Shares in buying and selling platform Robinhood Markets and Bitcoin treasury agency Technique fell in after-hours buying and selling on Monday after lacking out on being included within the S&P 500, amid a broader market dip.

S&P Dow Jones Indices stated late Monday that brokerage Interactive Brokers Group would be part of the index monitoring the five hundred largest US corporations at market open on Thursday and exchange the pharmacy chain Walgreens Boots Alliance.

Wall Avenue has lengthy been anticipating Robinhood to affix the S&P 500, and MicroStrategy, buying and selling as Technique, had not too long ago change into eligible for inclusion as its market cap has been boosted by the rising worth of its Bitcoin (BTC) holdings.

Inclusion on the S&P 500 is usually seen as a boon for a corporation, as its shares could be scooped up by passive traders and different funds aiming to trace the index.

Robinhood once more snubbed from S&P 500

Shares within the crypto and inventory buying and selling platform Robinhood (HOOD) ended after-hours buying and selling down 0.5% at $107.40 after closing buying and selling on Monday at a 1.26% loss.

Compared, Interactive Brokers (IBKR) noticed a 3.9% raise in prolonged buying and selling to $65.21 on the announcement of its inclusion after gaining lower than 0.6% all through the buying and selling day, whereas the S&P 500 ended buying and selling 0.4% down.

Robinhood shares had additionally dropped in early June after S&P Dow Jones Indices introduced there could be no modifications to the S&P 500 in its quarterly rebalancing.

The corporate’s inventory has, nonetheless, gained almost 190% this yr and has continued to interrupt worth data, seeing a raise from renewed retail investor enthusiasm.

Technique additionally down on S&P miss and Bitcoin drop

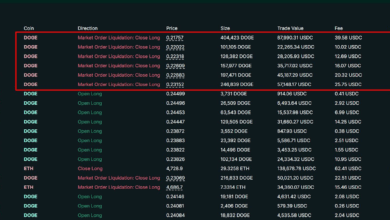

Shares within the software program agency Technique (MSTR) additionally dropped on Monday, ending the day’s session down 4.17% and an extra 0.6% in after-hours buying and selling to $341.

Associated: Bitcoin futures demand rises whilst BTC sells off: What provides?

The corporate’s inventory fell alongside Bitcoin, which was down 2% up to now day after briefly slipping beneath $110,000.

S&P 500 inclusion isn’t just about inventory worth

An organization’s inclusion on the S&P 500 is the choice of a committee who’re guided by a spread of standards an organization wants to satisfy earlier than it’s added.

An organization must have a market capitalization of not less than $22.7 billion, be based mostly within the US and listed on the New York Inventory Change, the Nasdaq or Cboe.

Its shares should additionally meet minimal necessities for market liquidity and quantity.

Jack Dorsey’s monetary providers firm, Block, Inc., was the most recent crypto-tied firm to make the index and joined the S&P 500 on July 23.

Journal: Altcoin season 2025 is sort of right here… however the guidelines have modified