Key factors:

-

Bitcoin builds on 1.6% day by day positive aspects as bulls overcome a recent spherical of BTC gross sales by an “OG” whale entity.

-

Accumulation is in full swing throughout the board, analysis says, with curiosity mimicking April’s worth rebound.

-

BTC worth motion must keep away from a “double prime” all-time excessive subsequent.

Bitcoin (BTC) broke above $113,000 on Thursday as demand from Asia ignored recent whale promoting.

Bitcoin whale gross sales fail to drive BTC decrease

Knowledge from Cointelegraph Markets Professional and TradingView confirmed BTC/USD gaining 1.6% on the day to hit highs of $113,365.

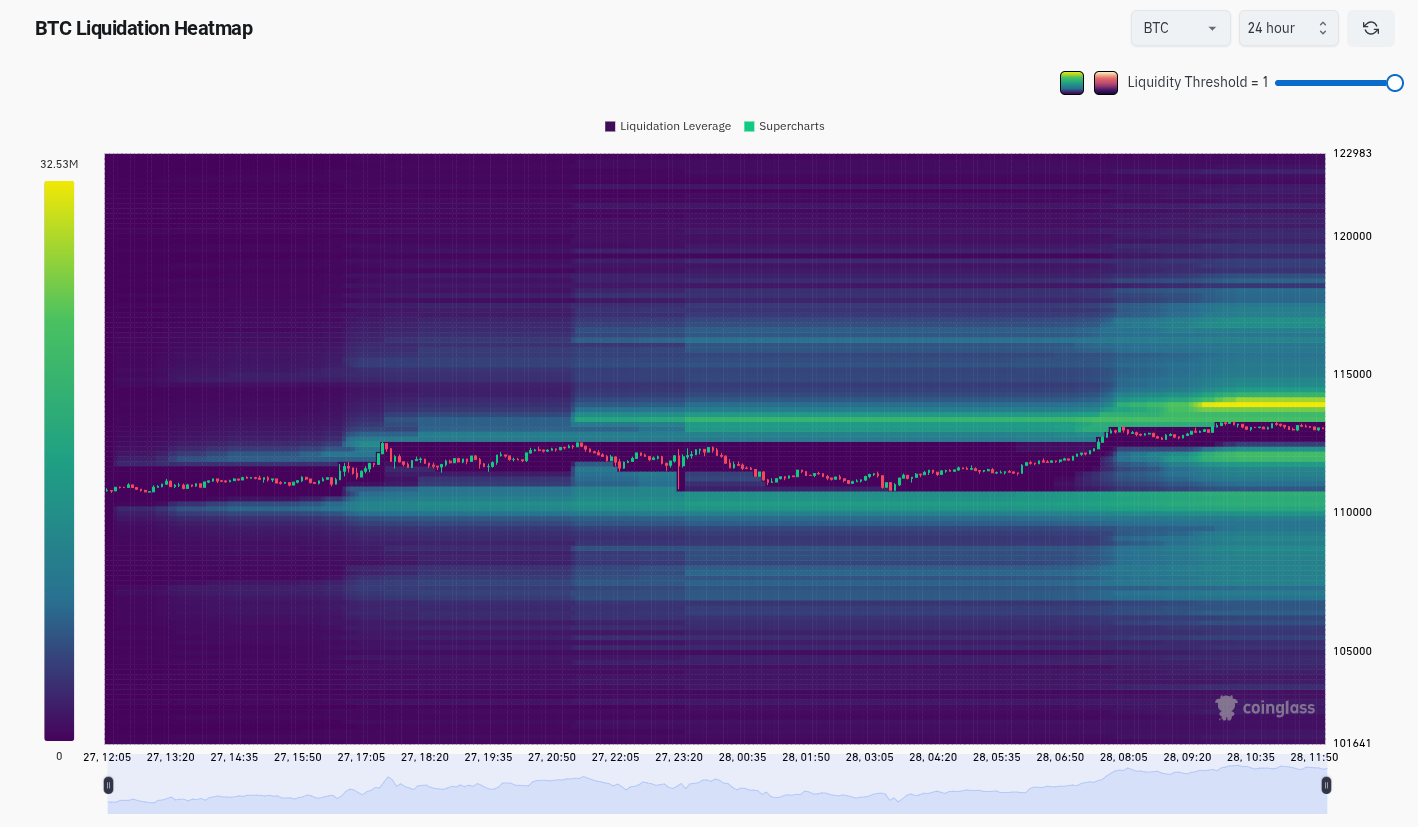

The uptick liquidated round $40 million of crypto shorts within the 4 hours to the time of writing, per knowledge from CoinGlass, with BTC resistance stacked overhead.

On the identical time, a Bitcoin “OG” whale started to distribute extra of their provide, with 250 BTC ($28.2 million) despatched to crypto alternate Binance. The transaction was famous by X analytics account Lookonchain, and adopted a 750 BTC sale the day prior.

Whale distribution habits, typically involving cash dormant for a decade or extra, beforehand sparked snap BTC worth draw back.

Bitcoin OG “bc1qlf” simply deposited one other 250 $BTC($28.29M) to #Binance, with 3,000 $BTC($339M) left.https://t.co/92XAZMJQsp pic.twitter.com/fAugznA7gL

— Lookonchain (@lookonchain) August 28, 2025

Commenting on the latest promoting pattern amongst whales, longtime market analyst Peter Brandt argued that it mirrored basic “market tops.”

“It represented SUPPLY. Tops in markets are created by SUPPLY or DISTRIBUTION,” he wrote in a part of an X put up on Wednesday.

As Cointelegraph reported, not all lessons of Bitcoin investor have rethought their market publicity.

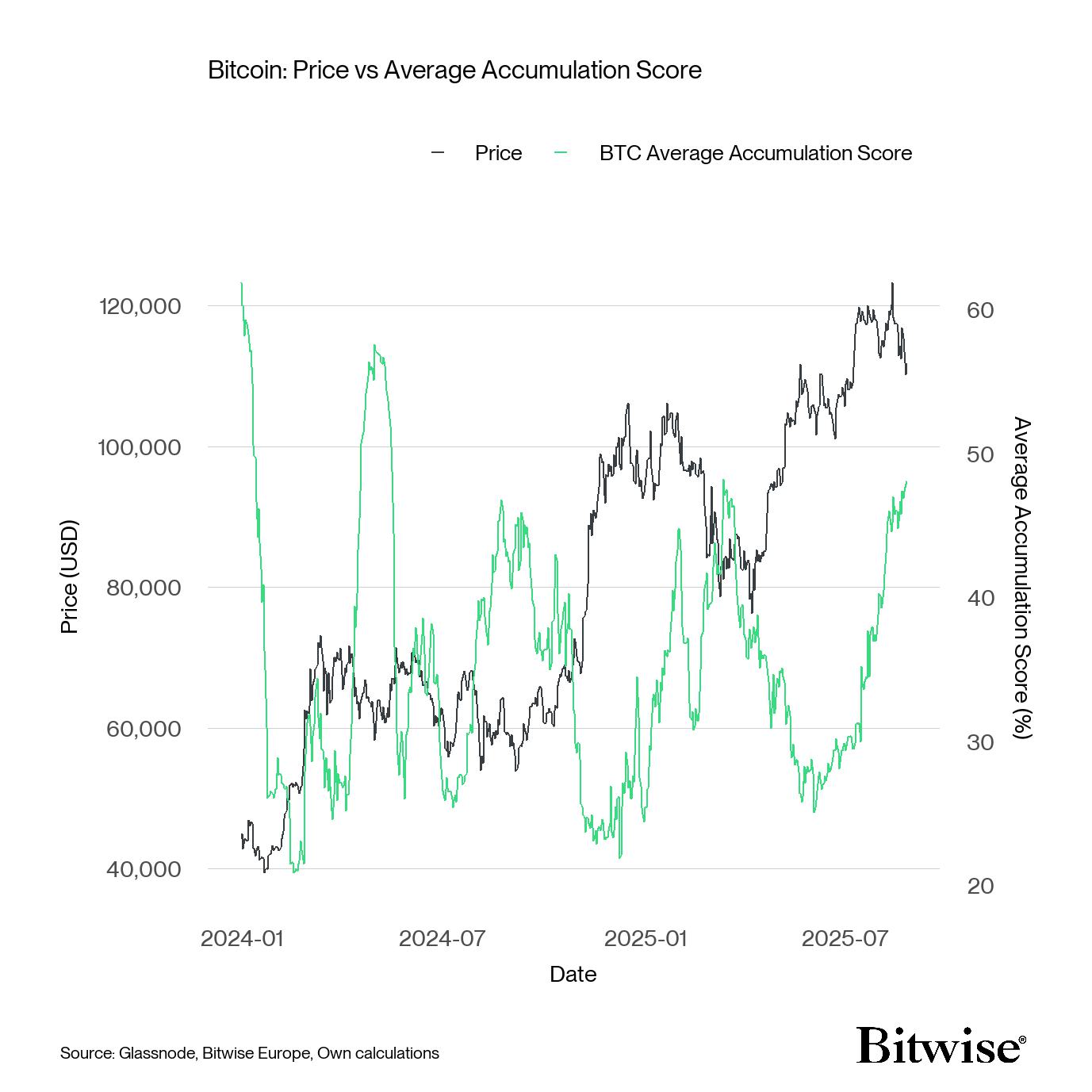

As famous by Andre Dragosch, European head of analysis at crypto asset supervisor Bitwise, each retail and institutional accumulation are actually at their highest since April, throughout the aftermath of a dip to native lows below $75,000.

“Such excessive stage of accumulation tends to precede main breakouts to the upside,” Dragosch concluded alongside Bitwise knowledge.

Dealer: Bitcoin “double prime” danger stays

In the meantime, Brandt remained level-headed on the outlook, saying that BTC/USD wanted to reclaim $117,500 to invalidate bearish pattern reversal indicators.

Associated: Bitcoin can nonetheless hit $160K by Christmas with ‘common’ This fall comeback

Failure to take action, he stated, would depart latest all-time highs as a “double prime” formation, discounting seven weeks of worth motion.

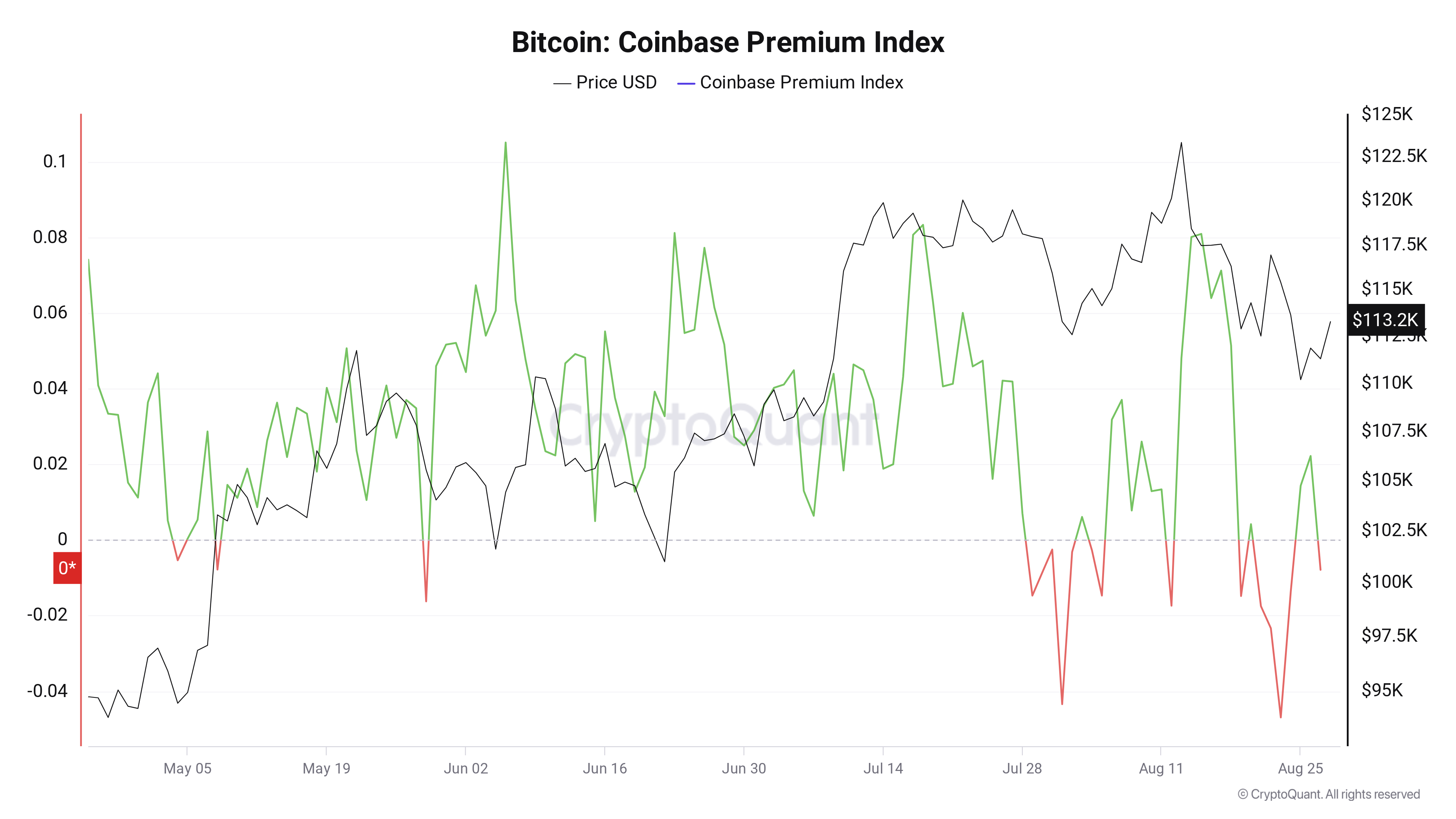

A warning sign from the Coinbase Premium Index forward of the Wall Avenue open confirmed that Bitcoin bulls weren’t but within the clear.

The Premium was crimson for Wednesday, per knowledge from onchain analytics platform CryptoQuant, pointing to weakening US demand after a powerful begin to the week.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.