Yearly, the Jackson Gap Symposium is likely one of the most carefully watched occasions on the monetary markets.

This 12 months was no exception, as Federal Reserve (Fed) Chair Jerome Powell’s speech marked a turning level in financial expectations, with fast repercussions for Commodities, significantly Gold.

A extra conciliatory Fed, relieved markets

By confirming that the US central financial institution was contemplating a primary rate of interest minimize as early as September, Jerome Powell gave traders the sign that they had been ready for.

The Fed Chair’s feedback highlighted the truth that inflation is now higher contained, but additionally a worrying slowdown in employment.

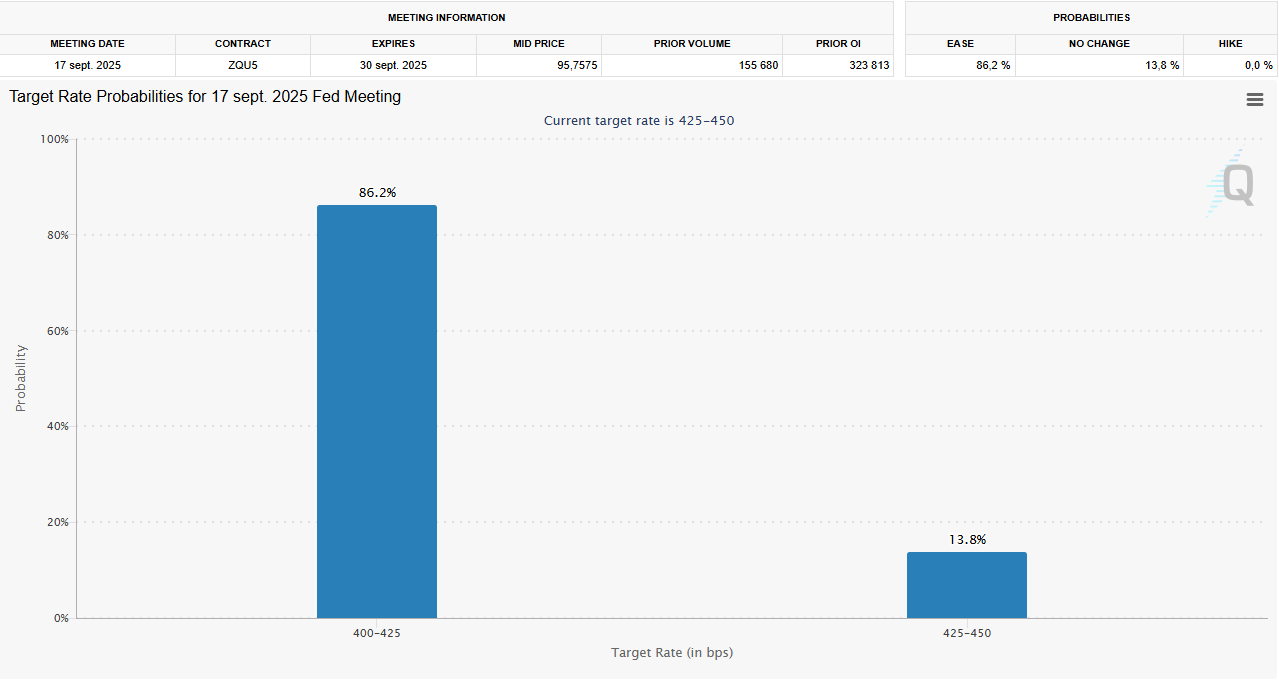

Consequently, markets are actually betting massively on speedy financial easing, with over 86% chance of a 25 foundation factors (bps) minimize as early as September, in line with the CME FedWatch software.

Fed Watch Software. Supply: CME Group.

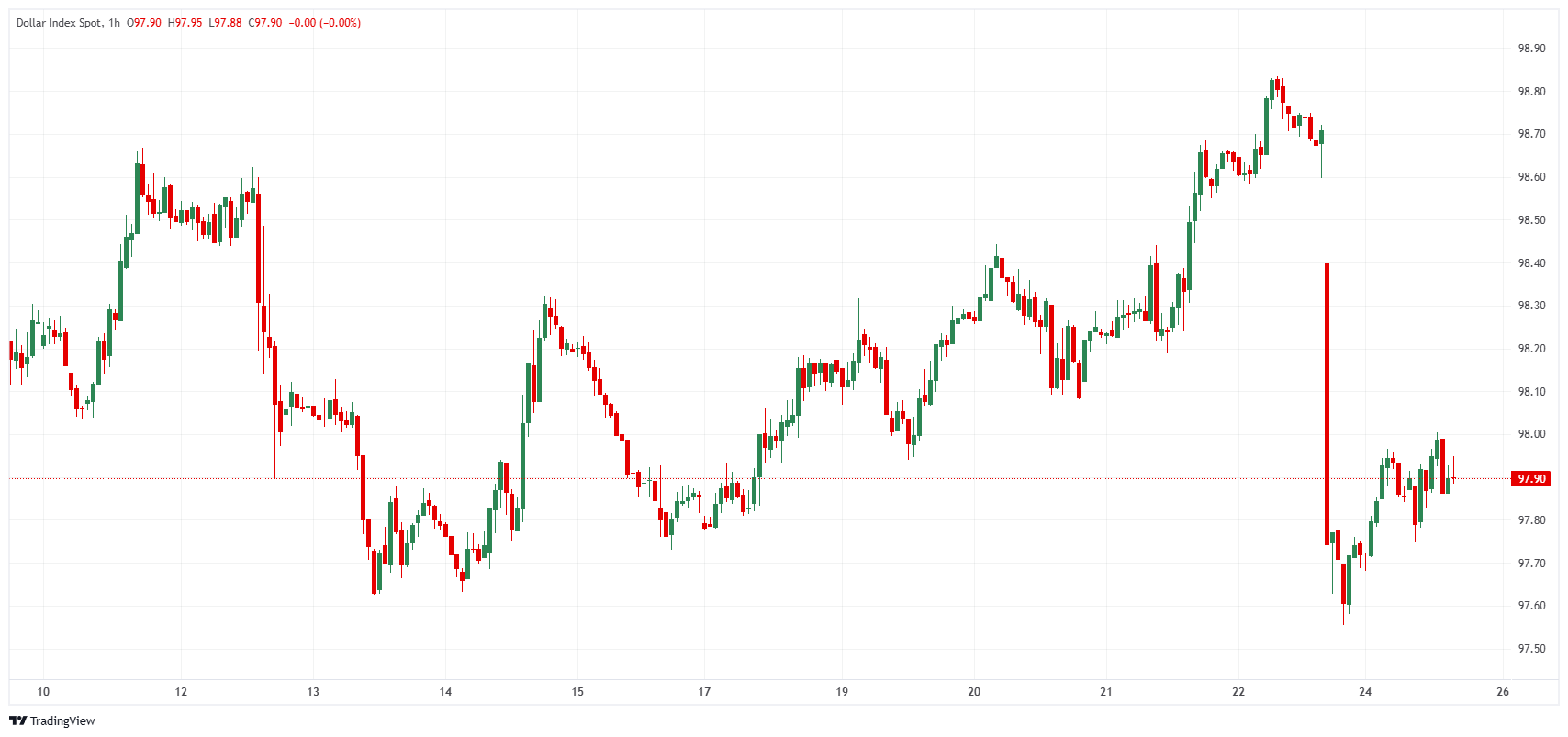

This extra dovish tone instantly weakened the US Greenback (USD) as a direct response, creating a good context for all the Commodities complicated, whose costs usually transfer inversely to the US forex.

US Greenback Index (DXY) 1-hour chart. Supply: FXStreet.

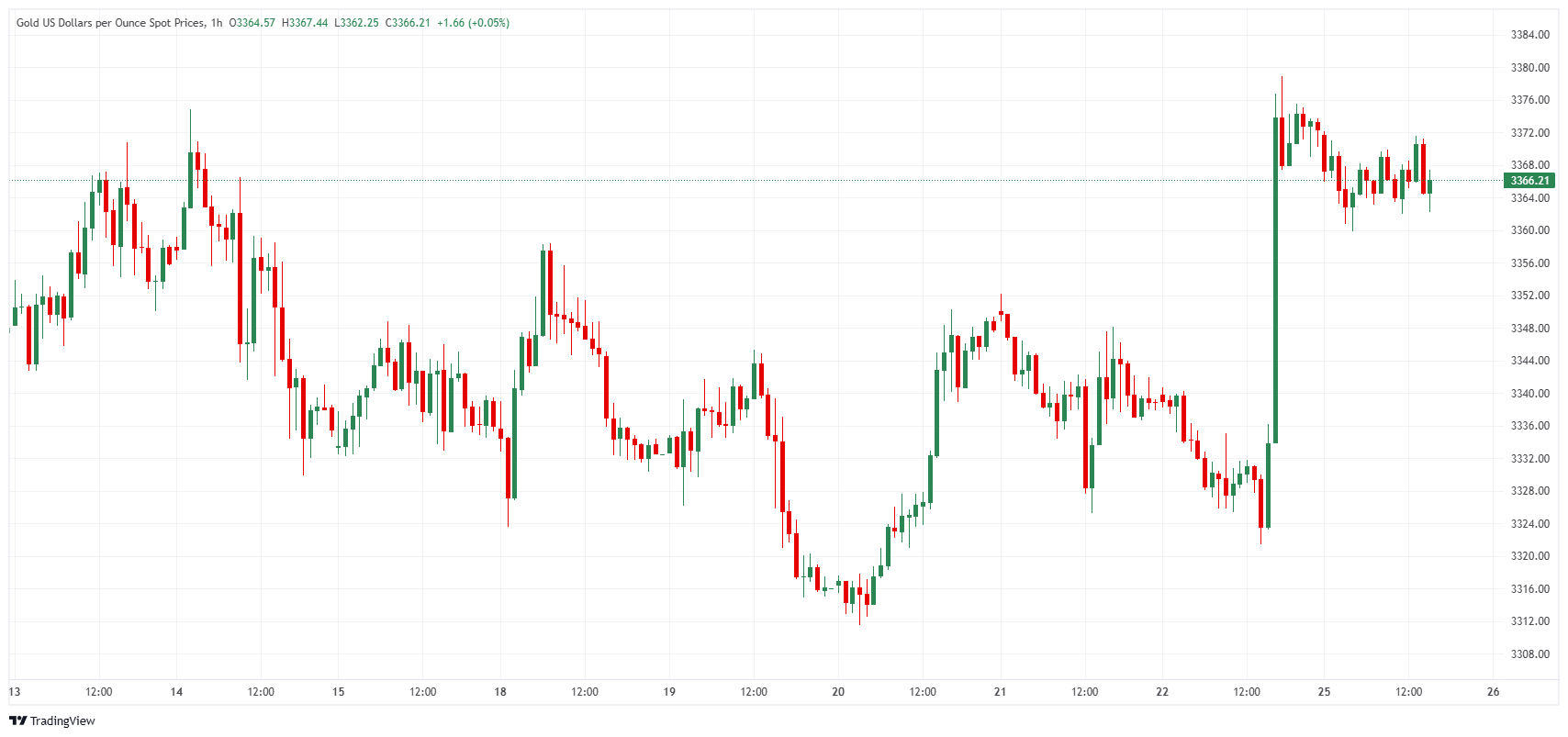

Gold within the highlight, boosted by the prospect of decrease rates of interest

Gold, the safe-haven par excellence, was the primary to profit from this variation in tone from Chair Powell. The yellow metallic surged by virtually 1% after the speech, breaking via new technical thresholds and resuming the upward momentum interrupted in latest weeks.

Gold value 1-hour chart. Supply: FXStreet.

Buyers see a double alternative. On the one hand, Bond yields are set to fall with decrease rates of interest; on the opposite, a weaker US Greenback makes Gold extra engaging to worldwide patrons.

Bodily demand additionally helped to maintain the motion: Swiss exports in July confirmed a notable enhance to the US and India, the place the festive season historically stimulates jewellery shopping for, famous Kedia Advisory.

For its half, China maintained stable premiums on its imports, an indication that consumption stays strong regardless of financial uncertainties.

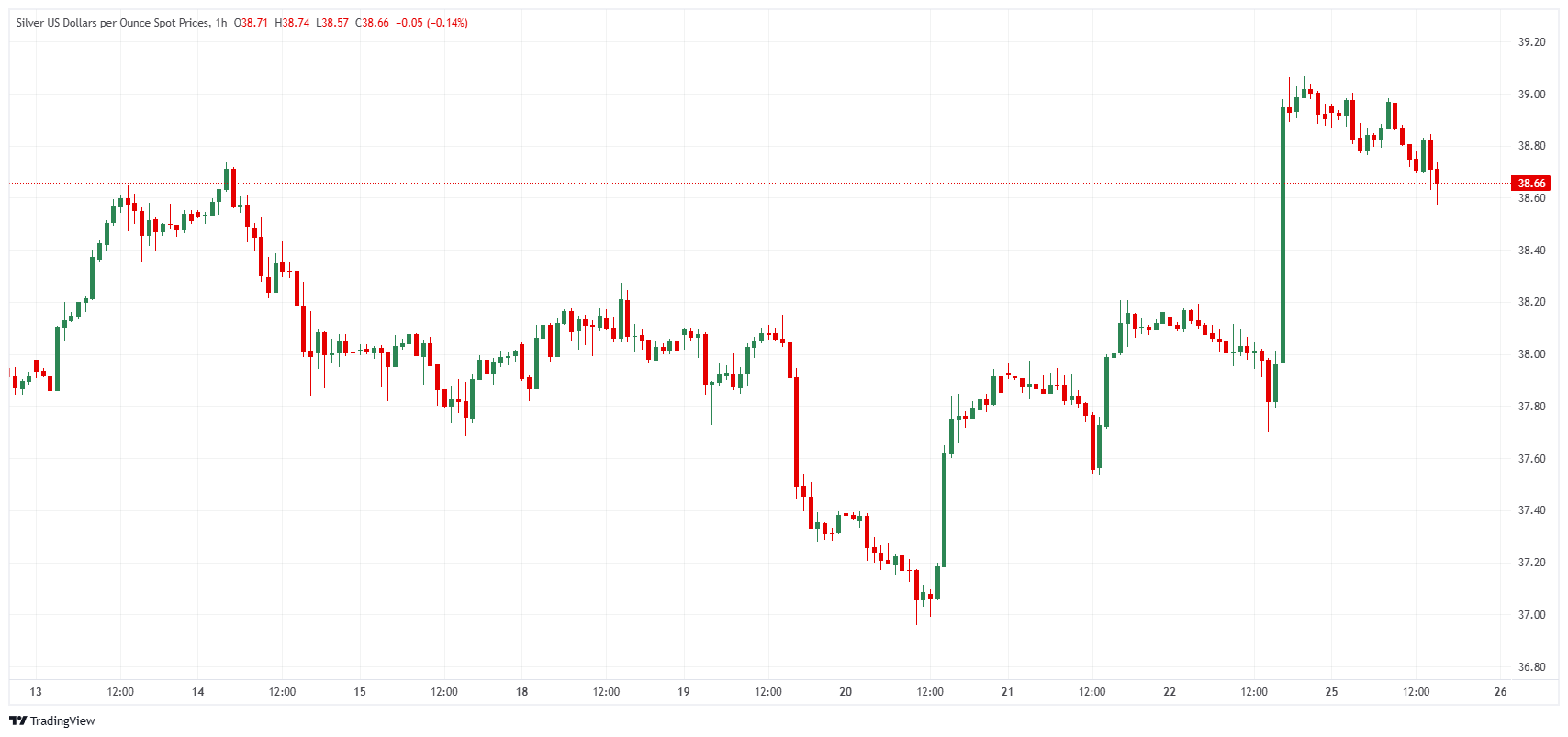

Silver, Oil and different Commodities observe go well with

Whereas Gold caught the attention, the Powell impact was additionally felt in Silver, which superior much more strongly, benefiting from its hybrid position between safe-haven asset and industrial metallic.

Silver value 1-hour chart. Supply: FXStreet.

Analysts are puzzled by the efficiency hole between Silver and Gold, some seeing it as an indication of Silver’s personal dynamic, usually extra risky however able to outperforming when treasured metals get better.

On the Power entrance, the Fed’s accommodating message offset a extra complicated context. Oil costs, already buoyed by uncertainties linked to the Russia-Ukraine battle and US sanctions, discovered the prospect of decrease rates of interest an extra issue of short-term help.

Nonetheless, the basics stay fragile. Provide stays considerable, and world demand may undergo if the financial slowdown worsens.

Fragile however revealing help

Jerome Powell’s speech at Jackson Gap confirms the extent to which US financial coverage stays a significant catalyst for Commodities.

The anticipated minimize in key rates of interest acts as a strong psychological and technical driver for dollar-denominated belongings, beginning with Gold.

However this impetus rests on a precarious steadiness. If inflation had been to rise once more, and the Fed must pause slicing rates of interest, the dynamic may rapidly reverse.

In the intervening time, Gold has emerged stronger from the Jackson Gap Symposium and stays within the highlight. As a barometer of investor confidence within the Federal Reserve, it may quickly take a look at new all-time highs if the central financial institution confirms its accommodative stance.