Decentralized trade Hyperliquid is beneath scrutiny after a pointy rally in its HYPE token coincided with whale-driven manipulation claims on its platform.

On Aug. 27, analytics agency SpotOnChain reported {that a} cluster of enormous wallets pushed XPL’s value up by 200% to $1.80 earlier than it shortly retraced. The sudden transfer transferred hundreds of thousands between merchants.

In keeping with the agency, the principle orchestrator of the manipulation gained greater than $15 million, whereas three others booked earnings starting from $9 million to $13 million. Against this, wallets caught on the mistaken facet of the swing misplaced over $6.5 million mixed.

One other blockchain platform, Lookonchain, reported that the frenzy compelled whales shorting XPL to inject liquidity to guard their positions. It famous that one dealer deposited $44 million USDC, whereas one other moved $29 million USDC into the protocol to stave off liquidation.

HYPE’s new ATH

Regardless of the controversy, Hyperliquid’s HYPE token climbed to a file $51.05 on Aug. 27, a ten% improve in 24 hours, in accordance with CryptoSlate knowledge.

The milestone surpassed the asset’s earlier July excessive of $48.55. Costs have since corrected to round $48.8, although the token nonetheless confirmed a 7.5% every day acquire at press time.

The momentum displays broader progress throughout Hyperliquid’s buying and selling platform.

DefiLlama knowledge revealed that in July, Hyperliquid processed $330.8 billion in mixed spot and perpetual quantity, surpassing Robinhood’s $237.8 billion throughout all asset courses. The hole represented a 39% lead for Hyperliquid, marking the third straight month it outpaced the US buying and selling big.

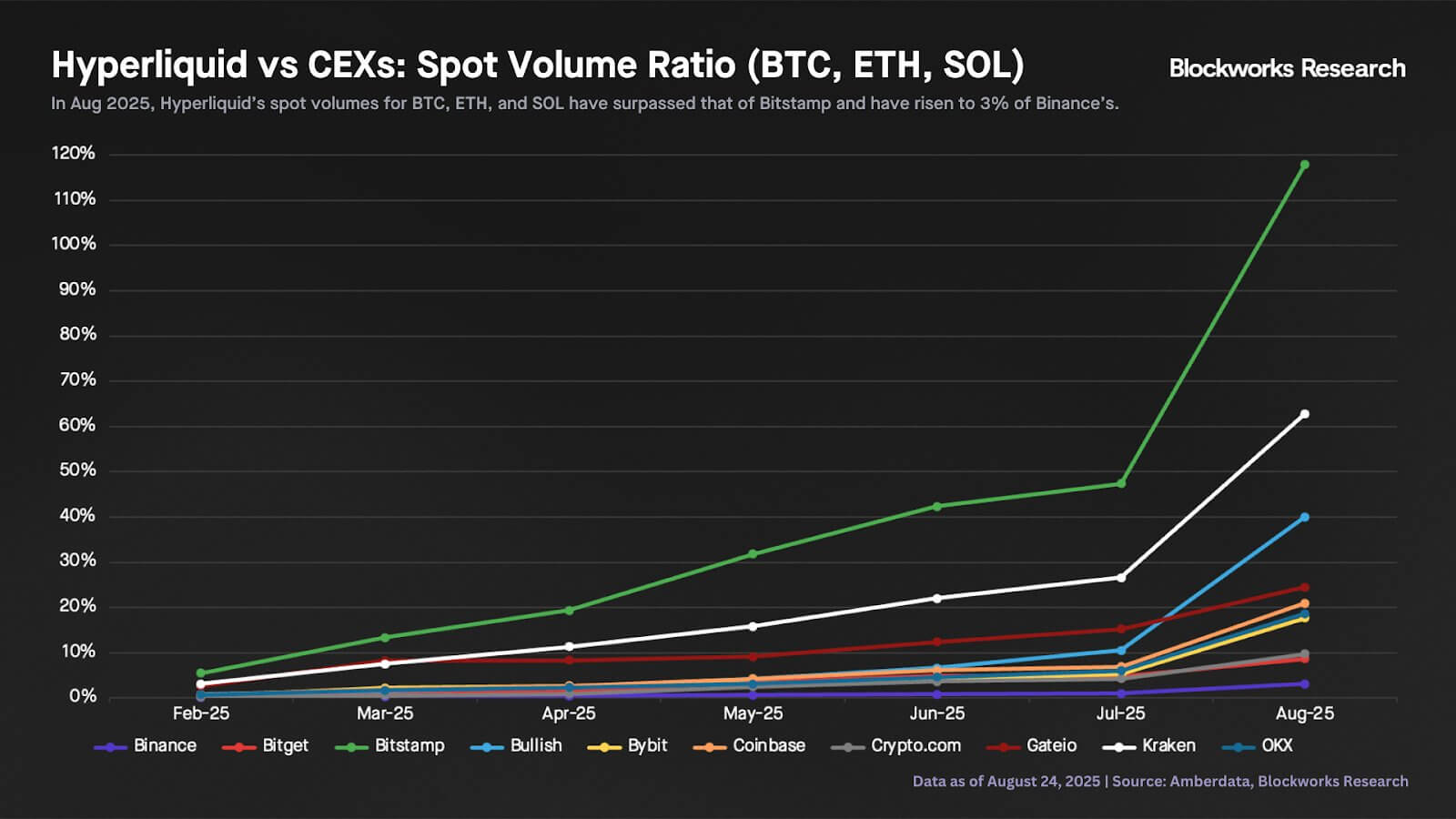

Business observers recommend the expansion trajectory may proceed for the decentralized buying and selling platform.

Blockworks researcher Carlos famous that Hyperliquid generated practically $100 million in income over the previous 30 days, outpacing a number of established Layer 1 networks.

In keeping with him, Hyperliquid’s spot volumes for Bitcoin, ETH, and Solana matched or exceeded these of Bitstamp and Kraken this month.

On the identical time, its derivatives exercise rose to just about 14% of Binance’s futures market, a bounce from simply 2% a yr earlier.

Contemplating this, he posited that “Hyperliquid will proceed to take market share away from CEXs.”