At this time in crypto, the US Commodity Futures Buying and selling Fee is rolling out Nasdaq’s market surveillance device to crack down on market abuse. Cronos (CRO) spiked 40% after Trump Media & Expertise Group introduced a $6.4B Cronos treasury, and the US has appealed the sentencing of HashFlare’s co-founders.

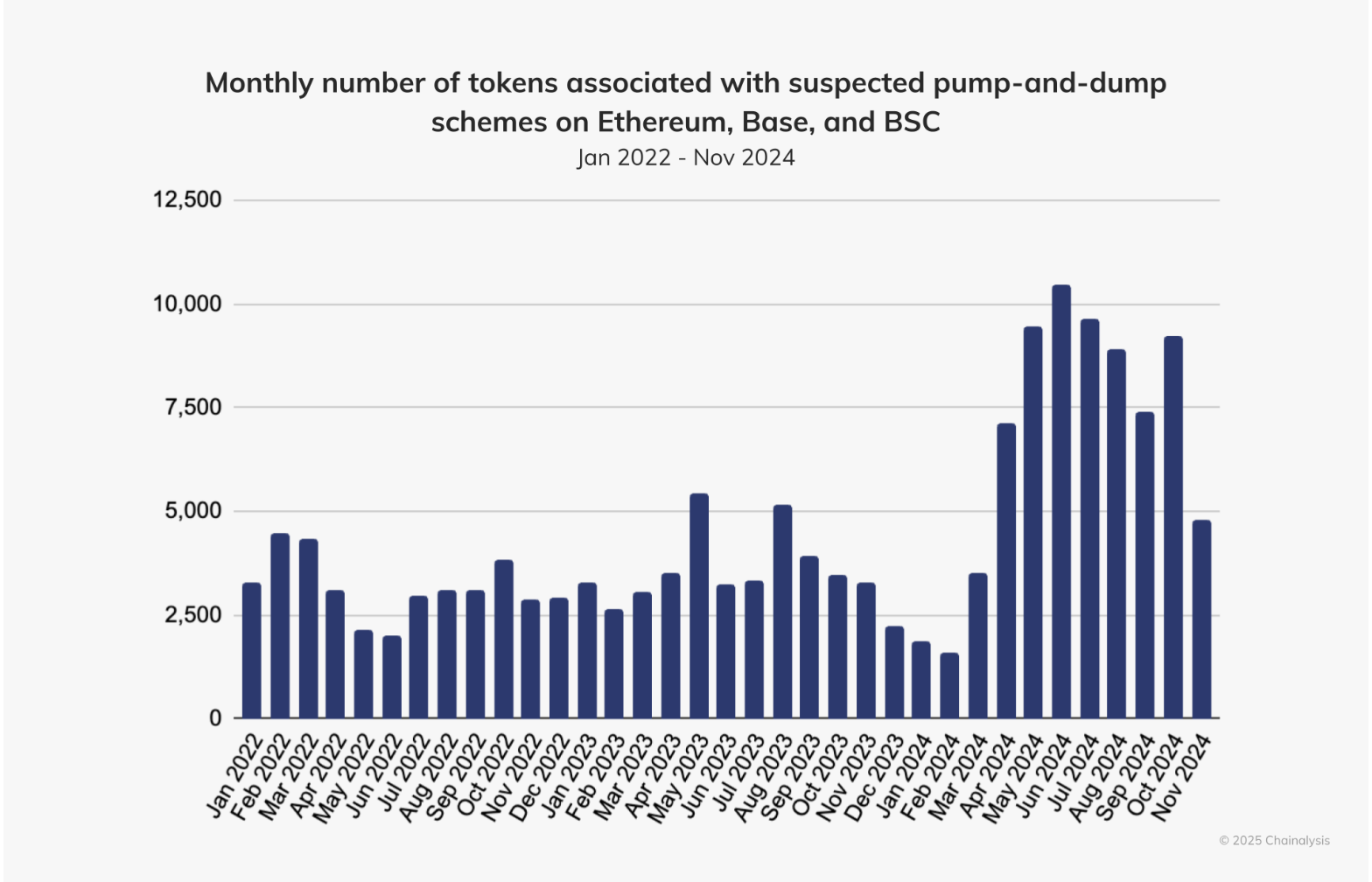

US regulator integrates Nasdaq surveillance device to fight market manipulation

The Commodity Futures Buying and selling Fee (CFTC), a US monetary regulator, is integrating a monetary surveillance device developed by inventory change firm Nasdaq in a bid to overtake its Nineteen Nineties infrastructure.

Nasdaq’s software program is concentrated on detecting market abuse, together with insider buying and selling exercise and market manipulation in equities and crypto markets, Tony Sio, head of regulatory technique and innovation at Nasdaq, instructed Cointelegraph. He mentioned:

“Tailor-made algorithms detect suspicious patterns distinctive to digital asset markets. It affords real-time evaluation of order e book knowledge throughout crypto buying and selling venues and cross-market analytics that may correlate actions between conventional and digital asset markets.”

The information fed into the monitoring system shall be “sourced by the CFTC by means of their regulatory powers,” Sio mentioned.

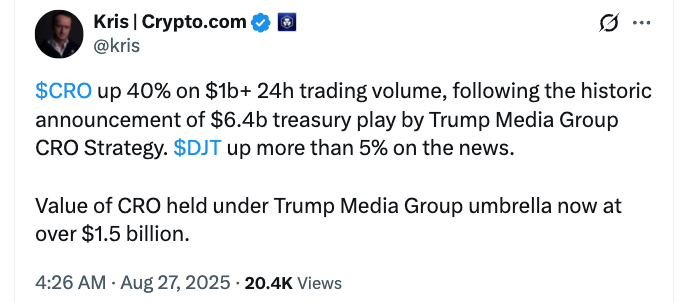

Crypto.com’s Cronos jumps 40% on Trump Media Group CRO Technique information

Cronos, the native cryptocurrency of the Crypto.com-backed Cronos Chain, surged to multi-year highs following information of the Trump Media Group CRO Technique launch.

On Tuesday, Trump Media and Expertise Group introduced the launch of a joint $6.4 billion Cronos treasury with Crypto.com and Yorkville Acquisition.

Cronos (CRO) surged 25% to $0.20 inside hours after the announcement, following which Crypto.com CEO Kris Marszalek took to X on Wednesday to report that the crypto asset had surged 40% following the Trump Media Group CRO Technique announcement.

US appeals time served sentences for HashFlare co-founders

On Tuesday, US prosecutors appealed the sentences given to the co-founders of HashFlare, telling a Seattle federal courtroom that the federal government was interesting the sentences handed down earlier this month to Sergei Potapenko and Ivan Turõgin to the Ninth Circuit.

Earlier this month, a federal courtroom gave the pair time served after spending 16 months in custody of their native Estonia after their arrest in October 2022, earlier than they have been extradited to the US in Might 2024, the place they pleaded responsible to conspiracy to commit wire fraud.

The federal government had argued that the pair ought to get 10 years in jail, saying that the HashFlare scheme precipitated severe hurt to victims and was probably the most vital fraud the courtroom had ever tried. Potapenko and Turõgin argued for time served.

Prosecutors mentioned that HashFlare’s gross sales totaled over $577 million, and the co-founders posted faux dashboards that falsely reported the agency’s mining capability and the returns traders have been making, which in actuality paid current members with funds from newer members.

Potapenko and Turõgin argued the corporate’s clients in the end obtained crypto price excess of their preliminary investments, primarily from the rise in crypto market costs because the scheme closed.