BitMine, an Ethereum-focused agency, introduced that its shares have change into probably the most closely traded equities in the US.

In its Aug. 25 disclosure, the corporate referenced Fundstrat knowledge displaying that its inventory recorded a median each day buying and selling quantity of $2.8 billion over the 5 buying and selling days ending Aug. 24.

That determine positioned BitMine twentieth nationwide, behind Coinbase at nineteenth, whereas surpassing JPMorgan at twenty seventh and Palo Alto Networks at twenty first out of greater than 5,700 publicly listed firms.

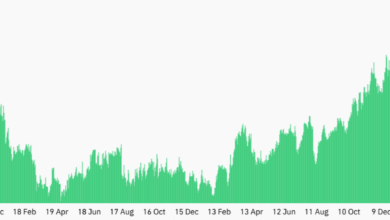

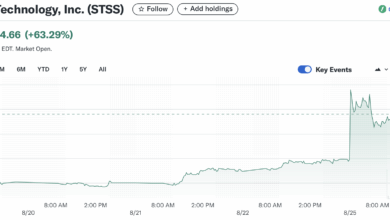

This surge in buying and selling exercise coincides with the corporate’s pivot towards Ethereum. Market knowledge from Google Finance signifies that BitMine’s inventory soared practically 1,000% throughout the transition, reaching a peak of $135 earlier than retreating to $53.49 on the newest verify.

This confirmed that the heightened liquidity has drawn stronger investor consideration and amplified its volatility.

Ethereum accumulation

Past market efficiency, BitMine can also be accelerating its accumulation of Ethereum.

The agency revealed that, as of Aug. 24, it managed 1.71 million ETH, valued at $4,808 per token on the time of reporting. Its steadiness sheet additionally included 192 BTC and $562 million in out there money, bringing complete holdings to $8.82 billion.

That scale makes BitMine the biggest holder of Ethereum globally and the second-largest company crypto treasury general, behind Technique, which maintains a Bitcoin reserve value about $71 billion.

The agency started its Ethereum treasury program on June 30 and accomplished its preliminary part lower than two weeks later. Since then, the agency has aggressively acquired ETH, evidenced by its buy of greater than 190,000 ETH final week.

Chairman Thomas “Tom” Lee attributed the fast buildup to robust institutional demand, which enabled BitMine to lift $2.2 billion in simply seven days.

In keeping with him:

“That is the second week that BitMine has been in a position to increase capital from institutional traders at this tempo, as we pursue the ‘alchemy of 5%’ of ETH.”

Lee emphasised that the corporate views Ethereum as a long-horizon alternative. He argued that Wall Road adoption and the combination of synthetic intelligence with blockchain networks might make Ethereum the spine of the subsequent monetary system.