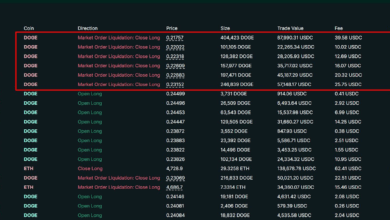

Crypto markets had been hit with practically $900 million in liquidations to begin the week, wiping out overleveraged longs after a pointy correction in each bitcoin (BTC) and ether (ETH).

ETH merchants bore the brunt, with $320 million in pressured unwinds, adopted by $277 million tied to bitcoin. Solana's SOL (SOL), XRP (XRP), and Dogecoin (DOGE) noticed one other $90 million mixed, in accordance with Coinglass. The wipeouts got here as ETH fell again from $4,700 towards $4,400 and BTC slipped to $110,200, monitoring weak spot within the S&P 500.

“This sharp transfer seems to be the results of overleveraged positioning, notably following ETH’s current run-up, and an in a single day dip within the S&P 500, which weighed on danger property extra broadly,” a dealer notice from Derixe.xyz famous.

Volatility surged within the aftermath. Every day BTC vol jumped from 15% to 38%, whereas ETH’s spiked from 41% to 70%, knowledge from Derive.xyz exhibits. That unfold suggests merchants see ether because the extra fragile guess proper now, as its rallies draw heavier leverage, however when the market turns, those self same positions get pressured out quicker, creating sharper strikes in each instructions.

Choices markets leaned defensive, with 25-delta skew flipping destructive for each majors — the strongest choice for places in two weeks.

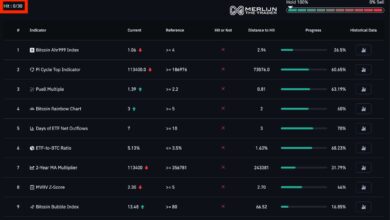

The reset has merchants eyeing round-number ranges as subsequent strain factors. Implied odds for BTC to revisit $100,000 by September-end rose to 35% from 20% final week, whereas ETH is now seen with a 55% likelihood of retesting $4,000, in accordance with market pricing.

That divergence between the 2 majors can also be displaying up in futures and vol. CME knowledge factors to document shorts in ETH futures, doubtless tied to hedging round digital asset tokenization (DAT) flows or funding-basis arbitrage.

“BTC implied vol collapsed to new document lows post-Powell as a little bit of a shock, resulting in a big divergence vs a (nonetheless) rising ETH IV,” mentioned Augustine Fan, head of insights at SignalPlus, in a message to CoinDesk.

With GDP knowledge due August 28 and U.S. unemployment figures early September, merchants are bracing for extra chop. Leverage might have flushed, however the setup suggests the trail forward might stay unstable particularly for ETH, the place positioning appears extra stretched and flows extra concentrated than in bitcoin.

Learn extra: Huge $14.6B Bitcoin and Ether Choices Expiry Reveals Bias for Bitcoin Safety