A cryptocurrency dealer upsized his multimillion-dollar social media stress marketing campaign towards MEXC after claiming that the digital asset alternate requested an in-person assembly to unfreeze the person’s $3 million value of private funds.

In July 2025, centralized cryptocurrency alternate (CEX) MEXC allegedly froze $3.1 million value of private funds with none phrases of service violations, in response to pseudonymous crypto dealer the White Whale.

On Sunday, the dealer launched a $2 million social media stress marketing campaign towards the alternate, aiming to extend consideration on the matter, after claiming that the alternate had requested a one-year evaluate interval earlier than unfreezing the person’s funds, Cointelegraph reported on Monday.

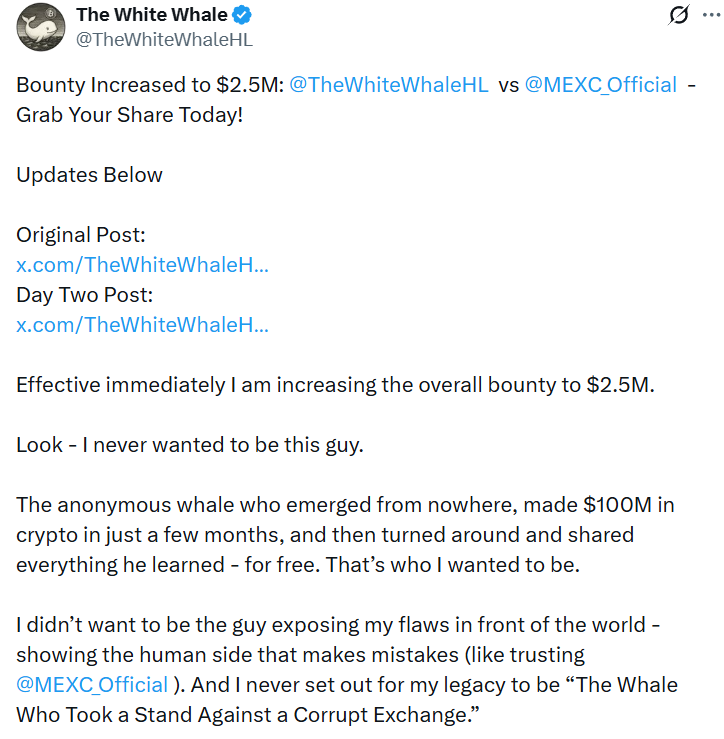

On Tuesday, the dealer introduced rising the “bounty” towards MEXC to $2.5 million, allocating a further $250,000 for the group of customers who take part in his social media marketing campaign, which incorporates minting a free non-fungible token (NFT) on the Base community, tagging MEXC or its chief working officer’s X account with the “#FreeTheWhiteWhale” tag.

One other $250,000 can be donated to verified charities, wrote the White Whale in a Tuesday X submit, including:

“I need to be certain that these video games cease.”

“We have to remind them: The minnows have gotten sharks – and sure, even whales. We’re not your prey anymore,” added the dealer.

Associated: Solana devs billed $5K for single question through Google Cloud’s BigQuery

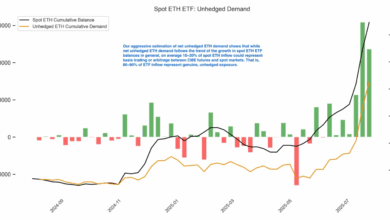

When initiating the preliminary $2 million social media marketing campaign, the dealer alleged that his account was issued a 12-month restriction for no clear guideline violations. He claimed that his account was extra worthwhile than the alternate’s exterior market makers.

Nonetheless, account restrictions “are imposed strictly as a result of they triggered our threat management guidelines, not resulting from profitability,” a spokesperson for MEXC instructed Cointelegraph, including the alternate’s 12-month evaluate interval applies “solely to accounts concerned in coordinated violations, high-risk accounts, or compliance-related dangers, and doesn’t have an effect on all customers topic to threat management measures.”

Associated: US retirement plans might gas Bitcoin rally to $200K regardless of downturn: Finance Redefined

MEXC can’t observe their very own rulebook: White Whale

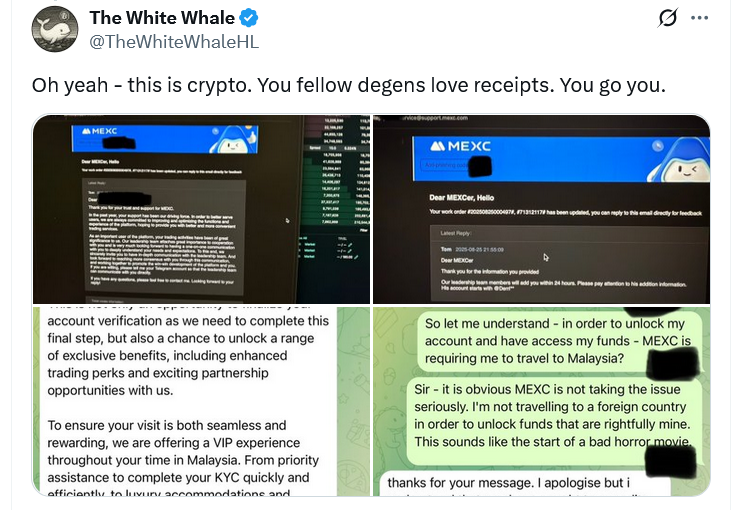

The pseudonymous dealer determined to extend the funds shortly after he claimed that MEXC requested he fly to Malaysia to show his identification in particular person to have his funds launched.

This falls exterior of the norm of cryptocurrency exchanges, which usually ask for proof of handle or different identification paperwork which are submitted on-line throughout Know Your Buyer (KYC) verification.

“I’m not a canine to return when summoned – not for any amount of cash. And I don’t must,” wrote the dealer within the Tuesday X submit, including:

“As a result of they’ll’t even observe their very own rulebook, which makes no point out of in-person KYC necessities.”

Different crypto buyers have additionally claimed struggling related account closures.

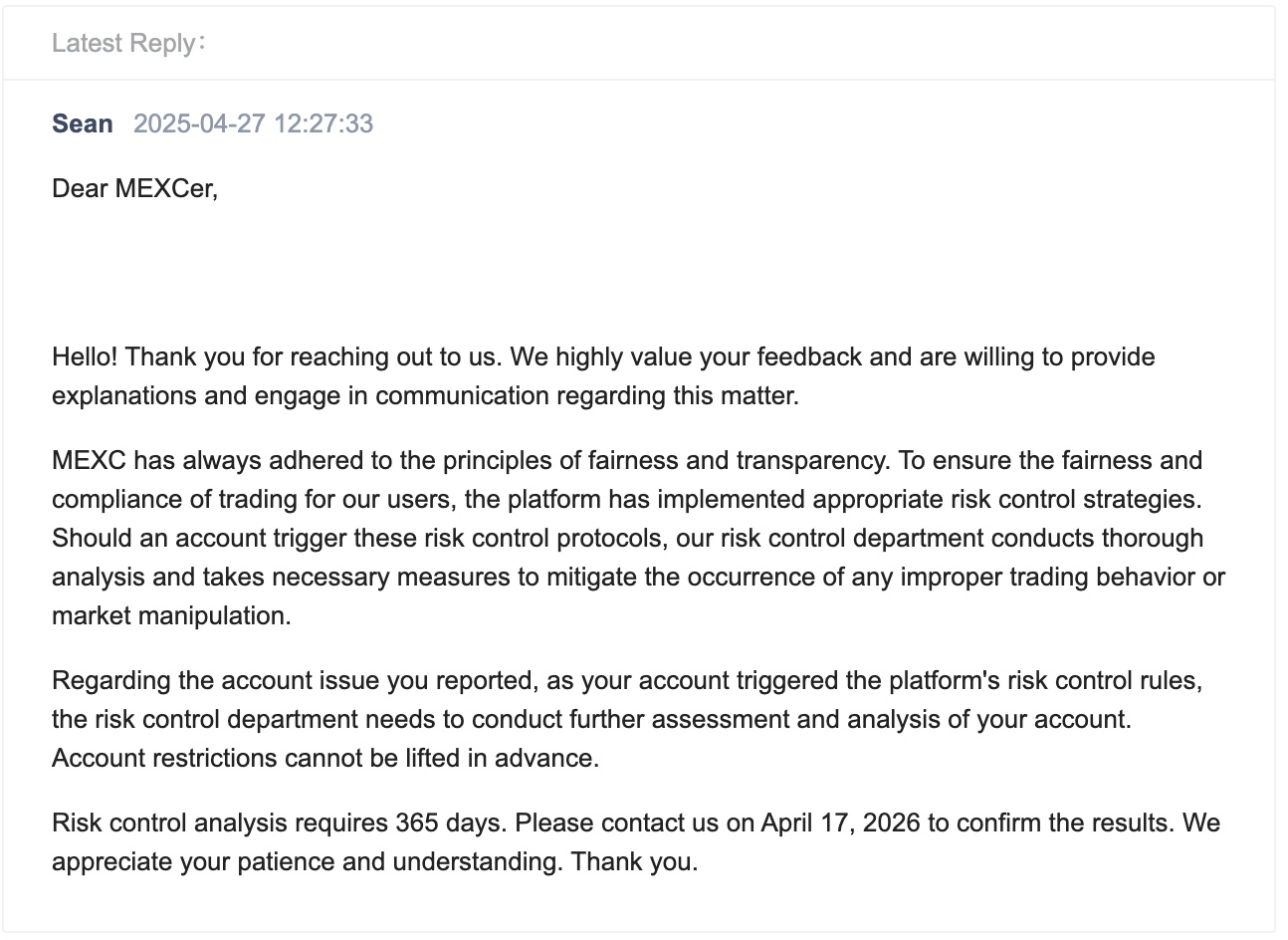

On April 17, crypto dealer Pablo Ruiz had his account frozen resulting from a “imprecise threat management protocol, with out prior discover, rationalization, or any alternative to cooperate.”

“Since then, practically 3 months have handed, and my funds — totaling $2,082,614 USDT — stay totally inaccessible,” wrote Ruiz in a July 13 X submit, including that his account was additionally subjected to a evaluate interval of one year, set to finish in April 2026.

The dealer shared screenshots of an e-mail stating the chance management course of was accomplished, “but assist insists the evaluate is ongoing, revealing an INTERNAL CONTRADICTION and a whole lack of transparency,” he mentioned.

Journal: Solana Seeker evaluate: Is the $500 crypto telephone value it?