Regulation agency Fenwick & West has denied accusations from an up to date class-action lawsuit alleging it was central to the crypto trade’s fraud and eventual collapse.

Earlier this month, FTX customers requested to replace their go well with in opposition to Fenwick, first filed in 2023, claiming new info from a chapter and legal case shared proof that the legislation agency “performed a key and essential function in a very powerful points of why and the way the FTX fraud was completed.”

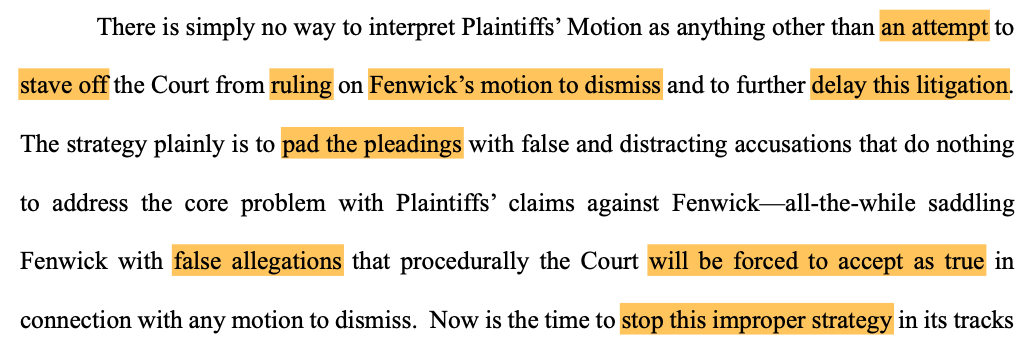

Fenwick informed a Florida federal decide in a submitting on Monday that the court docket ought to deny FTX customers’ request to replace a go well with in opposition to the agency, arguing their concept that it helped the trade perform fraud “is as facile as it’s flawed.”

“Fenwick will not be answerable for aiding and abetting a fraud it knew nothing about, primarily based solely on allegations that Fenwick did what legislation corporations do day by day — present routine and lawful authorized providers to their purchasers,” it stated.

Lawsuit makes use of “stale info,” Fenwick says

The brand new accusations in opposition to Fenwick stem from an enormous multi-district class-action lawsuit filed by FTX customers after it collapsed in late 2022.

The group has additionally introduced claims in opposition to celebrities and firms alleged to have labored with FTX, together with the legislation agency Sullivan & Cromwell, which the group later dropped for a scarcity of proof.

Fenwick argued the proposed up to date criticism is “premature — primarily based on stale info that has been obtainable to them for years — but additionally deceptive and futile.”

Fenwick additionally famous the allegations in opposition to the agency “mirror” those that they had used “fairly aggressively” in opposition to Sullivan & Cromwell, earlier than the group dismissed the motion after a report concluded that Sullivan didn’t learn about FTX’s fraud.

“They provide no credible motive why the identical allegations ought to survive in opposition to Fenwick,” it added.

“False characterization” of FTX govt’s claims

Fenwick has additionally refuted that Nishad Singh, FTX’s lead engineer, had testified that Fenwick was conscious and helped disguise the “misuse of buyer funds” and “improper loans” throughout FTX co-founder Sam Bankman-Fried’s legal trial.

“Singh testified that Fenwick merely suggested on find out how to construction founder loans, that are widespread devices for intently held corporations like FTX,” the agency stated.

Associated: US appeals time served sentences for HashFlare Ponzi schemers

It added that “dozens of witnesses” in Bankman-Fried’s trial testified that the fraud at FTX was carried out “with out the information of even FTX’s in-house counsel, different FTX workers, executives, and administrators, FTX’s long-time accountants, and different exterior legislation corporations and professionals that labored intently with FTX. Fenwick isn’t any completely different.”

Fenwick rejects new securities claims

In the meantime, Fenwick stated the proposed criticism’s new claims that it helped launch and promote the FTX Token (FTT) in violation of Florida and California securities legal guidelines have been far-fetched, frivolous and will have been “asserted months — if not years — earlier.”

“These new claims come far too late,” it wrote. “If Plaintiffs really thought that they had state securities claims in opposition to Fenwick, that they had each alternative to allege them on the outset.”

It accused the group of including the 2 new allegations after a decide dismissed all however the state securities legal guidelines claims in opposition to celebrities that allegedly promoted FTX.

“That is an eleventh-hour try and evade the Court docket’s ruling on the Celeb Defendants’ movement to dismiss, and to recast attorneys as ‘promoters,’” Fenwick claimed. “However this concept too goes nowhere.”

Journal: The $2,500 doco about FTX collapse on Amazon Prime… with assist from mother