As bitcoin bulls goal to reestablish an upward worth trajectory, they might face resistance from sellers close to the $113,600 stage, in keeping with on-chain knowledge.

BTC has already bounced to $112,800 from sub-$108,800 ranges hit Tuesday, CoinDesk knowledge present. The bounce is probably going fueled by a recent all-time excessive within the S&P 500 and a better-than-expected earnings report by Nvidia, one of many largest publicly listed corporations on the earth by market worth and a bellwether for all issues synthetic intelligence.

The trail forward might show difficult, as traders holding at a loss might look to promote into any worth rebound.

“At present, bitcoin trades beneath the fee foundation of each the 1-month ($115.6k) and 3-month ($113.6k) cohorts, leaving these traders beneath stress. Any reduction rally is due to this fact more likely to encounter resistance, as short-term holders search to exit at breakeven,” analytics agency Glassnode stated in a report printed Wednesday.

Glassnode’s price foundation metric reveals the common buy costs at which digital belongings have been acquired by wallets with various holding durations. For instance, the three-month price foundation of $113,600 signifies that traders holding belongings bought throughout the previous three months paid, on common, this worth stage.

Blended flows

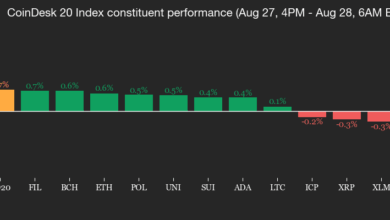

As of now, the spot market flows recommend an uphill battle for the bulls forward, whereas ETF and company exercise recommend in any other case.

“Spot demand stays impartial, as perpetuals tilt bearish with CVD unfavourable. The present funding price of ~0.01% factors to a fragile neutrality. If worth breaks above $112.4K with quantity, it opens the pathway to $114K – $116K,” Timothy Misir, head of analysis, BRN.

That stated, ETF inflows and company adoption of BTC continues to suck out important provide from the market, providing a bullish hope, Misir defined.

“ETF flows proceed to strengthen with $81 million for Bitcoin ETFs and $307 million for Ether ETFs over the previous day. ETFs, corporates, and governments are actually absorbing ~3,600 BTC/day, which interprets to ~4x miner issuance. Metaplanet introduced a brand new plan to boost $881 million to purchase $837 million BTC in Sep–Oct, including to its 18,991 BTC,” he famous.

Gauging key help

Ought to BTC flip decrease, then $107,000 is the important thing help stage to observe.

That is as a result of evaluation by Glassnode exhibits that the six-month price foundation is at that stage. So, a break decrease would immediate these holdings to promote, probably inflicting a extra profound decline.

“The 6-month price foundation sits close to ~$107k. A sustained transfer under this stage dangers triggering concern, which may speed up draw back momentum,” Glassnode stated.