A cryptocurrency dealer launched a $2 million social media strain marketing campaign in opposition to MEXC, claiming that the digital asset alternate had frozen greater than $3 million value of his private funds for no clear purpose.

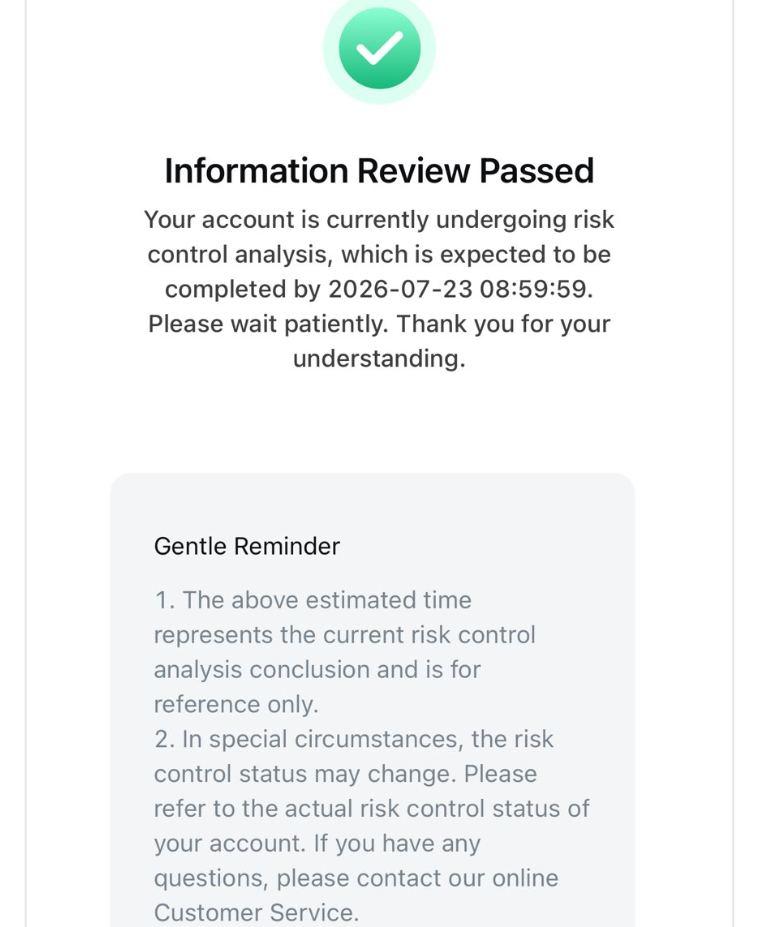

In July 2025, centralized cryptocurrency alternate (CEX) MEXC allegedly froze $3.1 million value of non-public funds with none phrases of service violations, in keeping with pseudonymous crypto dealer the White Whale.

In response, the dealer is launching a $2 million social media strain marketing campaign in opposition to MEXC, claiming that the alternate had requested a one-year evaluation interval earlier than unfreezing the consumer’s funds.

“I am Placing a $2M Bounty Up For Grabs (half may be claimed by YOU),” wrote the White Whale in a Sunday X submit, including:

“What sort of evaluation takes 12 months – with no single replace, doc, or cost?”

Quite a few different merchants are affected by comparable account freezes, the dealer mentioned, including that the business’s most profitable contributors are “punished for profitable.”

Associated: US retirement plans might gasoline Bitcoin rally to $200K regardless of downturn: Finance Redefined

In response to his account suspension, the dealer launched a social media marketing campaign, requesting that customers mint a free non-fungible token (NFT) on the Base community, tag MEXC or its chief working officer’s X account with the “#FreeTheWhiteWhale” tag, and alter their profile photos to the above picture.

For finishing these duties, $1 million of the bounty shall be equally divided among the many first 20,000 NFT holders, awarding every holder $50 USDC (USDC), offered that MEXC releases the frozen funds.

One other $1 million value of USDC shall be allotted to “verified, fastidiously vetted charities,” with the dealer promising onchain receipts after the donations.

The dealer claimed to have beforehand accomplished the alternate’s Know Your Buyer (KYC) verification course of.

Cointelegraph was unable to confirm the frozen account independently. Cointelegraph has approached MEXC for touch upon the matter.

Associated: Andrew Tate shorts Kanye West’s YZY, racks up $700K losses on Hyperliquid

‘White whale’ claims to surpass MEXC market makers earlier than $3M freeze

The dealer claimed that his funds had been frozen as a consequence of being extra worthwhile than the alternate’s crypto market makers, companies or people who present liquidity by inserting constant purchase and promote orders to make sure easy buying and selling.

“My solely conceivable offense? I used to be too worthwhile,” wrote the pseudonymous dealer, including:

“I constantly beat their exterior market makers – the companies they quietly companion with to be the counterparty to trades (that is public file).”

Crypto market makers are among the many most misunderstood contributors of the digital asset market, usually blamed by merchants for intentionally manipulating cryptocurrency costs, regardless of a scarcity of proof.

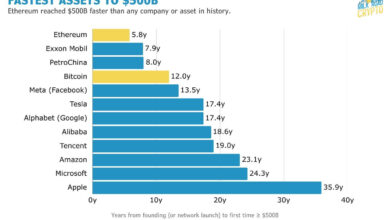

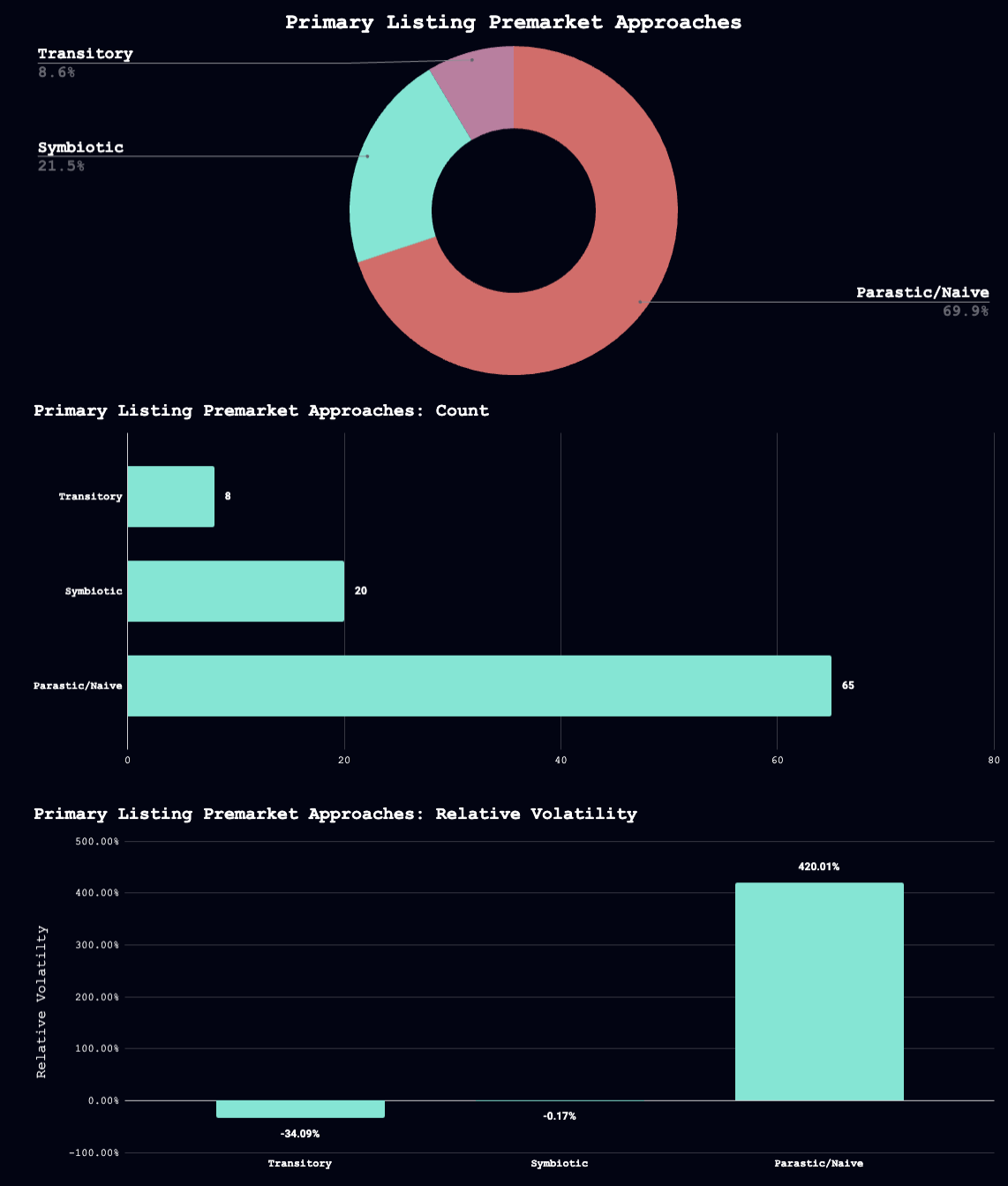

Nonetheless, analysis from Acheron Buying and selling advised that 78.5% of latest crypto launches between April and June 2024 had been performed in a fashion that disrupted honest value discovery, detrimentally affecting each end-users and the tasks themselves.

Furthermore, 69.9% of main token listings had been “Parasitic,” that means that market makers had been exploiting premarket situations by creating synthetic shortage and sentiment across the token.

Journal: Solana Seeker evaluation: Is the $500 crypto cellphone value it?