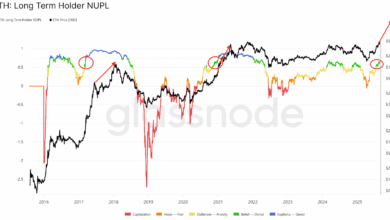

A pockets deal with labeled by blockchain safety analysts because the “Coinbase hacker” purchased $8 million in Solana on Sunday utilizing their reportedly ill-gotten beneficial properties.

In response to Lookonchain, the hacker transformed DAI (DAI) to USDC (USDC), then bridged to the Solana community and purchased 38,126 Solana (SOL) close to the $209 mark throughout a number of purchases.

Solana is at the moment buying and selling at $202.15, that means the hacker has made a paper loss because the commerce.

Blockchain analytics platform Arkham has flagged the pockets deal with as “Coinbase hacker,” whereas Lookonchain claims the pockets is linked to the theft of over $300 million from Coinbase customers.

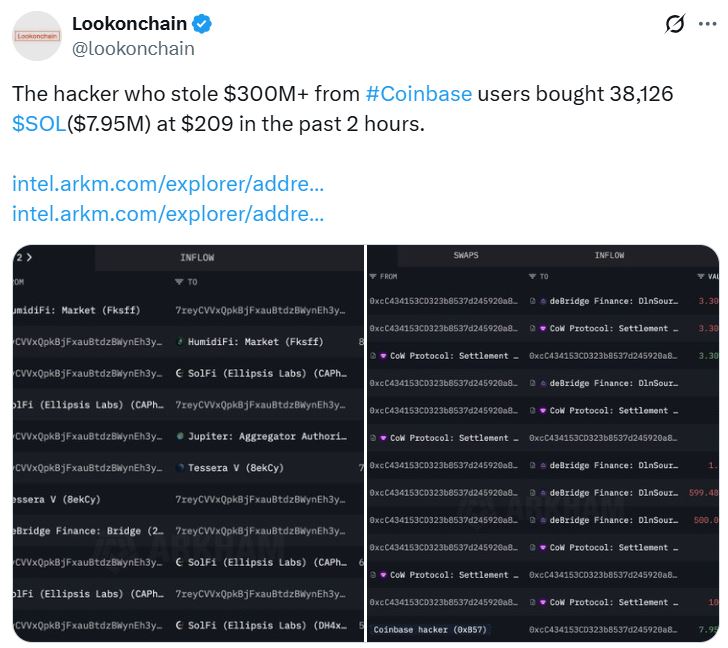

Hacker purchased Ether in July

The alleged hacker first got here to the eye of Lookonchain two months in the past, when the suspected cybercriminal bought 26,762 Ether value $69.25 million on the time.

In July, Lookonchain stated there have been additionally two main purchases from the identical pockets. On July 7, the identical hacker purchased up 4,863 Ether, value $12.55 million, then on July 19, they purchased 649 Ether for $2.3 million, at a price of $3,5621 per token.

Onchain sleuth and safety analyst ZachXBT estimated in Might that the full quantity misplaced by Coinbase customers to social engineering scams at $330 million, which he stated mirrored the rising variety of subtle assault methods to defraud crypto holders.

Radiant Capital hacker grows stack by way of trades

The Coinbase hacker isn’t the one one buying and selling up their ill-gotten beneficial properties. Final week, a pockets linked to the Radiant Capital exploit purchased up 4,913 Ether round Aug. 20, then bought 4,131 Ether on Saturday, making a revenue of $2.7 million.

“Their stolen $49.5M stash has now grown to over $105 million,” Lookonchain stated, representing a rise of round 114%.

Decentralized finance protocol Radiant Capital was hacked in mid-October 2024 when the crosschain lending protocol suffered a $58 million cybersecurity breach on BNB Chain and Arbitrum.

The attacker swapped proceeds into Ether, holding round 21,957 Ether value about $103 million, as of Aug. 14, in line with Lookonchain.

Associated: DOJ is investigating Coinbase information breach— Report

Specialists instructed Cointelegraph on the time that it was unlikely to be a deliberate market-timing technique and doubtless simply an unintended consequence of evasion strategies to obscure the stolen loot.

Unknown hacker panic sells

Nevertheless, some hackers haven’t been as fortunate.

In July, Lookonchain was monitoring a pockets they flagged as “seemingly belonging to hackers,” which bought 12,282 Ether and purchased again in at the next worth throughout a market downturn, leading to a lack of $6.9 million.

“Hackers are usually not good at buying and selling,” the agency stated.

Throughout one other market dip, the identical pockets panic bought 4,958 Ether on Aug. 15, locking in a revenue of $9.75 million.

Journal: Bitcoiner intercourse lure extortion? BTS agency’s blockchain catastrophe: Asia Specific