Key takeaways:

-

Bullish methods dominate the $5 billion Ether choices expiry, giving merchants a bonus if costs rise.

-

Impartial-to-bearish methods principally failed under $4,600, leaving merchants uncovered as Ether rallied in August.

The $5 billion Ether (ETH) choices expiry on Friday would possibly mark a turning level for the cryptocurrency, as bullish methods at the moment are higher positioned after a 22% ETH worth achieve over 30 days. The occasion might present the momentum wanted to push Ether above $5,000, although investor focus stays on Nvidia (NVDA) earnings anticipated this Wednesday.

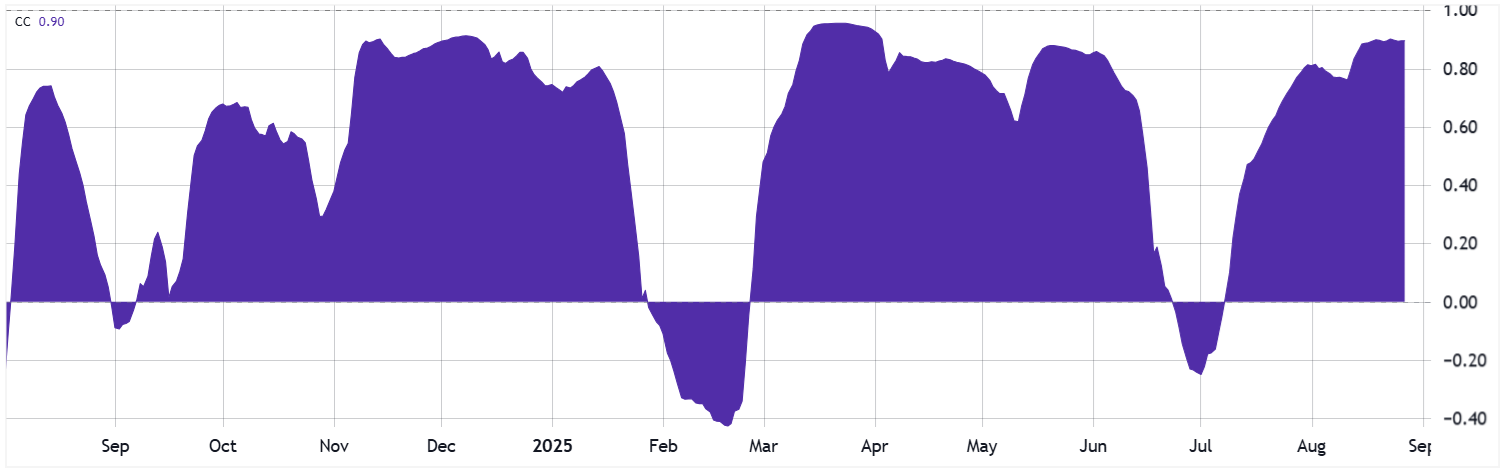

Ether’s present $557 billion market capitalization locations it among the many 30 largest tradable belongings, forward of giants resembling Mastercard (MA) and Exxon Mobil (XOM). Whereas it’s debated whether or not Ether must be in comparison with shares, its historic correlation with the S&P 500 means that merchants apply an identical threat evaluation to each belongings.

A correlation above 80% signifies Ether’s worth has intently mirrored the S&P 500 actions, though the connection briefly inverted throughout a two-week stretch in late July. Consequently, Ether merchants have cause to observe company earnings, significantly within the synthetic intelligence sector, which has been a serious driver for the inventory market index.

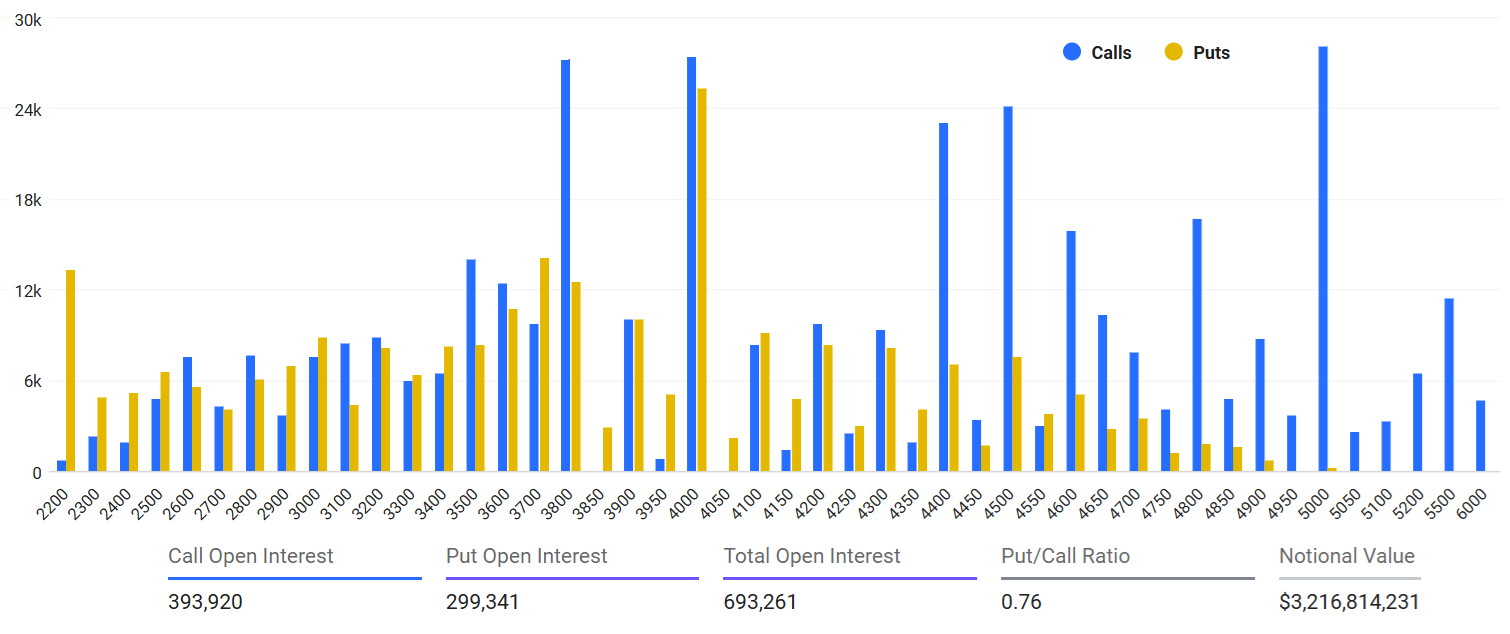

Ether name (purchase) choices maintain $2.75 billion in open curiosity, 22% greater than the $2.25 billion in put (promote) contracts, however the expiry consequence is dependent upon ETH’s worth at 8:00 am UTC on Friday. Deribit dominates the ETH choices market with a 65% share, adopted by OKX at 13% and CME with 8%, making it beneficial to research knowledge from the main trade.

Bearish Ether methods unwell ready for $4,000 and above

Ether bears had been caught off guard when ETH rallied earlier in August, as most bearish bets had been positioned at $4,000 or under. Regardless of rejection at $4,800, merchants pursuing bullish methods are nicely positioned to revenue from the $5 billion month-to-month expiry.

Solely 6% of ETH put choices had been positioned at $4,600 or larger, leaving most neutral-to-bearish buildings successfully nugatory. In distinction, 71% of name choices had been positioned at $4,600 or decrease, with notable clusters at $4,400 and $4,500. Consequently, bulls are anticipated to proceed supporting Ether’s worth forward of the month-to-month expiry.

Associated: Ethereum‘s greatest month ever places $7K ETH worth inside attain

Beneath are 4 possible situations at Deribit based mostly on present worth developments. These outcomes estimate theoretical earnings based mostly on open curiosity imbalances however exclude complicated methods, resembling promoting name choices to acquire draw back worth publicity.

-

Between $4,050 and $4,350: $820 million in calls (purchase) vs. $260 million in places (promote). The online outcome favors the decision devices by $560 million.

-

Between $4,350 and $4,550: $1.05 billion calls vs. $140 million places, favoring calls by $915 million.

-

Between $4,550 and $4,850: $1.4 billion calls vs. $45 million places, favoring calls by $1.35 billion.

-

Between $4,850 and $5,200: $1.82 billion calls vs. $2 million places, favoring calls by $1.8 billion.

Ether bulls are prone to emerge very glad from the month-to-month choices expiry, even when ETH retraces to $4,400. Whereas Ether breaking above $5,000 within the coming weeks stays possible, this consequence will probably rely upon merchants’ sentiment following Nvidia earnings and their total evaluation of world financial development dangers.

This text is for normal info functions and isn’t supposed to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don’t essentially mirror or signify the views and opinions of Cointelegraph.