Key takeaways:

-

Solana struggles to maintain $200 as onchain exercise weakens and leveraged demand stays subdued.

-

A spot ETF approval and institutional assist might elevate SOL, however present fundamentals counsel restricted rally potential.

Solana’s native token (SOL) has repeatedly failed to carry ranges above $200 over the previous six weeks, main merchants to query what’s limiting the upside. The priority is heightened by the truth that opponents Ether (ETH) and BNB (BNB) not too long ago reached new all-time highs.

The potential approval of a Solana spot exchange-traded fund (ETF) in the USA, mixed with corporations signaling intentions so as to add SOL to their company reserve methods, might push the token above $250. Nonetheless, three situations have to be met earlier than a sustainable rally can take maintain.

Sluggish onchain and futures knowledge makes traders cautious

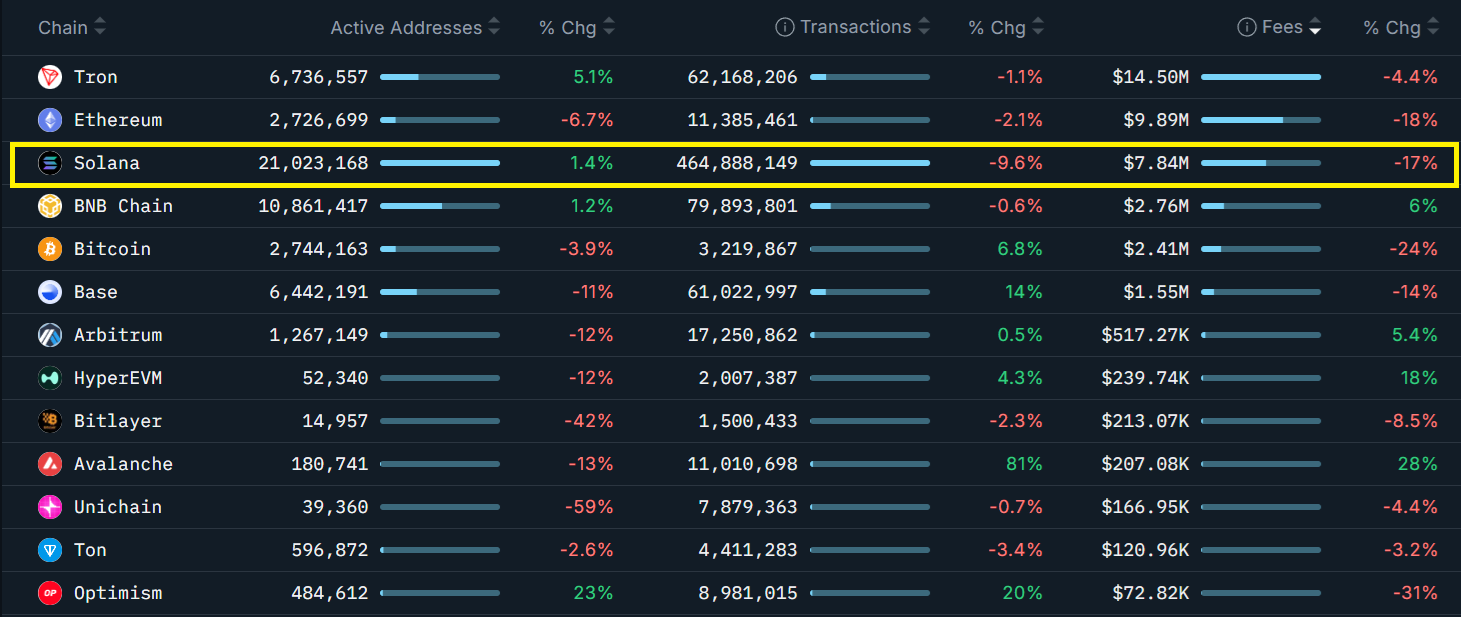

For SOL consumers to regain confidence, onchain exercise on Solana should strengthen. Community charges fell 17% in contrast with the prior week, whereas the variety of transactions dropped 10%. In the meantime, charges on BNB Chain rose 6%, whereas transaction ranges remained flat. Ethereum’s layer-2 exercise additionally confirmed development, with transactions on Base rising 14% and Arbitrum gaining 20%.

In relative phrases, Solana’s charge ranges stay notable given the community’s $12.5 billion in whole worth locked (TVL), in contrast with Ethereum’s almost $100 billion. Nonetheless, Solana’s chain income has declined 91% from January’s peak, a downturn that coincided with the launch of the Official Trump (TRUMP) token and the broader memecoin frenzy.

The shortage of demand for bullish leverage on SOL futures provides to the cautious sentiment.

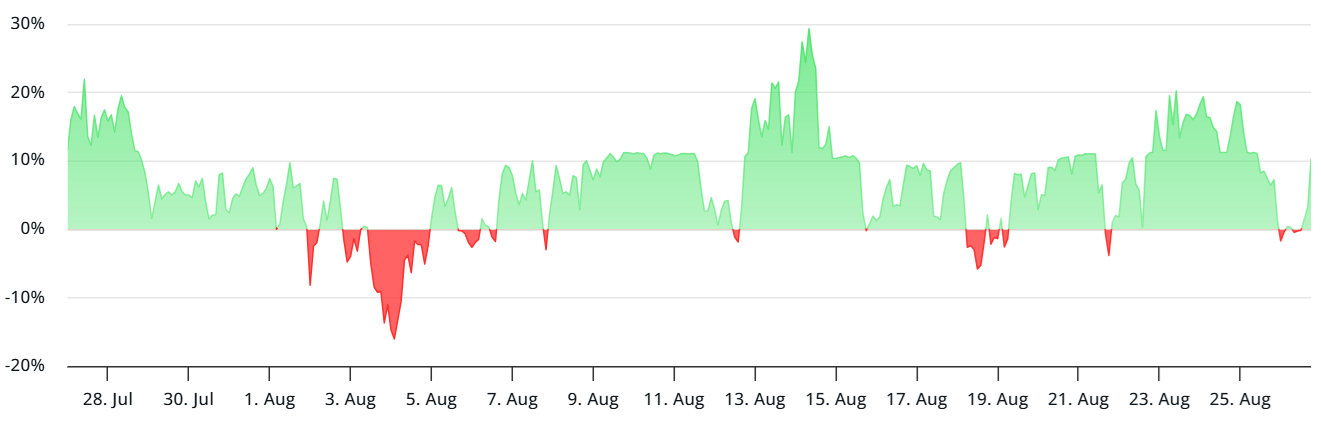

In impartial situations, perpetual futures sometimes present an annualized premium between 8% and 14%, reflecting capital prices and counterparty danger. The present 10% price signifies balanced demand, which isn’t inherently adverse, however it’s mildly regarding provided that SOL’s value has already gained 39% over the previous two months.

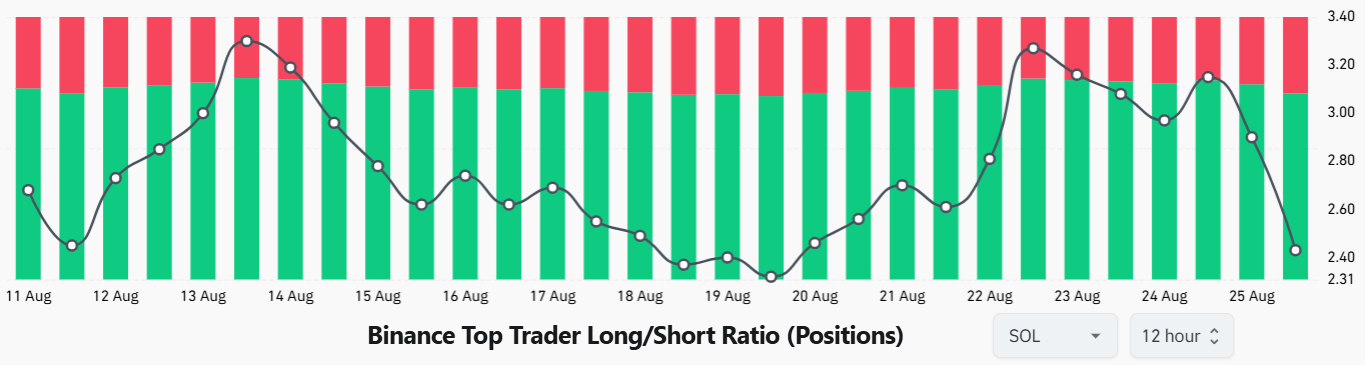

Binance’s top-trader long-to-short ratio has shifted sharply towards bearish positioning. This indicator offers a broader measure of sentiment because it incorporates futures, margin, and spot markets.

Demand for bullish SOL publicity on Binance reached a month-to-month excessive final Saturday however has since dropped considerably. In line with derivatives knowledge, whales and market makers should not aggressively bearish, but they continue to be cautious about SOL breaking decisively above $200.

Institutional backing and SEC actions stay key catalysts

SOL’s value confirmed little response to reviews that Galaxy Digital, Multicoin Capital, and Soar Crypto are working to lift $1 billion for a Solana-focused digital asset treasury firm. Bloomberg added that the Solana Basis has endorsed the initiative, but the information did not spark momentum.

Associated: Solana devs billed $5K for single question through Google Cloud’s BigQuery

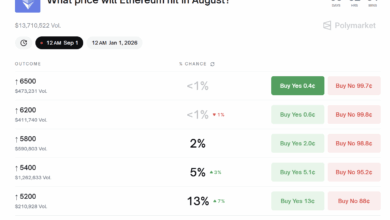

The ultimate impediment for SOL’s path towards $250 lies with the pending determination from the US Securities and Change Fee (SEC) on a number of Solana spot ETF filings. Bloomberg analyst Eric Balchunas estimates approval odds above 90%, although the SEC’s remaining deadline falls in mid-October.

Whereas SOL might nonetheless climb above $200 earlier than these catalysts play out, the probability of a sustainable rally stays low given weaker onchain exercise, restricted demand for bullish leverage, and lingering uncertainty across the ETF final result.

This text is for normal info functions and isn’t meant to be and shouldn’t be taken as authorized or funding recommendation. The views, ideas, and opinions expressed listed here are the creator’s alone and don’t essentially mirror or characterize the views and opinions of Cointelegraph.