Crypto trade Bitpanda turned away from London’s public markets, citing weak liquidity on the London Inventory Alternate (LSE) as a key consider its choice.

Eric Demuth, co-founder of the Vienna-based crypto trade, advised the Monetary Instances that whereas Bitpanda was actively evaluating a public itemizing, “it won’t be in London.” As an alternative, the agency is weighing potential listings in Frankfurt or New York, although no timeline has been set.

“At the moment, liquidity-wise, the LSE shouldn’t be doing too effectively,” Demuth advised the FT. “I hope that it will get higher, however over the subsequent few years, I believe the LSE is struggling a bit.”

Demuth famous that a number of firms, together with British fintech Clever, have already shifted or are within the means of shifting their main listings overseas to draw extra traders.

Cointelegraph reached out to Bitpanda for remark, however had not acquired a response earlier than publication.

Associated: Crypto Biz: IPO fever, Ether wars and stablecoin showdowns

London IPO market hits 30-year low

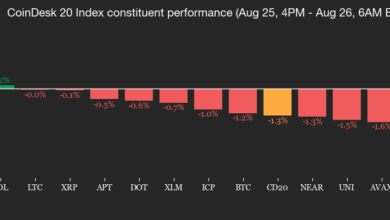

The UK is going through one in every of its steepest IPO droughts in many years. In line with market knowledge cited by the FT, the quantity raised from London listings within the first half of the yr dropped to a 30-year low, sparking issues over its means to compete with different world monetary facilities.

The UK has additionally been below fireplace for its crypto coverage. In June, analysts on the Official Financial and Monetary Establishments Discussion board (OMFIF), an impartial assume tank, argued that the UK had wasted its early-mover benefit in distributed ledger finance.

Final month, Coinbase launched a satirical video mocking the state of the UK economic system, contrasting upbeat lyrics about “all the things being fantastic” with bleak photographs of poverty, inflation, debt and crumbling infrastructure.

Associated: Blockchain-focused Determine Know-how joins crypto IPO wave with SEC submitting

Crypto firms file for US listings

Bitpanda’s rejection of London comes as crypto corporations more and more look to the US for capital market exercise. Earlier this month, Gemini Area Station, the crypto trade based by Cameron and Tyler Winklevoss, filed with the SEC to listing its Class A typical inventory on the Nasdaq World Choose Market below the ticker GEMI.

Different crypto corporations which have just lately filed for US listings embrace blockchain lender Determine, BitGo and Bullish, one other Thiel-backed trade that listed on the NYSE this month.

Bitpanda just lately launched within the UK, permitting customers to commerce over 600 digital property, and introduced a sponsorship cope with Arsenal Soccer Membership.

Journal: Altcoin season 2025 is sort of right here… however the guidelines have modified