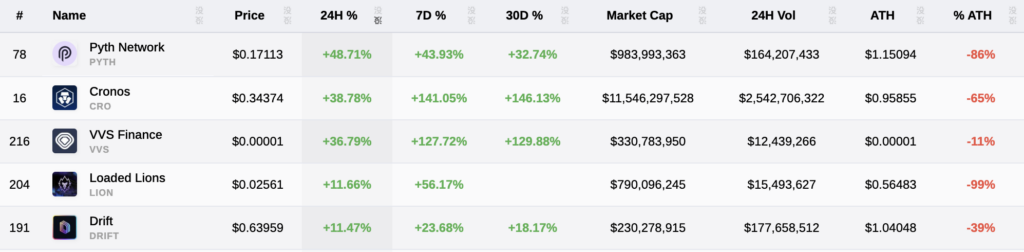

PYTH and CRO rose about 48% and 38% over 24 hours, main altcoin efficiency as Cronos-linked tokens reacted to a brand new treasury enterprise and oracle markets priced recent headlines and listings.

CRO’s transfer tracked a three-way deal to create a publicly traded CRO-focused treasury car.

Trump Media & Know-how Group, Crypto.com, and the Yorkville SPAC disclosed plans for “Trump Media Group CRO Technique,” funded with $1 billion in CRO, $200 million in money, $220 million in warrants, and a further $5 billion fairness line, with Yorkville to relist beneath ticker MCGA.

Associated particulars appeared in filings and press summaries, together with Crypto.com’s settlement to purchase $50 million of Trump Media inventory and Trump Media’s $105 million CRO buy. Liquidity then rotated throughout Cronos functions.

VVS Finance, up 36%, the chain’s largest DEX, posted sharp short-term jumps in charges and DEX turnover on DefiLlama’s trackers, aligning with a chain-wide uptick in exercise.

Loaded Lions’ LION, up 11%, the utility token tied to Crypto.com’s flagship NFT model, benefited from the identical Cronos move impulse. LION’s connection to the Crypto.com ecosystem is about out in product notices and launch supplies.

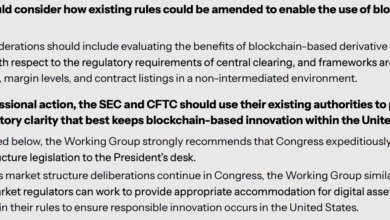

PYTH’s spike adopted market construction modifications reasonably than protocol economics. Pyth acknowledged on its official channels that the U.S. Division of Commerce chosen the community to confirm and publish financial information on-chain, naming quarterly GDP as an preliminary dataset.

SharpTrade commented, “Pyth is actually the nationwide treasury now. US authorities simply made a crypto oracle its official accountant 🔮,” which the official Pyth account confirmed.

Individually, incremental liquidity assist arrived this week as OKX enabled PYTH margin buying and selling, including leverage and borrow routes that may speed up spot-derivatives suggestions loops. Broader Pyth distribution and writer development stay documented within the mission’s supplies.

DRIFT’s advance (11%) aligned with exercise on Solana perps. The protocol launched a brand new charge schedule efficient Aug. 5 that tiers maker and taker charges by 30-day quantity and introduces further rebates for DRIFT stakers, per the crew’s replace web page.

Utilization metrics over the previous day and week stayed elevated on DefiLlama’s derivatives view, with charges and revenues trending increased alongside volumes.

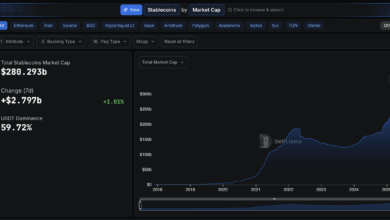

Flows on the index degree supplied the backdrop. Spot Ethereum ETFs recorded giant web inflows in latest periods, together with Aug. 21 totals throughout issuers and earlier report each day highs this month, in line with Farside Buyers’ dwell dataset.

When Ethereum leads on main market demand, increased beta belongings usually catch residual bid as liquidity extends down the curve, a sample according to as we speak’s distribution throughout PYTH, CRO, VVS, LION, and DRIFT.

The day’s tape due to this fact displays discrete catalysts, particularly a deliberate CRO treasury firm, Pyth being tapped by the US authorities, and change market-structure additions, all shifting inside a risk-on setting formed by latest Ethereum ETF inflows.