Information Background

- CME Group not too long ago mentioned its crypto futures suite surpassed $30 billion in notional open curiosity for the primary time, with XRP futures crossing $1 billion in simply over three months — the quickest tempo for a brand new contract.

- Broader crypto sentiment improved after Fed Chair Jerome Powell’s Jackson Gap remarks, which boosted expectations of coverage easing later this 12 months.

- XRP continues to commerce below the shadow of U.S. regulatory uncertainty, at the same time as company treasuries discover cross-border cost pilots with Ripple’s know-how.

Worth Motion Abstract

- From August 26 at 03:00 to August 27 at 02:00, XRP gained 3.60%, rising from $2.89 to $2.99 inside a $0.20 intraday band.

- The sharpest transfer got here at 19:00 GMT on August 26, when XRP pierced $3.08 on extraordinary 167.60 million quantity earlier than rejecting at that degree.

- Within the remaining hour (01:21–02:20 GMT on Aug. 27), XRP oscillated inside a $0.13 hall, consolidating positive aspects whereas holding regular close to the $2.99–$3.00 zone.

Technical Evaluation

- Assist: $2.89 stays the important thing base after a number of profitable retests; $2.99 now appearing as a psychological ground.

- Resistance: $3.06–$3.08 is the near-term ceiling, strengthened by the heavy rejection on excessive quantity at $3.08.

- Momentum: RSI recovered from oversold 42 to the mid-50s, suggesting strengthening near-term pattern.

- Quantity: 167.60 million tokens modified palms throughout the $3.08 check — greater than double the 30-day common — a transparent signal of institutional participation.

- Patterns: Double bull-flag and rounding-bottom buildings spotlight potential upside, with technicians eyeing $5.85 as a longer-term breakout goal.

- Compression: Diminishing peaks round $3.01–$3.00 in late buying and selling point out a coiling setup forward of a directional transfer.

What Merchants Are Watching

- Whether or not $2.99–$3.00 can maintain as a strong psychological assist.

- A confirmed break above $3.08 probably opens a run to $3.20 and past.

- Draw back dangers stay if $2.84 is breached, with $2.80 as the following key degree.

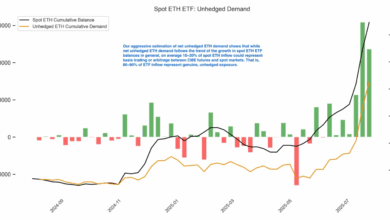

- CME open-interest development and institutional flows might be watched carefully for affirmation of sustained momentum.