Cryptocurrency whales, or huge buyers, are shopping for a whole lot of thousands and thousands of Ether, as analysts level to an natural rotation of investor mindshare towards altcoins with extra upside potential.

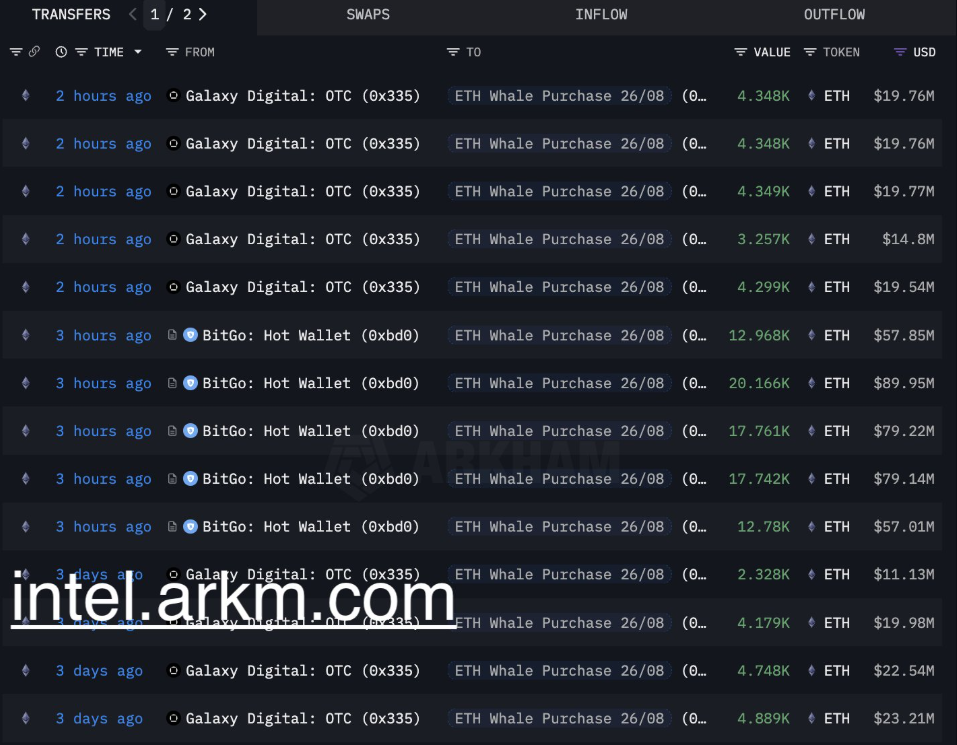

9 “huge” whale addresses purchased a cumulative $456 million price of Ether (ETH) from Bitgo and Galaxy Digital, blockchain information platform Arkham mentioned in a Tuesday X submit.

The rising whale demand for the world’s second-largest cryptocurrency alerts the market’s “pure rotation” into Ether and different altcoins with extra upside potential, in line with Nicolai Sondergaard, analysis analyst at crypto intelligence platform Nansen.

“Quite a lot of this seems like pure rotation, buyers locking in income from Bitcoin’s run and shifting into different tokens to catch potential upside,” the analyst advised Cointelegraph, including:

“Ether particularly is benefiting as a result of it has sturdy present mindshare and momentum from Ether treasury corporations.”

Whereas latest Ether whale actions are “notable,” the “broader development is solely that flows are spreading out past Bitcoin as market members search for the subsequent transfer,” the analyst mentioned.

Associated: Andrew Tate shorts Kanye West’s YZY, racks up $700K losses on Hyperliquid

Nonetheless, the rising Bitcoin revenue taking could also be a precursor to extra “investor mindshare” specializing in Ether, Sondergaard added.

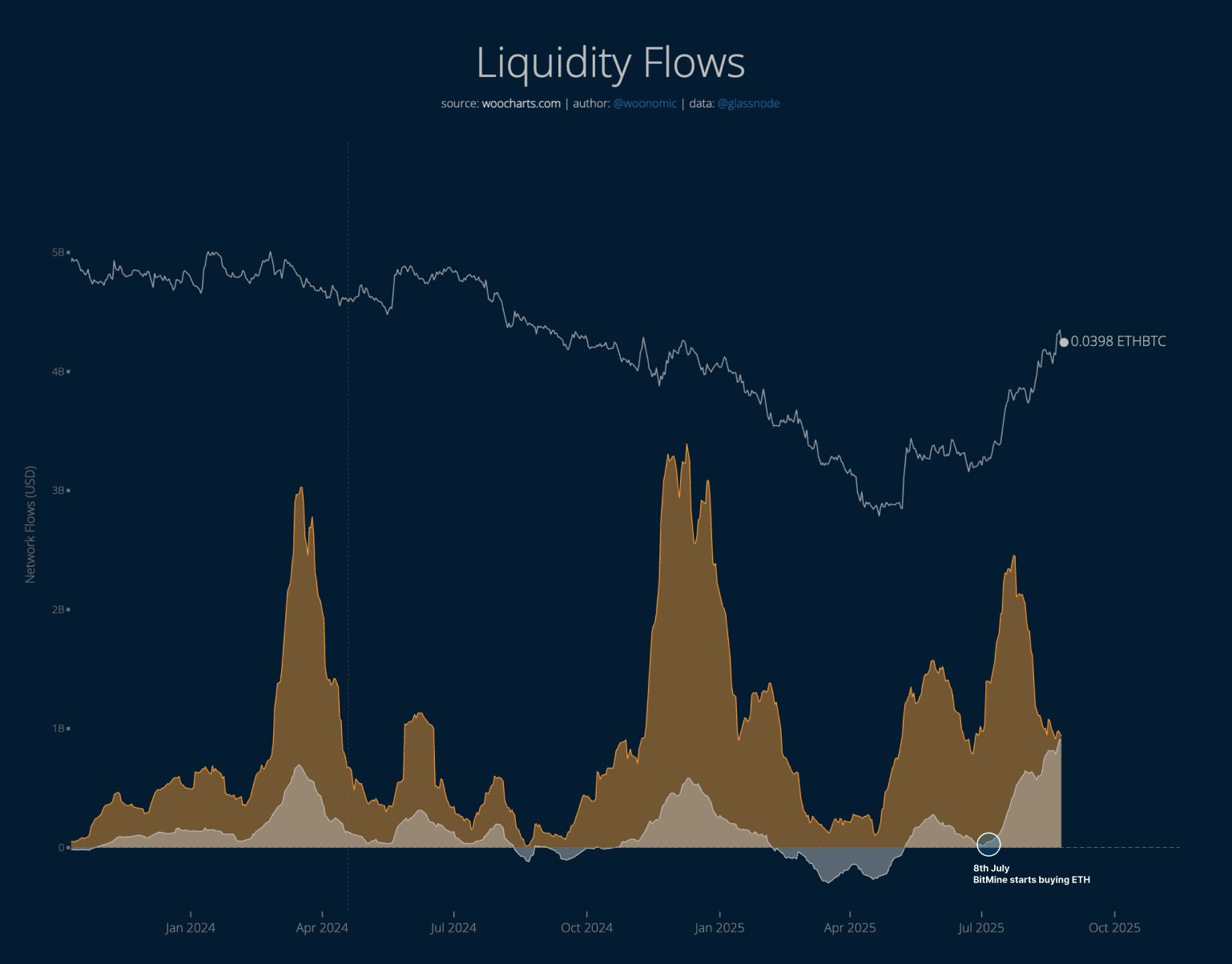

Crypto analyst Willy Woo additionally pointed to the rising capital rotation from Bitcoin (BTC) into Ether.

“Flows into ETH, at 0.9B USD per day (silver), is now approaching BTC’s inflows (orange),” wrote the analyst in a Tuesday X submit, including that the most recent streak of inflows “began when Tom Lee’s ETH treasury co, BitMine, began their ETH accumulation.”

These feedback got here per week after a Bitcoin whale price greater than $11 billion bought $2.59 billion price of Bitcoin, rotating the funds right into a $2.2 billion spot Ether and a $577 million Ether perpetual lengthy place on the decentralized trade Hyperliquid, Cointelegraph reported.

Associated: US retirement plans may gasoline Bitcoin rally to $200K regardless of downturn: Finance Redefined

Good cash merchants are shopping for altcoins: Nansen information

The business’s most profitable cryptocurrency merchants by returns, tracked as “sensible cash” merchants on Nansen’s blockchain intelligence platform, are already rotating into altcoins, stoking investor expectations of a 2025 altcoin season.

Taking a look at their most vital large-cap token acquisitions, sensible cash merchants acquired $1.2 million price of Chainlink (LINK) tokens, $967,000 price of Ethena (ENA) and $614,000 price of Lido DAO (LDO) tokens, Nansen information reveals.

The rising LINK acquisitions could have are available in response to Bitwise Asset Administration submitting to launch a LINK-based exchange-traded fund with the US Securities and Change Fee, Cointelegraph reported on Tuesday.

But, these cumulative altcoin acquisitions pale compared to the $28 million Ether acquired by a dormant whale, who has been inactive since 2021, Cointelegraph reported on Tuesday.

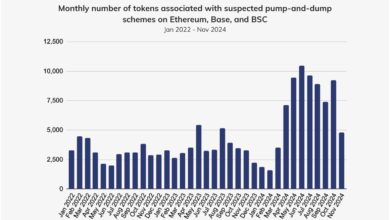

Journal: Altcoin season 2025 is sort of right here… however the guidelines have modified