Bitcoin (BTC) begins the final week of August removed from all-time highs as merchants turn into more and more nervous.

-

An enormous lengthy liquidation occasion has introduced $110,000 again into play as a brand new CME hole turns into a brand new hope for bulls.

-

Bitcoin whales are below scrutiny after an enormous rotation from BTC into ETH.

-

Smaller hodlers stay in accumulation mode, evaluation reveals, not like whales.

-

The newest BTC worth motion has resulted in speak of the whole bull market now being over.

-

The Fed’s “most well-liked” inflation gauge is due once more as markets double down on rate-cut bets.

BTC worth weak spot sparks speak of $100,000 retest

Bitcoin is again at multi-week lows as August nears its finish — and market members are busy drawing new BTC worth targets.

Information from Cointelegraph Markets Professional and TradingView exhibits whipsaw BTC worth motion defining the market since Sunday’s flash volatility.

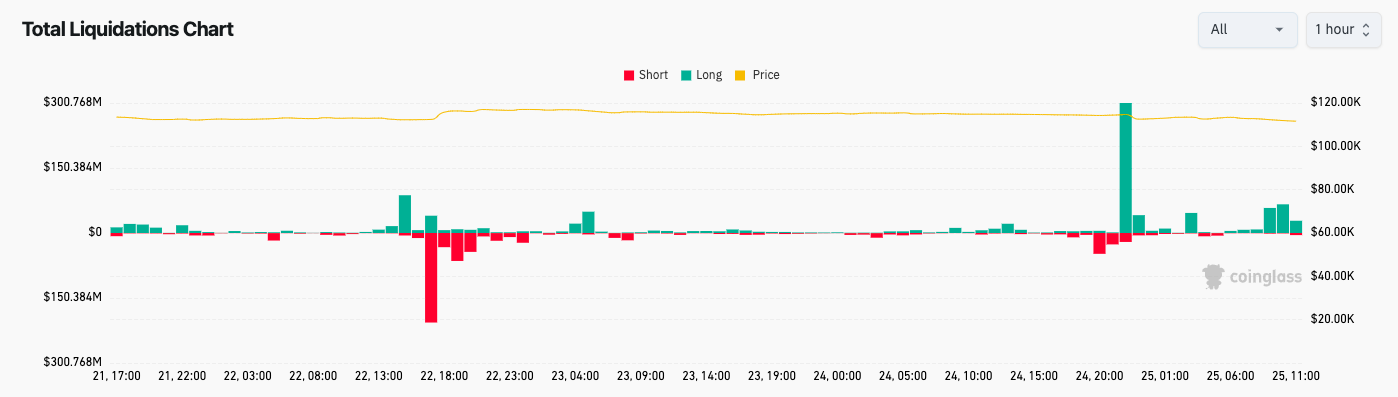

This took BTC/USD to $10,700 — its lowest ranges since July 10 and a impolite wake-up name for late longs.

Monitoring useful resource CoinGlass put 24-hour crypto lengthy liquidations at $640 million on the time of writing.

Merchants had been break up on the short-term outlook. Whereas some eyed a retest of outdated all-time highs as a bounce level, others noticed a extra nuanced state of affairs.

$110,000 goal on this dip is close to shut. I wish to see this hit after which consolidate for the following run up pic.twitter.com/k1d8E0Qxmg

— Crypto Tony (@CryptoTony__) August 25, 2025

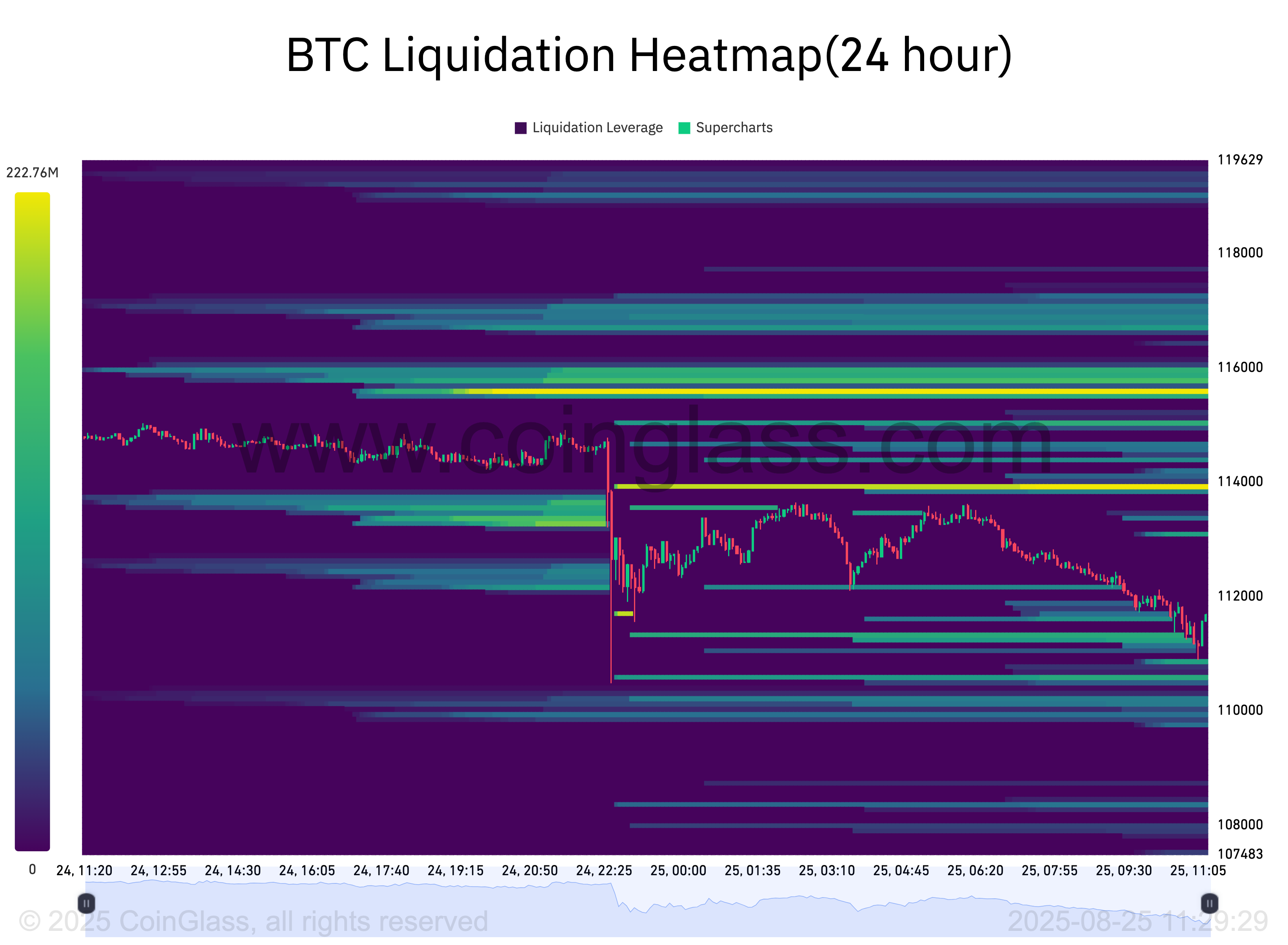

In style dealer Daan Crypto Trades flagged an “essential retest” at the moment in progress.

“$BTC Opened up with a big CME hole at the moment,” he famous, referring to the weekend hole in CME Group’s Bitcoin futures market.

“That is the most important we have seen in a number of weeks. We’ve been opening up with gaps fairly usually and most of those have been filling on Monday/Tuesday.”

Fellow dealer Jelle was amongst these seeing a visit to even decrease ranges.

“Bitcoin continues to be murdering leveraged merchants across the vary lows, and from the appears to be like of it, the sharks are nonetheless hungry,” he warned.

“Would actually choose worth holds this space, or we’ll fall again into the earlier vary which might open us as much as one other retest of $100k.”

CoinGlass change order-book knowledge reveals little bid help in place instantly under worth into the week’s first Wall Road open.

Final week, Cointelegraph reported on conviction over $100,000 staying in place — even unchallenged — as help.

Bitcoin OG: Whale distribution “wholesome”

Sunday’s sudden BTC worth dive has introduced Bitcoin whales again into focus.

Present ranges, nonetheless inside 10% of all-time highs, have confirmed engaging to massive gamers searching for to take revenue on long-held cash.

The weekend noticed one entity promote an enormous tranche of BTC after seven years, tanking the market $4,000 in minutes — a drop from which it has but to get well.

Information from crypto intelligence agency Arkham uploaded to X by analytics account Lookonchain exhibits the entity rotating from Bitcoin into Ether.

“Up to now 5 days, they’ve deposited ~22,769 $BTC($2.59B) to Hyperliquid on the market, then purchased 472,920 $ETH($2.22B) spot and opened a 135,265 $ETH($577M) lengthy,” it summarized whereas relaying the BTC and ETH addresses concerned.

The entity’s BTC is now value round $11.4 billion — a revenue margin of 1,675%.

“No paper BTC conspiracies are required. The value has stalled as a result of a lot of whales have hit their magic quantity and are unloading,” Bitcoin fanatic Vijay Boyapati commented on the occasion.

“That is wholesome – their provide is finite and their promoting is required for the total monetization of Bitcoin. Huge blocks of provide, with monumental buying energy, are being distributed into the inhabitants. This cycle is likely one of the best monetization occasions in historical past.”

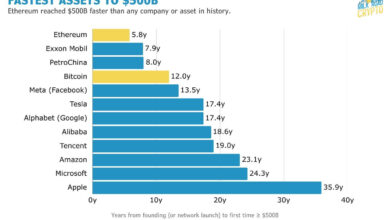

Statistician Willy Woo, who made headlines final month for his personal BTC gross sales, underscored the sway that the oldest whales nonetheless have on market dynamics.

“Why is BTC transferring up so slowly this cycle?” he queried alongside a chart.

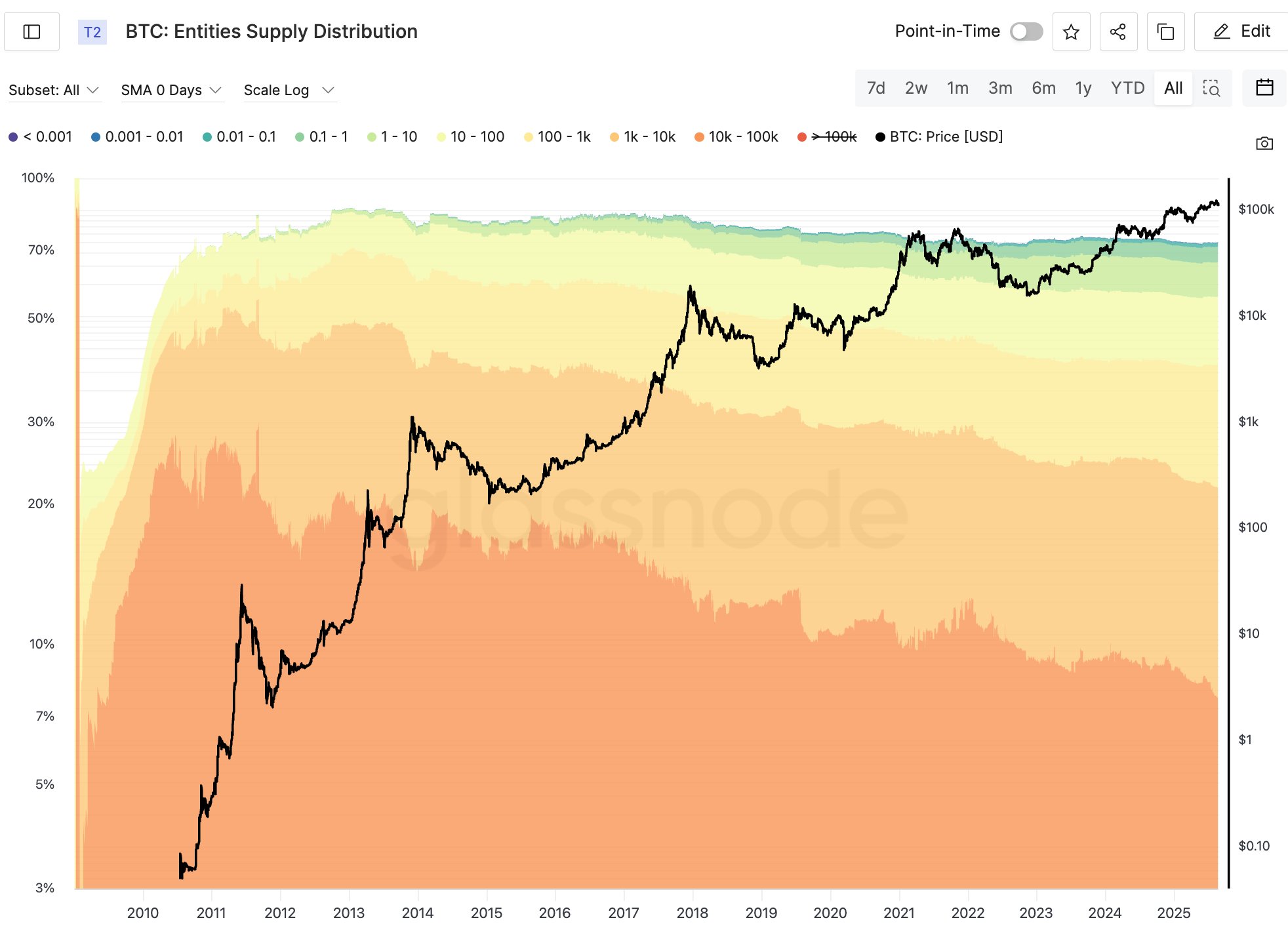

“BTC provide is concentrated round OG whales who peaked their holdings in 2011 (orange and darkish orange). They purchased their BTC at $10 or decrease. It takes $110k+ of recent capital to soak up every BTC they promote.”

As Cointelegraph reported, whale distribution has been evident all through the newest part of the bull run.

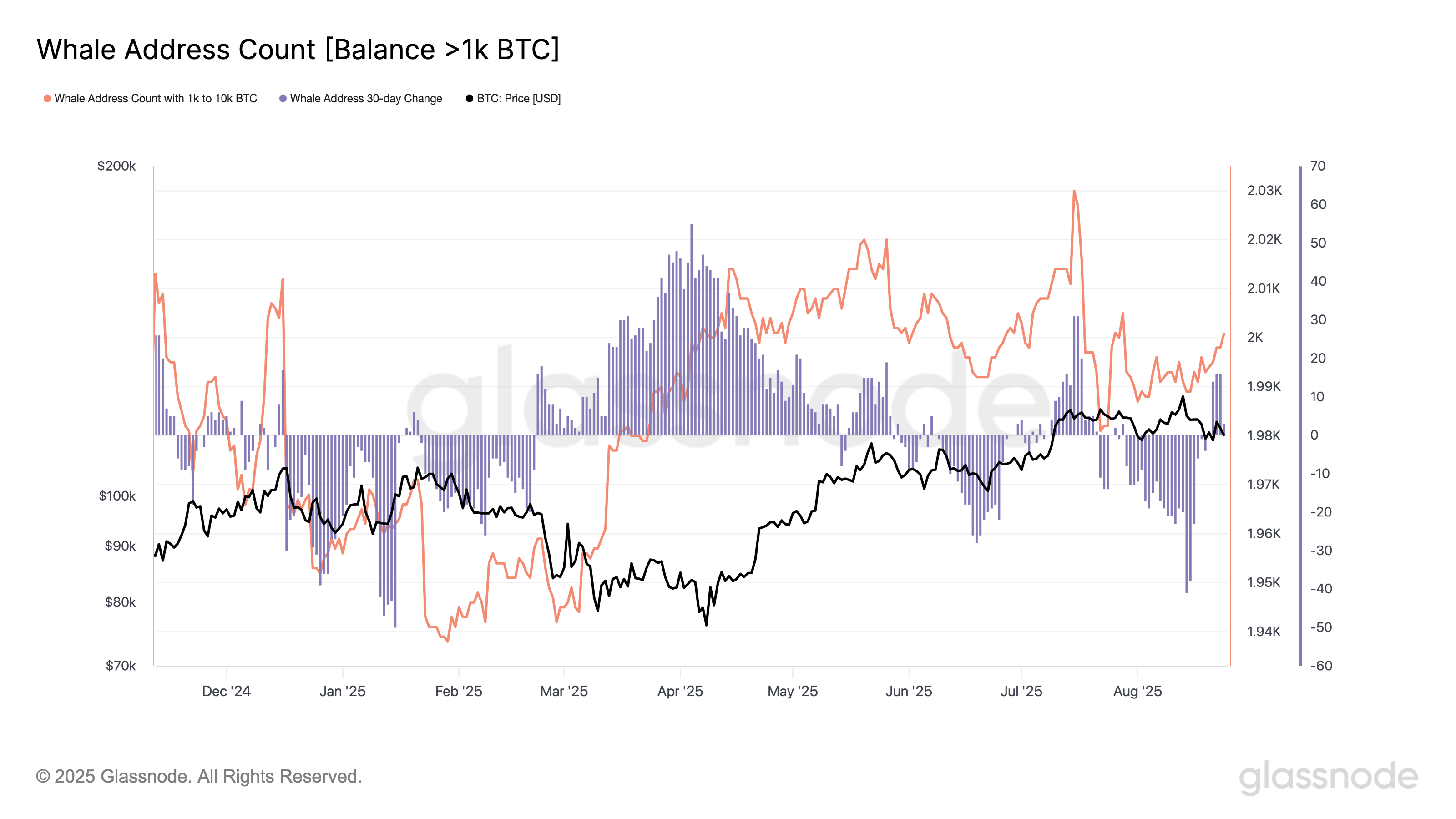

Information from onchain analytics agency Glassnode confirms that as of Sunday, there have been 2,000 addresses with a stability of between 1,000 and 10,000 BTC — comparable to all however the largest “mega” whales. This marked a brand new August excessive.

Smaller Bitcoin hodlers proceed accumulating

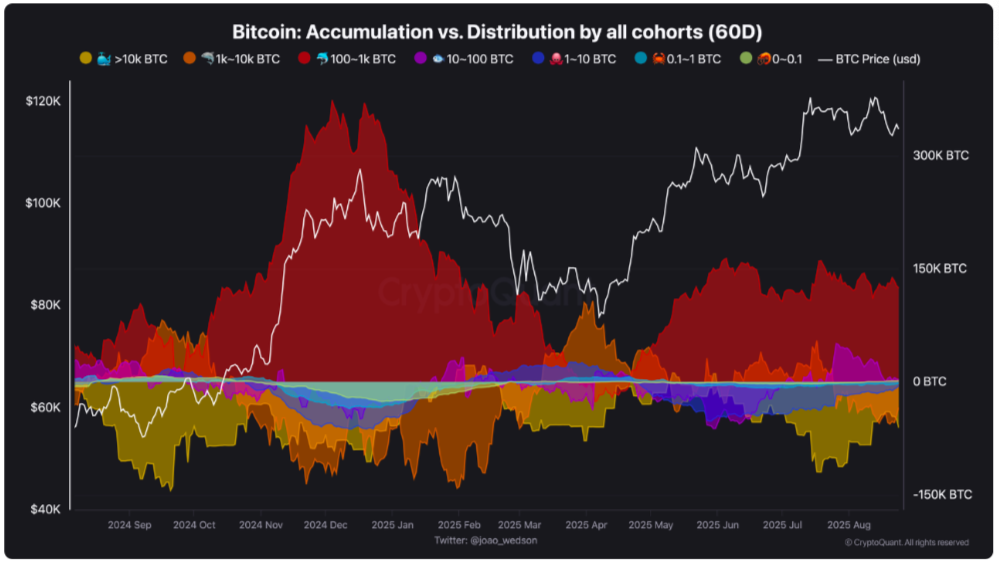

Wanting into different pockets cohorts, onchain analytics platform CryptoQuant sees causes for bulls to remain hopeful a few rebound.

Distribution, it warned Monday, isn’t but in full swing throughout the Bitcoin investor spectrum.

“After reaching its ATH at 124K, Bitcoin has entered a pullback part,” contributor BorisD summarized in one in all its “Quicktake” weblog posts, predicting that the retracement could “proceed for some time.”

In contrast to whales, smaller hodler lessons have retained an total “accumulation” mindset. Particularly, wallets holding as much as 10 BTC proceed so as to add publicity.

Conversely, these between 10 and 100 BTC show distribution conduct, having shifted to profit-taking en masse as the worth hit $118,000.

Between 100 and 1,000 BTC, market affect features significance, BorisD says.

“Whereas typically in accumulation mode, they’ve proven stability between accumulation and distribution since 105K, reflecting indecision,” he commented.

“This degree acts as a essential support-turning zone.”

Due to the relative dimension of the wallets concerned, CryptoQuant describes distribution as now being “dominant.”

“Distribution continues to be the dominant pattern, however its depth is weakening as Bitcoin pulls again,” the put up concludes.

“The 105K degree stands out because the strongest zone. A transfer right down to this area would create important stress available in the market and will set off widespread worry.”

Is the bull market “over” already?

For some market members, there’s little purpose to anticipate a full-on return of the Bitcoin bull market.

These already harboring conservative views of future worth motion have doubled down on their outlook as BTC/USD falls to its lowest ranges since early July.

Amongst them is fashionable dealer Roman, whose newest evaluation warned that high-timeframe indicators recommend that the very best of the bull run has come and gone.

As proof, he cited a head and shoulders reversal sample enjoying out, with the ultimate third “shoulder” factor nonetheless to come back.

“All we want is the reversal sample setup to doubtlessly take shorts. They’ll get caught on the low quantity pump as soon as once more,” he forecast.

“The $BTC bull run is over.”

$BTC 1D

The Head & shoulders reversal AKA the bull killer.

HTF is bearish. All we want is the reversal sample setup to doubtlessly take shorts.

They’ll get caught on the low quantity pump as soon as once more. The $BTC bull run is over. pic.twitter.com/Q3rAet5YiP

— Roman (@Roman_Trading) August 25, 2025

Earlier than that, Roman and others had flagged declining quantity and weakening relative energy index (RSI) knowledge to help the thesis that Bitcoin had run out of steam. As worth made new highs, RSI made decrease highs — a traditional bearish divergence setup.

Late final week, citing Wyckoff evaluation, fellow buying and selling account ZAYK Charts put the potential draw back goal for BTC/USD at $95,000.

“$BTC nonetheless transferring precisely as Wyckoff predicted,” it wrote in an replace.

US inflation battle lurks within the background

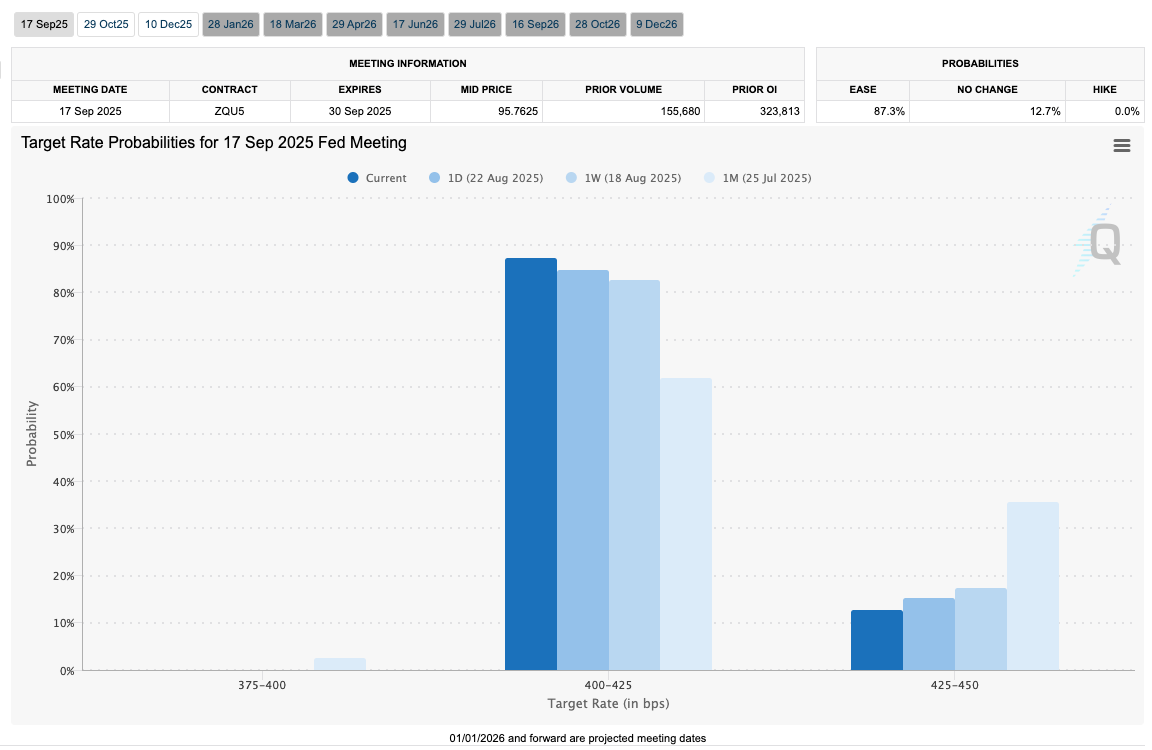

The Federal Reserve’s “most well-liked” inflation gauge is due for launch at a essential time for financial coverage.

Associated: ETH ‘god candle,’ $6K subsequent? Coinbase tightens safety: Hodler’s Digest, Aug. 17 – 23

The July print of the Private Consumption Expenditures (PCE) Index, due Friday, can be of key significance to each Fed officers and markets searching for affirmation of interest-rate cuts subsequent month.

Final week, at its annual Jackson Gap symposium, Fed Chair Jerome Powell delivered a shock pivot on his beforehand hawkish stance. Danger property instantly surged as hopes of a fee lower gained momentum.

Since then, the temper has cooled, with loads of inflation knowledge nonetheless to come back earlier than the speed resolution in mid-September.

The newest knowledge from CME Group’s FedWatch Software places market odds of a 0.25% lower at practically 90%.

Commenting, buying and selling agency Mosaic Asset emphasised Powell’s language and the Fed’s altering strategy to its 2% inflation goal.

“If abandoning common inflation focusing on means the Fed is turning into much less tolerant of inflation above the two% goal, then you definitely wouldn’t anticipate a dovish tone out of the Fed,” it summarized within the newest version of its common publication, “The Market Mosaic.”

“That can make upcoming inflation and payrolls studies forward of September’s rate-setting assembly essential datapoints for the Fed.”

Mosaic stated that betting on a number of fee cuts is likely to be “misplaced” as a method going ahead.

Elsewhere, Wednesday’s Nvidia earnings may inject volatility into crypto and threat property, with a robust efficiency anticipated.

“Nvidia is about to shut out an total robust earnings season with consideration shifting to the Fed,” buying and selling useful resource The Kobeissi Letter summarized.

This text doesn’t comprise funding recommendation or suggestions. Each funding and buying and selling transfer entails threat, and readers ought to conduct their very own analysis when making a choice.