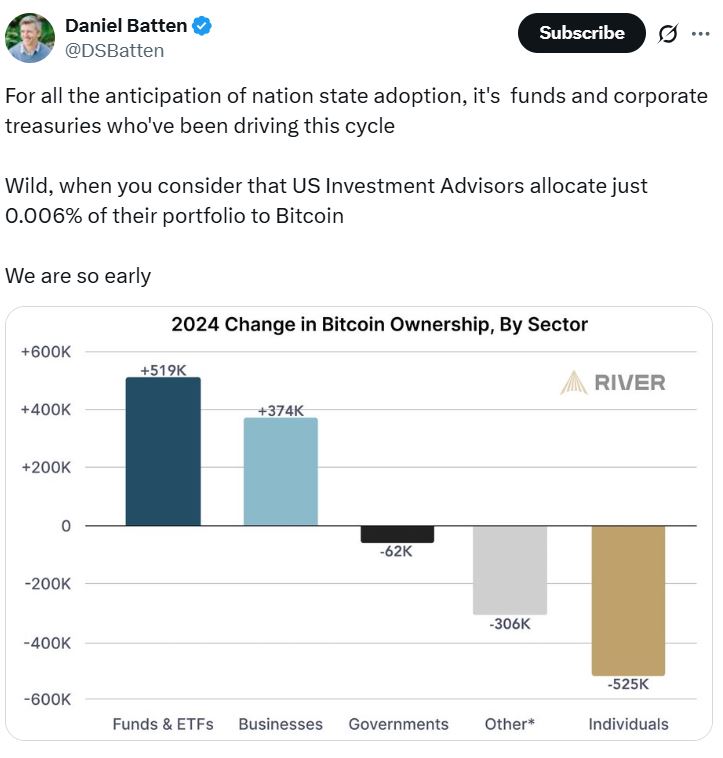

Funding advisers are the most important trackable cohort outdoors of retail which are shopping for Bitcoin and Ether exchange-traded funds, based on new knowledge from Bloomberg Intelligence.

Bloomberg ETF analyst James Seyffart stated in an X submit on Wednesday that funding advisers are “dominating the identified holders” of Ether ETFs, investing over $1.3 billion or 539,000 Ether (ETH) in Q2 — a rise of 68% from the earlier quarter.

The identical was noticed in US spot Bitcoin ETFs. Seyffart stated on Monday that “advisers are by far the most important holders now,” with over $17 billion of publicity in 161,000 Bitcoin (BTC).

In each circumstances, the publicity from funding advisers was almost twice that from hedge fund managers.

Nevertheless, Seyffart stated this was based mostly on knowledge filed with the SEC, which represents solely a fraction of all of the spot Bitcoin ETF holders.

“This knowledge is usually 13F knowledge. It solely accounts for about 25% of the Bitcoin ETF shares. The opposite 75% are owned by non-filers, which is essentially going to be retail,” he added.

Crypto ETF knowledge tells a narrative, analysts say

Vincent Liu, the chief funding officer at Kronos Analysis, stated the information alerts a shift from speculative flows to long-term, portfolio-driven allocations.

“As the highest holders, their strategic positioning gives deeper liquidity and an enduring basis for crypto’s integration into world markets,” he informed Cointelegraph.

Liu stated that as extra advisers undertake Bitcoin and Ether ETFs, crypto shall be beneficial and acknowledged as a long-term diversification instrument inside conventional portfolios, complementing equities, bonds, and different mainstream property.

“As extra altcoins be part of the ETF house and yield-bearing property like staked Ether achieve approval, advisers can use crypto not simply to diversify portfolios but in addition to generate returns, driving broader and longer-term adoption.”

Room for advisers to lean additional into crypto ETFs

Some have speculated that the variety of monetary advisers in crypto ETFs may explode as rules come into pressure. In July, Fox Information Enterprise predicted that trillions of {dollars} may flood the market via monetary advisers.

Pav Hundal, lead market analyst at Australian crypto dealer Swyftx, informed Cointelegraph that funding adviser holdings in Bitcoin ETFs have grown by about 70% since June, triggered by softening within the US regulatory context, coupled with an virtually unprecedented demand for risk-on property.

“We’re doubtless nonetheless solely within the early chapter of progress. Like with any funding that begins to construct momentum, you get two forms of individuals: those that arrive early and those that come later out of concern of lacking out,” he stated.

“That dynamic performs out throughout each establishments and retail traders. With Ethereum urgent into new all-time highs, and US policymakers hinting at a softer financial stance because the labor market reveals cracks, the setup is there for advisers to lean in additional.”

Regulation to play a job in crypto ETF progress

In the meantime, Kadan Stadelmann, chief know-how officer of the blockchain-based Komodo Platform, informed Cointelegraph the information makes it clear “Most important Road, via their monetary advisers, is looking for entry to crypto markets via Wall Road.”

“Ether ETFs are experiencing the success of Bitcoin ETFs, however on a smaller scale, representing a shift from early to institutional adoption. And we’re not speaking about smaller Wall Road corporations, however the greatest names, akin to BlackRock and Constancy,” he added.

Nevertheless, in the long term, Stadelmann thinks “regulatory realities” will play a job within the progress of monetary advisers within the crypto market.

The US Securities and Alternate Fee launched Challenge Crypto in July to foster blockchain innovation, and the US Home handed the Genius Act in the identical month, which represented regulatory readability lengthy referred to as for by crypto lobbyists.

“In decrease Manhattan, crypto is certainly extra seen as an fairness than a revolution, and the transfer by these large gamers has merely been adopted by monetary advisers, who now have the boldness of regulatory readability,” Stadelmann stated.

Associated: Altseason gained’t begin till extra crypto ETFs launch: Bitfinex

Nevertheless, Stadelmann thinks that if a much less crypto-friendly authorities have been to be voted in on the subsequent election, it may throw a spanner within the works,

“The method to crypto may embody crackdowns, which may put a freeze over the institutional crypto market, and strike concern into the hearts of monetary advisers that they might lose their licenses if they provide the merchandise,” he stated.

“That’s but to be seen, and Democrats may depart the brand new established order as a result of market calls for.”

Journal: ETH ‘god candle,’ $6K subsequent? Coinbase tightens safety: Hodler’s Digest, Aug. 17 – 23