crypto Worry & Greed Index has now dropped into the “concern” zone at 46, down from “impartial” ranges seen final week and “greed” over 30 days in the past, reflecting rising investor warning, knowledge from Different.me exhibits.

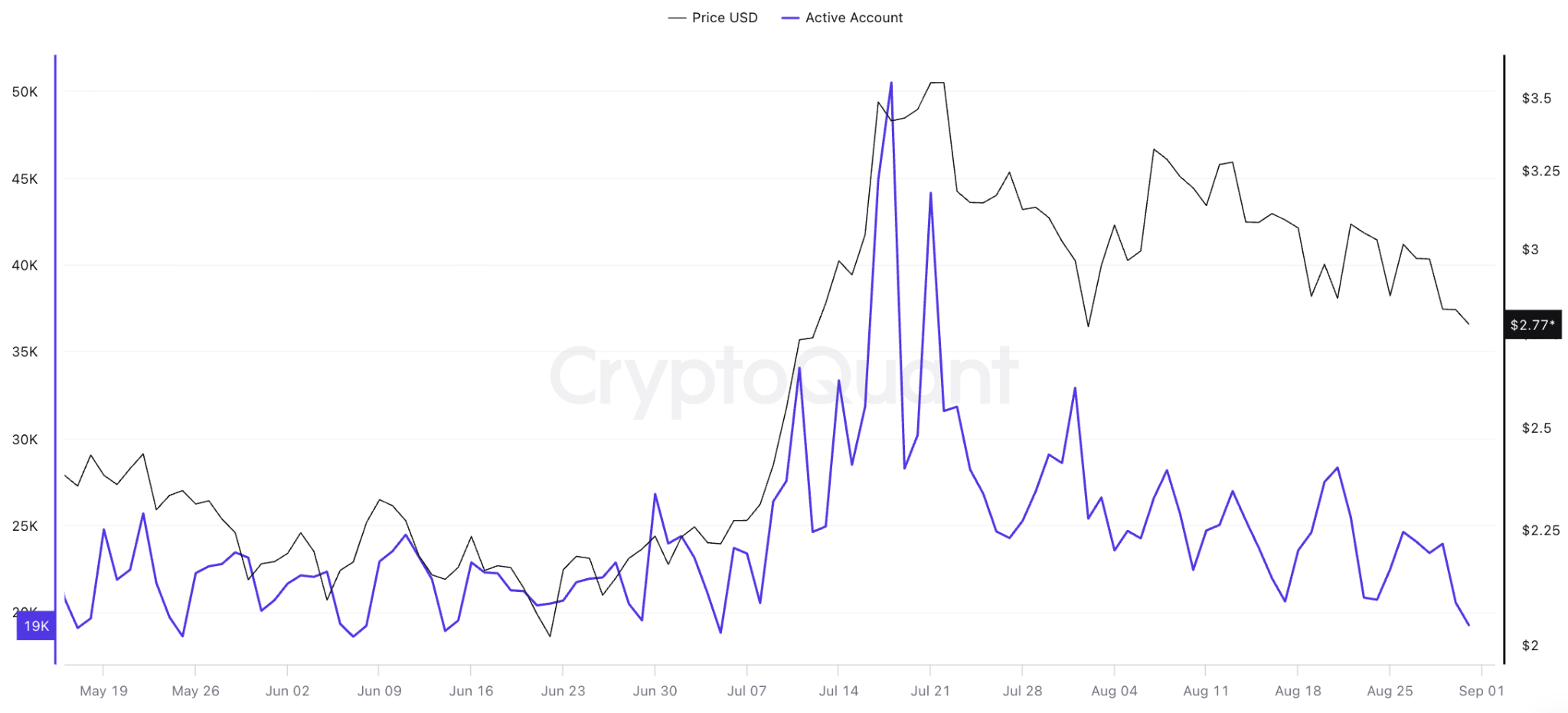

This concern is mirrored in declining onchain exercise, with the variety of energetic addresses having plummeted over the previous few weeks, to roughly 19,250 on Monday from $50,000 in mid-July.

The Energetic Addresses is a metric that tracks the variety of wallets actively interacting with the XRP Ledger (XRPL) by sending or receiving XRP. Due to this fact, such a big drop signifies a diminished threat urge for food, leaving XRP weak to promote strain.

Associated: XRP ‘distribution’ section doesn’t change $20 value goal: Analyst

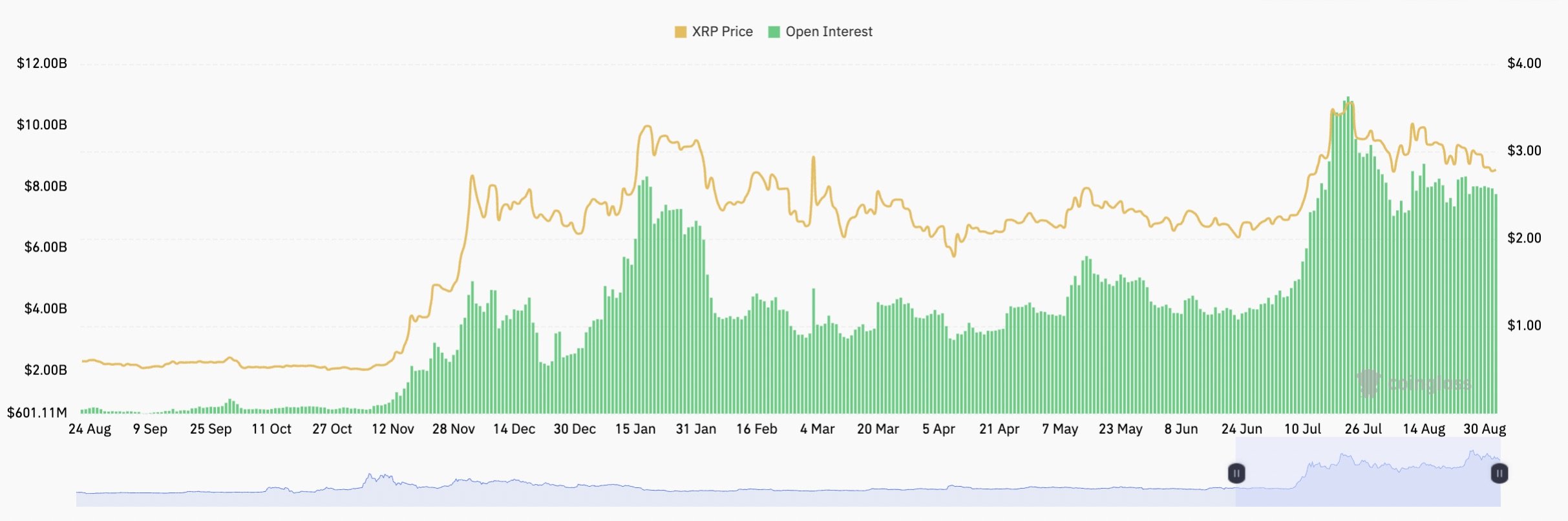

Declining investor curiosity can also be evidenced by the numerous pullback within the futures open curiosity (OI) to $7.7 billion from $10.94 billion over the identical interval.

Diminishing OI implies an absence of investor conviction, presumably growing the probability of the downtrend persevering with within the brief time period.

$2.70 should maintain as XRP value help

Regardless of the weak fundamentals, the technical setup initiatives a attainable rebound if the help at $2.70 holds. In any other case, an prolonged drawdown towards $2 might play out.

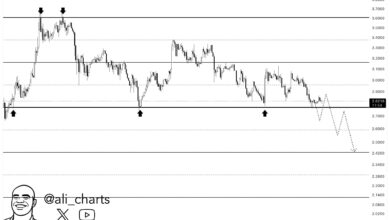

The XRP value chart has been forming a descending triangle sample on its day by day chart since its July rally to a multi-year excessive of $3.66, characterised by a flat help stage and a downward-sloping resistance line.

A descending triangle chart sample that kinds after a robust uptrend is seen as a bearish reversal indicator. As a rule, the setup resolves when the worth breaks under the flat help stage and falls by as a lot because the triangle’s most top.

The bulls are struggling to maintain XRP above the triangle’s help line at $2.70. In the event that they succeed, the worth might rise to interrupt the higher trendline at $3.09, coinciding with the 50-day easy transferring common (SMA) and the 0.618 Fibonacci retracement stage.

This can verify bullish momentum and probably set off a rally towards the apex of the prevailing chart sample round $3.70.

Shedding $2.70 might set off one other sell-off, with the primary line of protection offered by the demand zone between $2.6 (the 100-day SMA) and $2.48 (the 200-day SMA).

A breakdown of this stage will see XRP value fall towards the draw back goal at round $2.08 over the subsequent few weeks, down 25% from present value ranges.

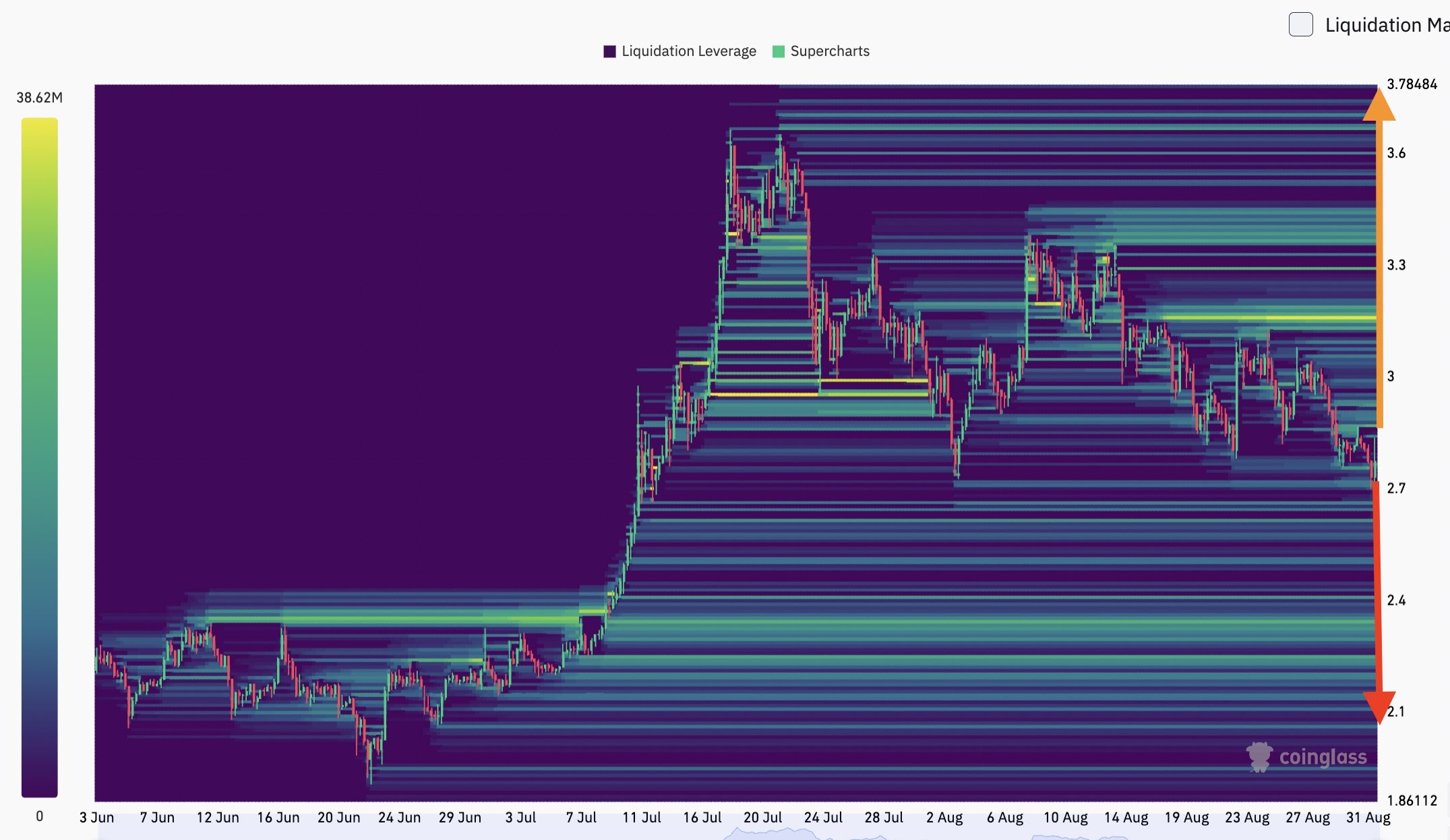

The liquidation heatmap exhibits XRP consumers stepping in at $2.70. Giant clusters of ask orders are additionally sitting between $2.87 and $3.74.

As Cointelegraph reported, XRP’s Transferring Common Convergence Divergence (MACD) factors to a probably bearish crossover in September, risking a drop towards $2.17.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a call.