Key takeaways:

-

Bitcoin value wants to carry above $110,000 to keep away from additional losses.

-

The Taker-Purchase-Promote-Ratio is all the way down to ranges final seen in November 2021, when BTC value reached its cycle peak.

Bitcoin’s (BTC) value noticed modest positive aspects on Wednesday, rising 0.9% over 24 hours to commerce at round $111,000.

A number of analysts stated the following most important help stays $110,000, and the worth should maintain it to keep away from a deeper correction.

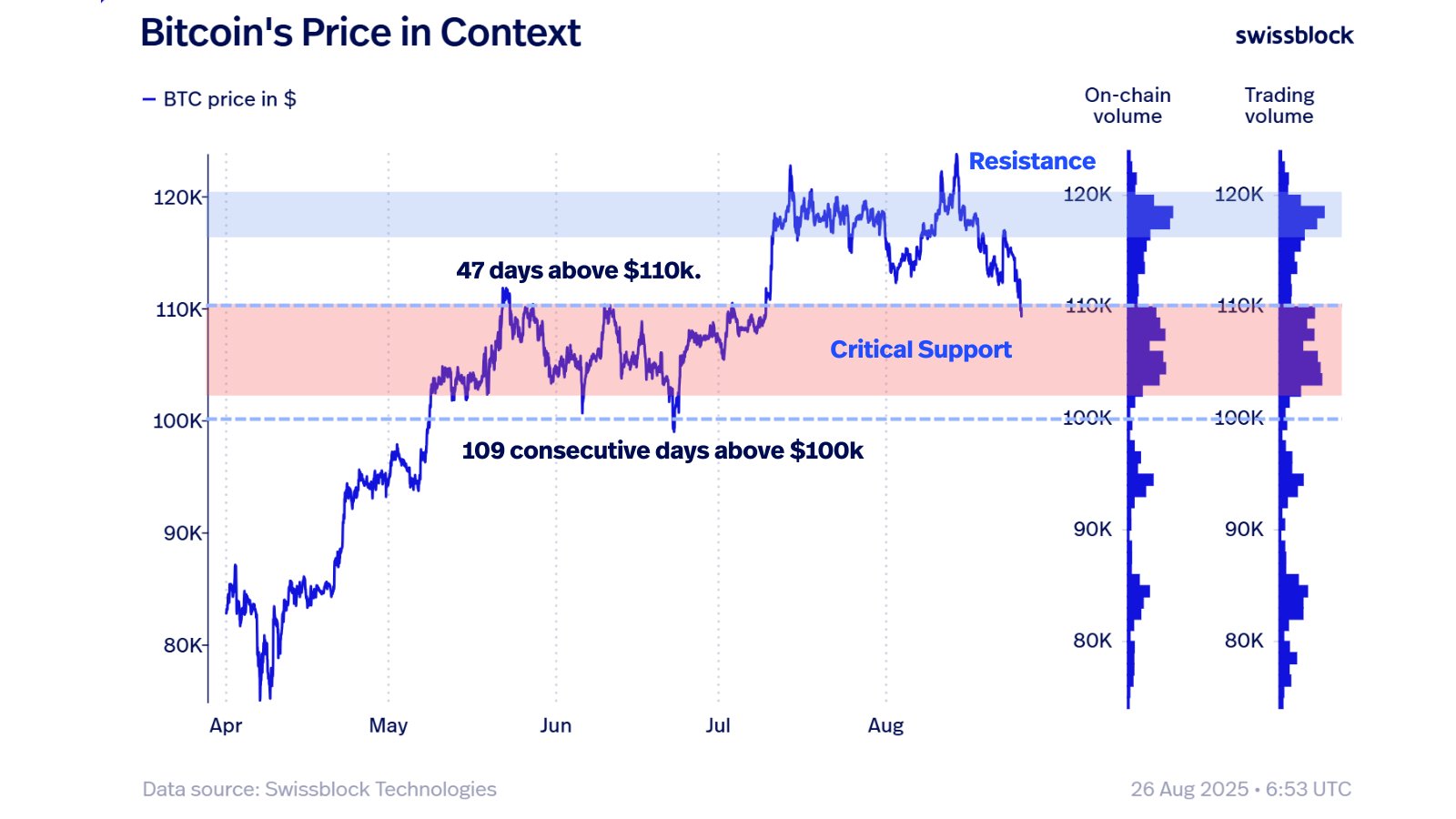

“BTC is at a make-or-break degree,” stated Swissblock in a Wednesday put up on X.

The non-public wealth supervisor asserted that Bitcoin’s “lifeline help” sits at $110,000, a degree bulls should maintain to make sure the bullish development continues.

“BTC has confirmed resilience above $100K, however survival above $110K will determine if the development continues bullish or ideas into structural weak point.”

In style Bitcoin analyst AlphaBTC shared a chart displaying that the world between $110,000 and $112,000 was key for Bitcoin.

Based on the analyst, a four-hour candlestick shut above this space was required for the BTC value excessive to rebound; in any other case, a drop to $105,000 is probably going.

“Till we get a four-hour shut above $112K, I nonetheless really feel $105K is in play, so I will likely be watching that degree carefully.”

📈#Bitcoin recreation plan 📈

Decrease timeframe view as $BTC makes an attempt to interrupt again out of the June / July vary.

For me, till we get a H4 shut above 112K I nonetheless really feel 105K is in play, so I will likely be watching that degree carefully.#Crypto #BTC https://t.co/pUUFtwwVDX pic.twitter.com/vCfRVF7s5s

— AlphaBTC (@mark_cullen) August 27, 2025

Bitcoin value is presently holding the $110,000–$112,000 help, which “stays the important thing battleground,” stated investor and dealer Crypto Storm, including:

“So long as this zone holds, a rebound towards the highs remains to be potential.”

Bitcoin taker buy-sell ratio flashes a “peak” sign

Sadly for the bulls, a number of bearish indicators recommend BTC might fall beneath $110,000 within the following days or even weeks.

Bitcoin’s value has deviated roughly 11% from its all-time excessive above $124,500 reached on Aug. 14, per Cointelegraph Markets Professional and TradingView knowledge.

This drawdown has saved buyers on the again seat, “reflecting a notion that the market could also be overextended,” in keeping with CryptoQuant analyst Gaah.

The Bitcoin Taker-Purchase-Promote-Ratio, a metric gauging market sentiment, was at -0.945. When the metric dips beneath 1, it signifies that bears are in charge of the market, and when the metric is above 1, the bulls are in management.

Presently, the indicator’s worth is beneath its historic common, reflecting a state of affairs the place gross sales have constantly outpaced shopping for.

“This indicators that, regardless of Bitcoin’s current appreciation, the market is displaying pessimism and warning,” Gaah stated in a Tuesday Quicktake evaluation.

The final time comparable ranges had been noticed was on the peak of November 2021, when Bitcoin reached the $69,000 vary earlier than coming into a protracted interval of correction, the analyst defined, including:

“Taker Purchase Promote Ratio reinforces that the market is in a zone of consideration: rising promoting stress exposes weaknesses within the bullish value construction that shouldn’t be ignored!”

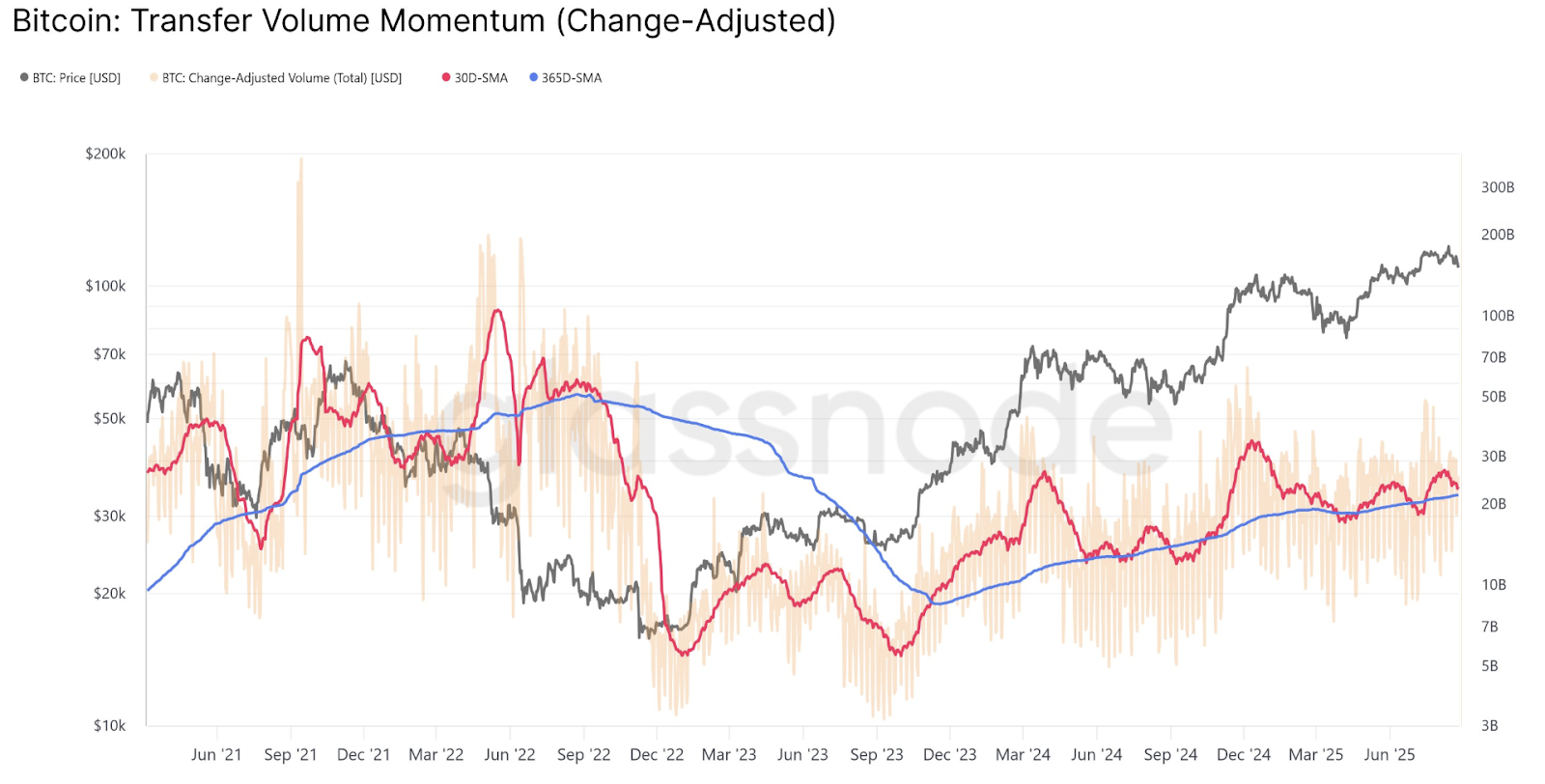

In the meantime, declining community exercise, evidenced by a 13% drop within the month-to-month common of change-adjusted switch quantity to $23.2 billion from $26.7 billion, reinforces the bearish case for Bitcoin, per Glassnode.

The market intelligence agency stated:

“A break beneath the yearly common of $21.6B would verify weakening speculative exercise and sign a broader contraction in onchain demand.”

Nonetheless, as Cointelegraph reported, a number of bullish indicators stay. A optimistic Coinbase Premium and the return of optimistic flows into spot Bitcoin ETFs have raised hopes of a BTC market rebound.

This text doesn’t include funding recommendation or suggestions. Each funding and buying and selling transfer includes danger, and readers ought to conduct their very own analysis when making a choice.