Bitcoin and ether (ETH) choices price over $14.6 billion are set to run out Friday on Deribit in what’s shaping as much as be probably the most vital spinoff occasions of 2025.

The expiry is closely skewed towards BTC put choices, underscoring a continued demand for draw back safety, whereas it is extra balanced for ether.

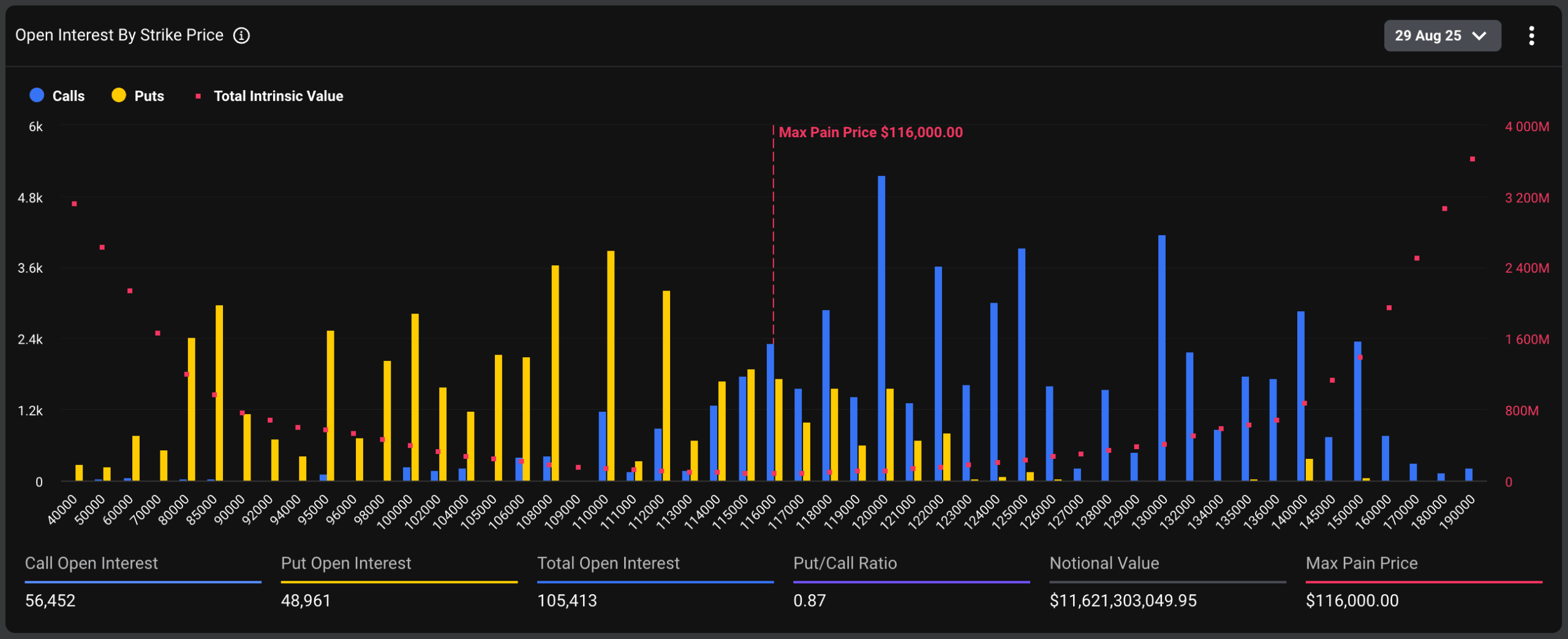

As of the time of writing, 56,452 BTC name choice contracts and 48,961 put choice contracts have been due for settlement, totalling a notional open curiosity of $11.62 billion, in keeping with knowledge supply Deribit Metrics. Deribit is the world’s largest crypto choices trade, accounting for 80% of the worldwide exercise. On Deribit, one choice contract represents one BTC or ETH.

A better take a look at open curiosity reveals concentrated exercise in put choices with strike costs between $108,000 and $112,000. Conversely, the preferred name choices are clustered at $120,000 and above.

In different phrases, near-the-money places round BTC’s present market value of roughly $110,000 are extremely wanted, whereas calls with larger strike costs mirror hopes for additional upside.

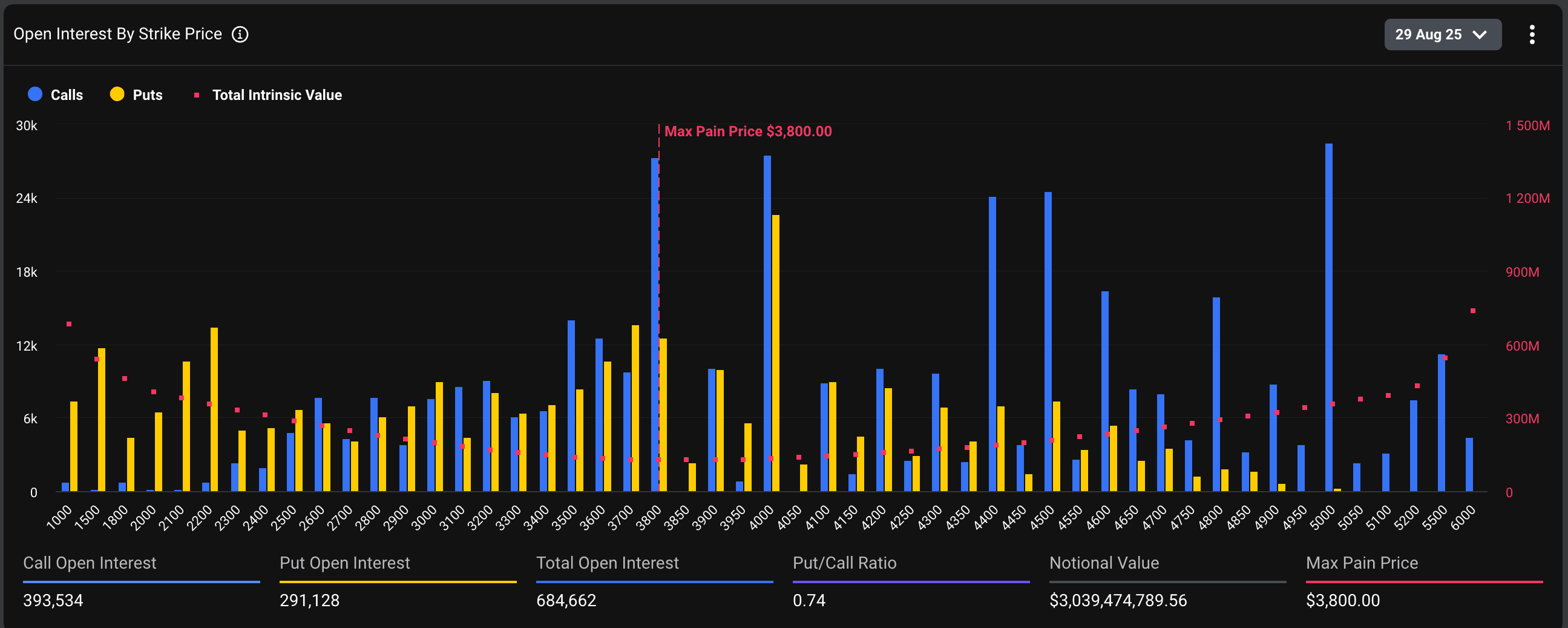

In ether’s case, a complete of 393,534 calls are due for settlement, outstripping the put tally of 291,128 by a major margin, each totaling $3.03 billion in notional open curiosity.

Vital OI is concentrated in calls at strikes $3,800, $4,000 and $5,000, and put choices at strikes $4,000, $3,700 and $2,200.

“BTC expiry factors to persistent demand for draw back safety, whereas ETH seems extra impartial. Mixed with Powell’s Jackson Gap sign, this expiry might assist set the market tone for September,” Deribit mentioned on X.

Choices are spinoff contracts that give the purchaser the appropriate to purchase or promote the underlying asset at a predetermined value on or earlier than a specified future date. A name choice provides the appropriate to purchase and represents a bullish guess available on the market. In the meantime, a put choice offers insurance coverage towards value slides.

The choices market has grown leaps and bounds since 2020, with month-to-month and quarterly settlements gaining prominence as main market-moving occasions.

By 2021, some observers proposed that costs are inclined to gravitate towards ‘max ache’ ranges – the strike costs the place choices holders undergo the best losses – within the days main as much as expiry. Nonetheless, the validity of this idea stays a matter of debate amongst merchants and analysts.

As of writing, the max ache ranges for bitcoin and ether are 116,000 and $3,800, respectively, serving as focal factors for believers of the max ache idea.

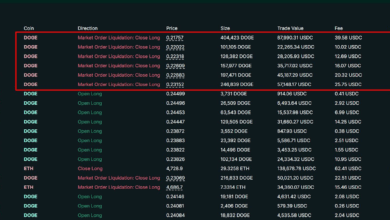

Learn extra: Ether, Dogecoin, Bitcoin Plunge Sees $900M in Bullish Bets Liquidated