Ether treasury firm ETHZilla, which just lately pivoted from its biotechnology roots to cryptocurrency, has accepted a $250 million share repurchase program — signaling that some companies might more and more faucet digital-asset beneficial properties as a supply of liquidity.

ETHZilla’s board of administrators approved the buyback of as much as $250 million price of its excellent widespread shares, the corporate disclosed Monday. The corporate at the moment has 165.4 million shares excellent.

The transfer comes lower than a month after the agency rebranded from 180 Life Sciences and made Ether (ETH) its core technique — a pivot that helped revive its beaten-down inventory.

ETHZilla has since acquired 102,237 ETH at a mean worth of $3,948.72, spending simply over $403 million. At present market ranges, these holdings are price about $489 million. The corporate stated its most up-to-date ETH purchases might be staked with Electrical Capital.

Administration’s language across the repurchase echoed basic triggers, citing “market situations,” “administration discretion,” and “different makes use of of capital.”

ETHZilla’s new technique comes in opposition to a backdrop of weak fundamentals. As a public firm, it has struggled with restricted revenues, persistent losses and shareholder dilution. Final yr alone, it reported an gathered deficit of over $141.5 million.

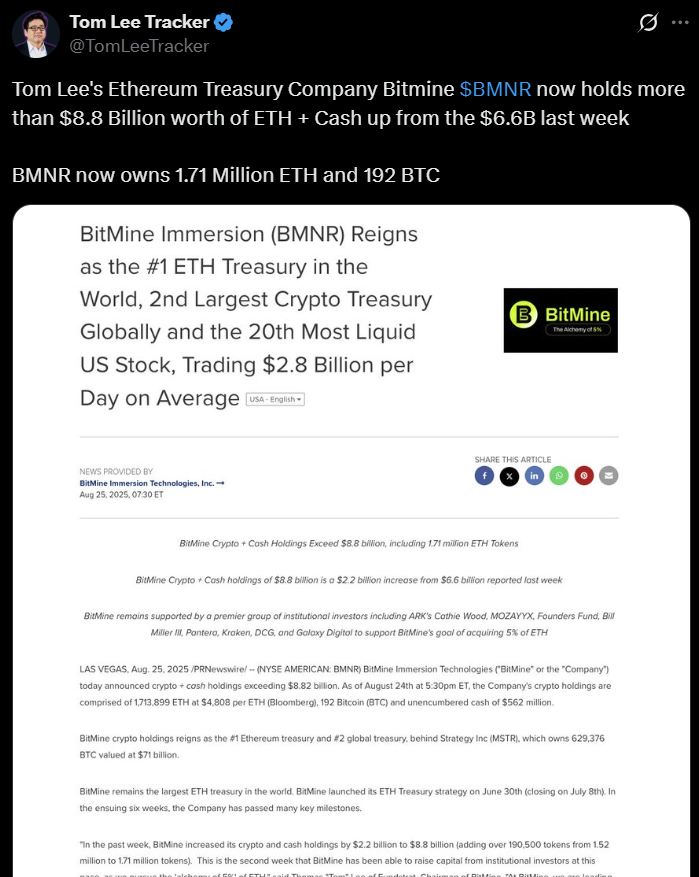

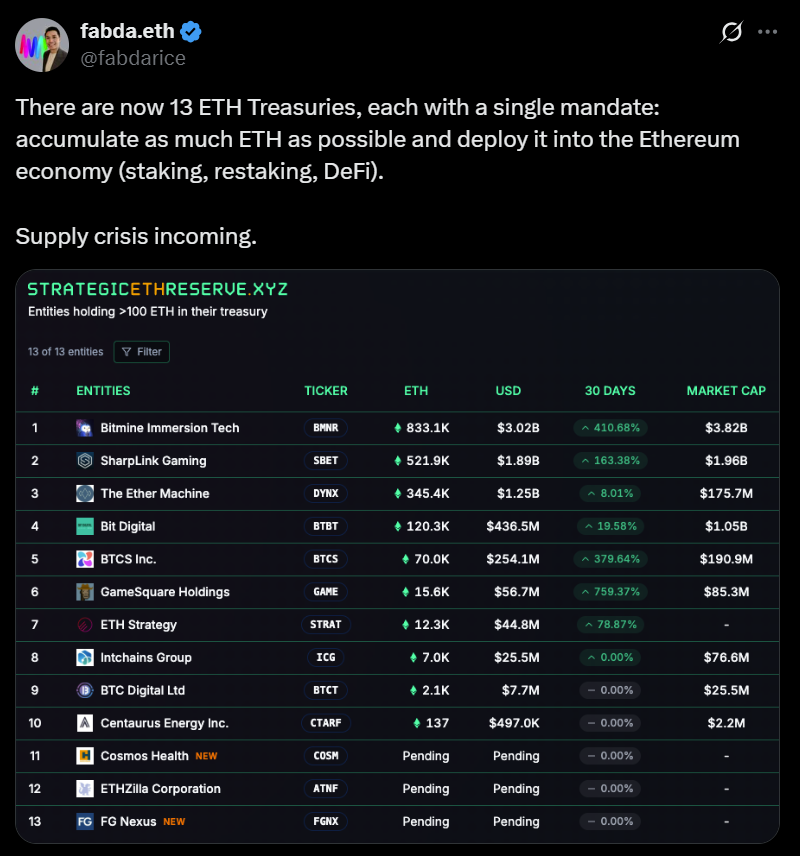

ETHZilla just isn’t alone in embracing crypto as a balance-sheet asset. Firms each inside and out of doors the digital-asset sector — together with BitMine Immersion Applied sciences, The Ether Machine, SharpLink Gaming, Bit Digital and Ether Capital Corp. — have all made strategic Ether acquisitions.

Associated: Ether treasuries climb to $13B as worth breaks $4,300

Leverage and focus dangers

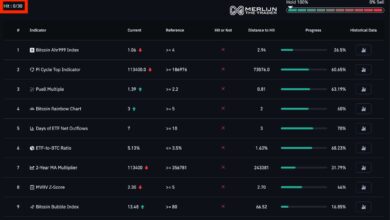

Analysts see parallels between at the moment’s “crypto treasury” performs and earlier waves of company gold adoption, however warn that leverage-fueled stability sheet builds stay a significant threat. Firms that borrow closely to build up crypto may face worsening financials if — or when — one other bear market hits.

Mike Foy, chief monetary officer at Amina Financial institution, advised Cointelegraph that it’s nonetheless too early to inform whether or not crypto-treasury methods are sustainable in the long term. Within the meantime, he stated it’s essential to find out whether or not corporations are pursuing the strategy for speculative beneficial properties, signaling functions or as a part of a broader strategic plan.

“If any of those [purchases] appear unusual or out of the unusual, then that is presumably an indication that this isn’t a long-term plan however reasonably a short-term share worth play,” Foy stated.

Kadan Stadelmann, chief expertise officer at Komodo Platform, drew parallels between ETH-treasury companies and spot exchange-traded funds (ETFs), noting that the previous can supply advantages that ETFs can’t. “Spot ETFs can’t legally supply staking and DeFi,” he stated. “Ethereum treasury companies supply increased yields.”

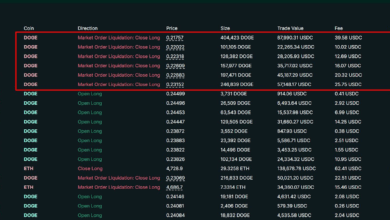

Nonetheless, Stadelmann cautioned that the mannequin carries important dangers. “ETH treasury companies have dangers, comparable to overleveraging,” he stated. In a bear market, this might set off pressured liquidations, probably creating cascading results on Ether’s worth.

Falling ETH costs may undermine debt-financed methods at corporations that acquired their holdings by loans, convertible notes or fairness dilution.

Of the present digital asset treasury methods, Ether is probably the most uncovered, with roughly 3.4% of its whole provide held by such entities, in line with Anthony DeMartino, founder and CEO of Sentora Analysis.

Journal: How Ethereum treasury corporations may spark ‘DeFi Summer time 2.0’