- The US Greenback Index could discover speedy assist on the psychological degree of 98.00.

- Market bias is bearish because the 14-day Relative Power Index is positioned under the 50 mark.

- The preliminary barrier seems on the nine-day EMA of 98.20.

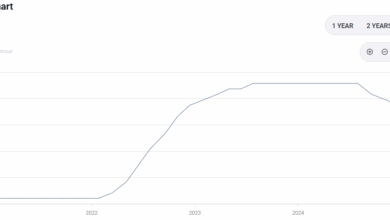

The US Greenback Index (DXY), which measures the worth of the US Greenback (USD) in opposition to six main currencies, is extending its losses for the third successive session and buying and selling round 98.10 throughout the European hours on Thursday. The technical evaluation of the each day chart reveals the greenback index stays inside the descending channel sample, suggesting a prevailing bearish bias.

The 14-day Relative Power Index (RSI) is positioned under the 50 degree, suggesting that market sentiment is bearish. Moreover, the short-term worth momentum is weakening because the DXY moved under the nine-day Exponential Transferring Common (EMA).

On the draw back, the speedy assist lies on the psychological degree of 98.00, adopted by a seven-week low of 97.11, which was recorded on July 24. Additional declines would put downward stress on the US Greenback Index to check 96.38, the bottom since February 2022, which was recorded on July 1, 2025, aligned with the descending channel’s decrease boundary.

The US Greenback Index is testing its speedy barrier on the nine-day EMA of 98.20, adopted by the 50-day EMA at 98.42 and the higher boundary of the descending channel across the psychological degree of 98.50. A profitable break above this confluence resistance zone would trigger the emergence of the bullish bias and assist the DXY to discover the area across the three-month excessive at 100.26, which was recorded on August 1.

US Greenback Index: Each day Chart

US Greenback Value At this time

The desk under reveals the share change of US Greenback (USD) in opposition to listed main currencies immediately. US Greenback was the strongest in opposition to the Euro.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.06% | -0.06% | -0.22% | -0.13% | -0.26% | -0.16% | -0.25% | |

| EUR | 0.06% | 0.03% | -0.17% | -0.08% | -0.17% | -0.08% | -0.18% | |

| GBP | 0.06% | -0.03% | -0.18% | -0.07% | -0.20% | -0.09% | -0.18% | |

| JPY | 0.22% | 0.17% | 0.18% | 0.10% | -0.08% | -0.22% | -0.00% | |

| CAD | 0.13% | 0.08% | 0.07% | -0.10% | -0.13% | -0.03% | -0.02% | |

| AUD | 0.26% | 0.17% | 0.20% | 0.08% | 0.13% | 0.10% | 0.03% | |

| NZD | 0.16% | 0.08% | 0.09% | 0.22% | 0.03% | -0.10% | -0.08% | |

| CHF | 0.25% | 0.18% | 0.18% | 0.00% | 0.02% | -0.03% | 0.08% |

The warmth map reveals proportion modifications of main currencies in opposition to one another. The bottom forex is picked from the left column, whereas the quote forex is picked from the highest row. For instance, should you choose the US Greenback from the left column and transfer alongside the horizontal line to the Japanese Yen, the share change displayed within the field will signify USD (base)/JPY (quote).