Key takeaways:

-

Retail merchants are aggressively shopping for BTC worth dips in spot and futures markets, however internet promoting from bigger order traders is stopping a strong worth restoration.

-

Threat of one other liquidation cascade to $105,000 appears much less seemingly, however investor sentiment is misaligned with the development seen in assorted cumulative quantity information cohorts.

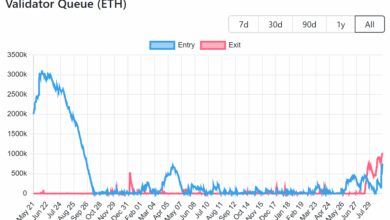

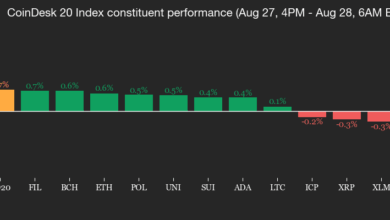

Bitcoin (BTC) and Ether (ETH) are recovering and trying to get better the worth ranges that every cryptocurrency misplaced through the sharp sell-off seen on Saturday and Sunday. Bitcoin worth is up a mere 2.4% from its $108,665 low, whereas ETH fared higher, rising 8.26% to a day by day excessive at $4,663 from its Monday low at $4,310.

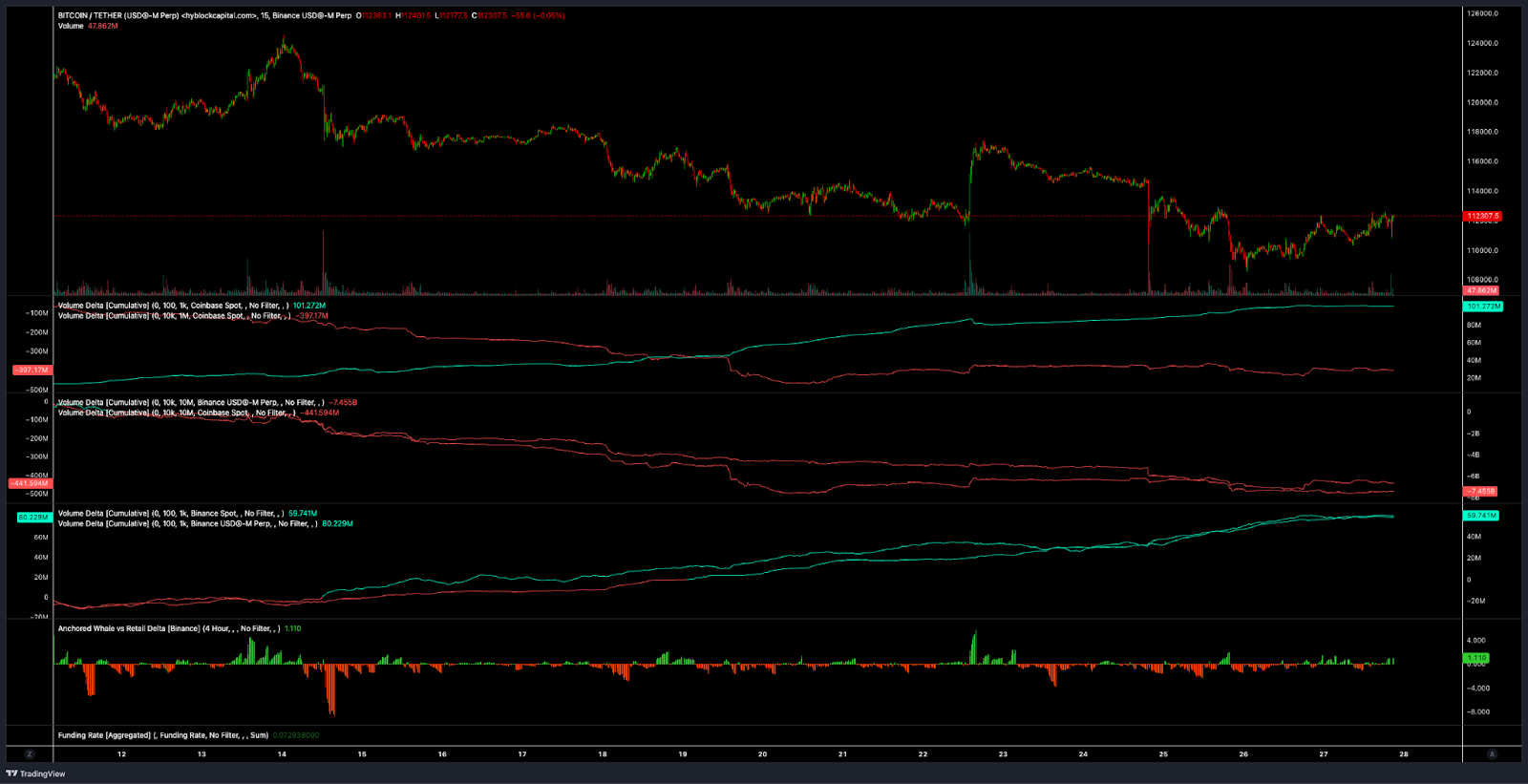

Information exhibits an assortment of merchants shopping for the dip, but BTC worth stays caught in a downtrend. The anchored cumulative quantity delta (aggregated) for the cohort thought of to be retail merchants (1K to 10K) exhibits these entities internet shopping for all through the correction from Sunday to Wednesday.

Whale and institutional-sized merchants (1 million to 10 million) had been internet sellers in the identical time-frame, however because the chart exhibits, the depth of the promoting has subsided as BTC worth reclaimed the $111,000 zone.

A extra granular take a look at CVD information exhibits retail merchants in Binance’s Bitcoin spot and perpetual futures markets opening longs all through the dip, whereas whales and institutional investor-sized merchants have been internet sellers.

Retail merchants within the Coinbase Bitcoin spot market have additionally been lively, with volumes reaching $101.253 million in internet shopping for, whereas the institutional investor cohort at Coinbase and Binance have been internet sellers with perps markets unloading roughly $7.5 billion in the timeframe portrayed.

The takeaway is, whales dominate the promoting stress throughout the market, whereas retail and mid-size gamers try to supply worth assist and appear to imagine that they’re both shopping for Bitcoin at a reduced valuation or banking on a fast imply reversion again to the $117,000 to $118,000 vary. Regardless of this, Bitcoin continues to languish in a short-term downtrend regardless of a optimistic,smaller-order CVD at Binance and Coinbase.

Associated: BlackRock Bitcoin ETF holdings overtake Coinbase, Binance; ETH could also be subsequent

$120,000 or $105,000, which comes first?

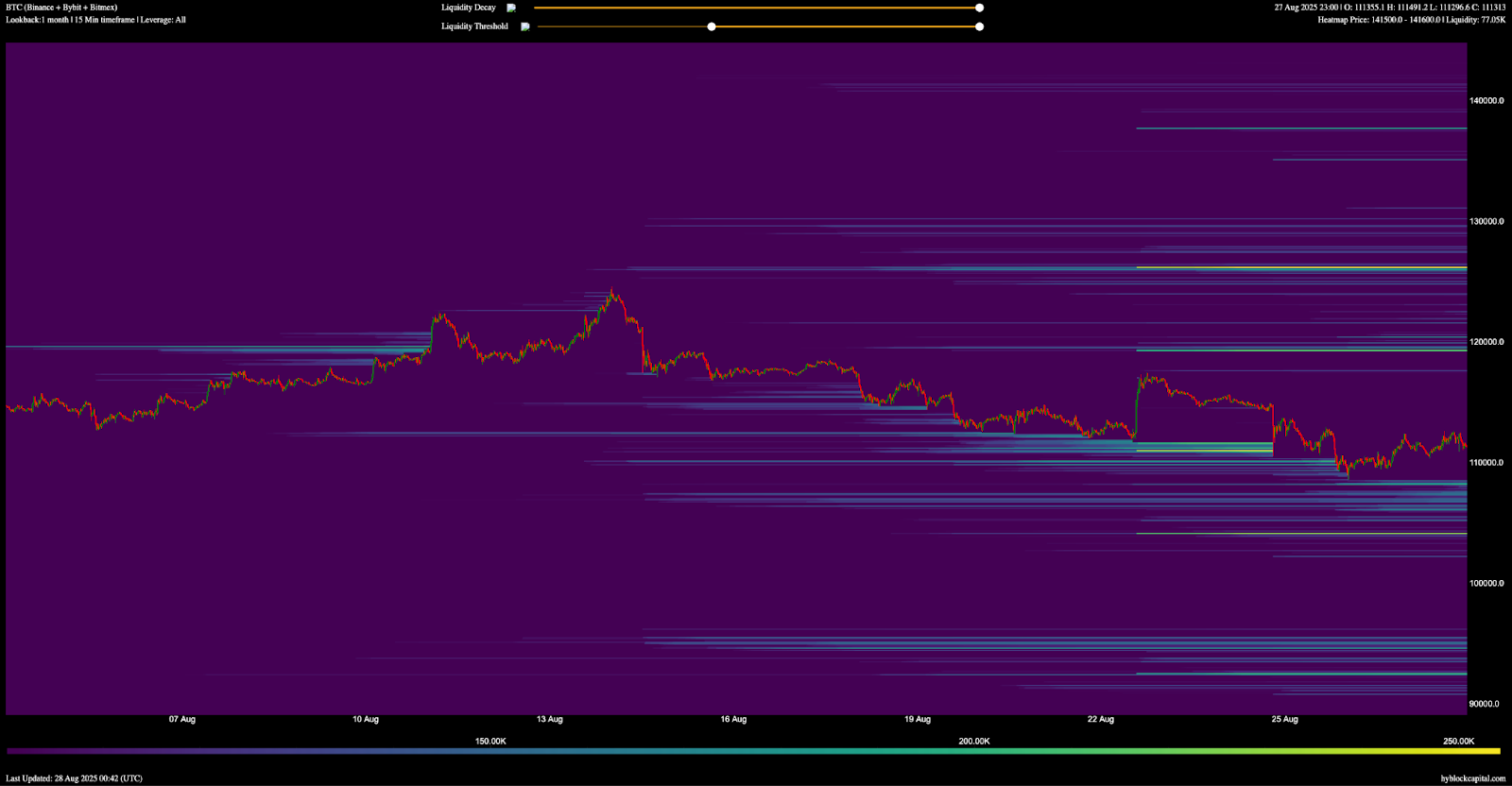

Liquidation heatmap information from Hyblock exhibits Bitcoin absorbing bids within the $111,000 to $110,000 space through the weekend sell-off, and one other cluster exists close to $104,000.

Whereas a breakdown to the bottom liquidity cluster appears unlikely, the present dynamic of bigger order promoting far outweighing the retail cohort continues to place stress on BTC worth.

Merchants hoping for a interval of consolidation ought to rigorously observe the anchored aggregated day by day CVD to see if this promote stress alleviates and if such a change in quantity aligns with shifting sentiment amongst traders.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a call.